FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

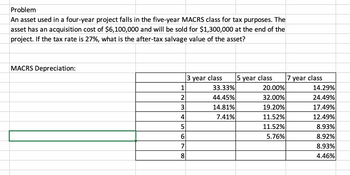

Transcribed Image Text:Problem

An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The

asset has an acquisition cost of $6,100,000 and will be sold for $1,300,000 at the end of the

project. If the tax rate is 27%, what is the after-tax salvage value of the asset?

MACRS Depreciation:

2

3

4

5

6

7

8

3 year class

33.33%

44.45%

14.81%

7.41%

5 year class

20.00%

32.00%

19.20%

11.52%

11.52%

5.76%

7 year class

14.29%

24.49%

17.49%

12.49%

8.93%

8.92%

8.93%

4.46%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- klp.1arrow_forward7. The table below details three possible alternatives to replace existing machinery. The life of each alternative is 5 years. Assuming the cost of capital is 10%, depreciation for tax purposes of capital expenditure is allowable at 30% on a declining balance basis and the effective tax rate is 45%. Determine the preferred alternative. Alternative Capital Expenditure $ 700,000 900,000 Annual Salvage value $ Operating Cost $ 200,000 130,000 100,000 150,000 300,000 1,300,000 70,000 (BCarrow_forwardbhavuarrow_forward

- RRarrow_forwardff1arrow_forwardInput area: Installation cost Pretax salvage value Operating cost per year Initial NWC Tax rate Discount rate *Depreciation straight-line over life Output area: Annual depreciation charge Aftertax salvage value OCF NPV $ SA SA SA GA $ 385,000 $ 60,000 $ 135,000 35,000 21% 10% ᏌᏊ Ꮚ Ꮚ $ 77,000 $ 47,400 $ 122,820 5arrow_forward

- Problem: A leasing company is planning to purchase an asset for $15,000 with a 6-year life and assume no salvage value. The company can depreciate the asset over its useful life using a straight-line depreciation method. The company has just issued five-year notes at an interest rate of 10% per year. Tax rate = 21%. Maintenance (and other) costs = $1,350 per year for years 1-4, $2,200 per year for years 5-6. What is the after-tax break-event rent for this lease if payments occur at the beginning of the periods? (Hint: Use an excel sheet to solve this problem. You need to draw the lease cash flow table.)arrow_forwardNonearrow_forwardWhat is the NPV of a project that costs $100,000, provides $23,000 in cash flows annually for six years, requires a $5,000 increase in net working capital (recaptured at the end), and depreciates the asset at 15 percent declining balance over six years and sold at zero salvage value? The discount rate is 14 percent. The tax rate is 40 percent $6,136.52 -$29639.22 -$23,460 -$13,283arrow_forward

- Thank you!!arrow_forwardUsing (a) straight-line depreciation and (b) MACRS depreciation, complete the last four columns of the table below using an effective tax rate of 40 percent on an asset that has a first cost of $20,000 and a 3-year recovery period with no salvage value. Both cash flows are in units of $1000.arrow_forward12arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education