Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

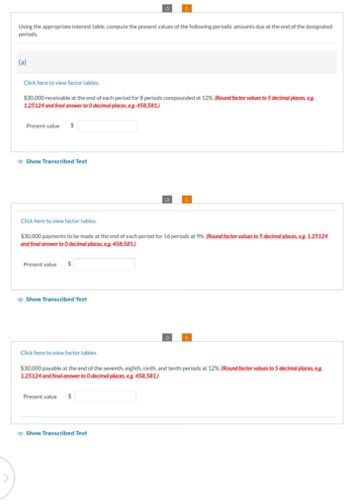

Transcribed Image Text:Using the appropriate interest table, compute the present values of the following periodic amounts due at the end of the designated

periods.

(a)

Click here to view factor tables.

$30,000 receivable at the end of each period for 8 periods compounded at 12%. (Round factor values to 5 decimal places, e.g.

1.25124 and final answer to O decimal places, eg. 458,581.)

Present value $

Show Transcribed Text

Click here to view factor tables.

$30,000 payments to be made at the end of each period for 16 periods at 9%. (Round factor values to 5 decimal places, eg. 1.25124

and final answer to 0 decimal places, eg. 458,581.)

Present value $

Show Transcribed Text

Click here to view factor tables.

$30,000 payable at the end of the seventh, eighth, ninth, and tenth periods at 12%. (Round factor values to 5 decimal places, e.g.

1.25124 and final answer to O decimal places, e.g. 458,581.)

Present value $

Show Transcribed Text

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- don't give answer in image formatarrow_forwardConsider the problem below... Find the accumulated balance after 3 years when $6500 is deposited into an account that compounds monthly with an APR of 4% compounding monthly. Match the values given in the problem with the correct notation. Question 2 options: 1234 0.04 1234 3 1234 12 1234 6500 1. P 2. APR 3. n 4. Yarrow_forward< A debt of $7931 23 is repaid by payments of $1129.24 in 7 months, $1229.85 in 15 months, and a final payment in 23 months. If interest was 9% compounded annually, what was the amount of the final payment? The final payment is $☐ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forward

- (b) What is the present value of $30,700 to be received at the end of each of 5 periods, discounted at 10%? (Round answer to 2 decimal places, e.g. 25.25.)arrow_forward$30,000 payments to be made at the end of each period for 16 periods at 9%. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Present value $ 194218arrow_forwardIf an investment grew to $15,000 in 2 years and the interest amount earned was $1,000, calculate the nominal interest rate compounded monthly.arrow_forward

- Click here to view factor tables What is the present value of 9 receipts of $2,720 each received at the beginning of each period, discounted at 9% compounded interest? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 458,581.) The present value $arrow_forwardA debt of $8866.59 is repaid by payments of $1211.36 in 3 months, $1326 43 in 14 months, and a final payment in 29 months. If interest was 6% compounded monthly, what was the amount of the final payment? CHOD The final payment is $ (Round the final answer to the nearest cont as needed Round all intermediate values to six decimal places as needed)arrow_forwardWhat amount of money invested today at 3.54% compounded monthly will have an accumulated value of $452,000 in 6 years from now. Round all answers to two decimal places if necessary. A P/Y = C/Y = N = I/Y = PMT = $ FV = $ PV = $arrow_forward

- Find the principal and the interest amount. Present Value Interest Amount Future Value Interest (Principal) (Maturity Value) Time Rate $2676.15 4.9% 103 days The principal is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) The interest amount is $ 1 (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) unarrow_forwardYou have taken a loan of $77,000.00 for 29 years at 5.3% compounded quarterly. Fill in the table below: (Round all answers to 2 decimal places.) Payment number Payment amount Principal Amount Interest 0) 1) 2) 3) $ S $ $ Balance $77,000.00 $ sarrow_forwardK t 1 ences Using Exhibit 1-B, complete the following table. (Round FVA factors to 3 decimal places and final answers to the nearest whole dollar.) Annual Deposit Rate of Return $ $ $ $ 1,200 1,200 1,200 1,200 4% 7% 6% 9% Number of Years 10 10 30 30 Investment Value at the End of Time Period Total Amount of Investment Total Amount of Earningsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education