Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:<

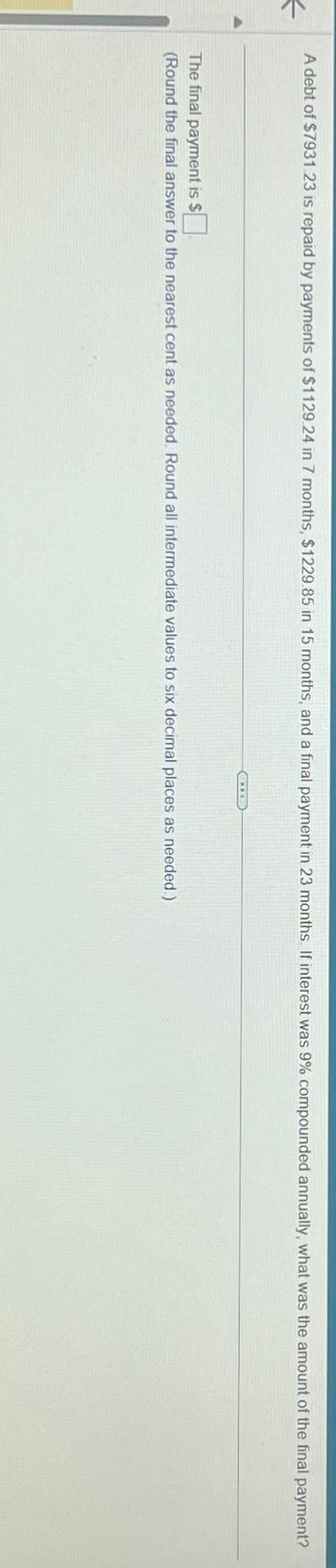

A debt of $7931 23 is repaid by payments of $1129.24 in 7 months, $1229.85 in 15 months, and a final payment in 23 months. If interest was 9% compounded annually, what was the amount of the final payment?

The final payment is $☐

(Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Similar questions

- What is the nominal annual rate of interest compounded monthly if a 9-year loan of $57,300 is repaid by monthly payments of $781.91 made at the end of each month? The nominal annual rate of interest is % compounded monthly. (Round to two decimal places as needed.)arrow_forwardHow much will deposits of $35 made at the end of each month amount to after 12 years if interest is 4% compounded quarterly? The deposits will amount to S (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardA loan of $2766 borrowed today is to be repaid in three equal installments due in two years, three years, and six years, respectively. What is the size of the equal installments if money is worth 7.7% compounded annually? The payments are each $ ☐ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forward

- The interest rate on a $15,300 loan is 9.7% compounded semiannually. Semiannual payments will pay off the loan in nine years. (Do not round intermediate calculations. Round the PMT and final answers to 2 decimal places.) a. Calculate the interest component of Payment 12. $ b. Calculate the principal component of Payment 5. Principal c. Calculate the interest paid in Year 8. Interest paid d. How much do Payments 5 to 8 inclusive reduce the principal balance? Principal reduction Interestarrow_forwardWhat is the future value of 20 periodic payments of $5,140 each made at the beginning of each period and compounded at 8%? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to O decimal places, e.g. 458,581.) The future value $ 54502arrow_forwardWhat is the discounted value of payments of $120.00 made at the end of each month for 7.5 years if interest is 8% compounded monthly? The discounted value is S (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forward

- A loan of 814, 000 is to be repaid in 20 years by month - end repayments starting in one month. The interest rate is 8.3% p.a. compounded monthly. Calculate the principal paid in Year 6. (between the end of month 60 and the end of month 72). Correct your answer to the nearest cent without any units. (Do not use "$" or ","in your answer. e.g. 12345.67) (Hint: you can use Excel to find the answer.)arrow_forwardA debt of $33,000 is repaid over 13 years with payments occurring monthly. Interest is 10% compounded semi-annually. (a) What is the size of the periodic payment? (b) What is the outstanding principal after payment 81? (c) What is the interest paid on payment 82? (d) How much principal is repaid in payment 82? (a) The size of the periodic payment is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) (b) The outstanding principal is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) (c) The interest paid is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) (d) The principal repaid is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardA debt of $3051 with interest at 7.27% compounded monthly is to be repaid by equal payments at the end of each month for 5 years. What is the balance remaining (BAL) after the first payment? Payment Number 0 1 Answer: PMT INT PRN BAL 3051 ?arrow_forward

- On June 2, Fat Tires Ltd. borrowed $10,000.00 with an interest rate of 7.6%. The loan was repaid in full on November 14, with payments of $2700 00 on September 1 and $3300.00 on October 3. What was the final payment? The final payment was $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed)arrow_forwardA loan of $1980 can be repaid in 145 days by paying the principal sum borrowed plus $55 interest. What was the rate of interest charged? The interest rate is%. (Round the final answer to two decimal places as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardDetermine the present value of a debt of $8000 due in eleven months if interest at 6-% is allowed. The present value is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as rarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education