FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

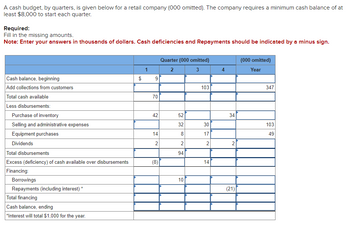

Transcribed Image Text:A cash budget, by quarters, is given below for a retail company (000 omitted). The company requires a minimum cash balance of at

least $8,000 to start each quarter.

Required:

Fill in the missing amounts.

Note: Enter your answers in thousands of dollars. Cash deficiencies and Repayments should be indicated by a minus sign.

Cash balance, beginning

Add collections from customers

Total cash available

Less disbursements:

Purchase of inventory

Selling and administrative expenses

Equipment purchases

Dividends

Total disbursements

Excess (deficiency) of cash available over disbursements

Financing:

Borrowings

Repayments (including interest) *

Total financing

Cash balance, ending

*Interest will total $1,000 for the year.

$

1

S

70

42

14

2

(8)

Quarter (000 omitted)

2

3

52

32

8

2

94

10

103

30

17

2

14

4

34

2

(21)

(000 omitted)

Year

347

103

49

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dogarrow_forwardA cash budget, by quarters, is given below for a retail company (000 omitted). The company requires a minimum cash balance of $4,000 to start each quarter. Required: Fill in the missing amounts. Note: Enter your answers in thousands of dollars. Cash deficiencies and Repayments should be indicated by a minus sign. Cash balance, beginning Add collections from customers Total cash available Less disbursements: Quarter (000 omitted) (000 omitted) 1 2 3 4 Year 6 $ 4 $ 4 $ 4 6 Assessment Tool iFrame 63 96 108 104 369 69 100 112 108 375 Purchase of inventory 47 Selling and administrative expenses 15 530 57 51 31 186 32 30 21 98 Equipment purchases 10 9 22 10 51 Dividends 2 2 2 2 8 Total disbursements Excess (deficiency) of cash available over disbursements 74 100 105 64 343 (5) (1) 7 44 32 Financing: Borrowings Repayments (including interest) * Total financing 9 6 14 (2) (13) (15) 9 6 (2) (13) (1) Cash balance, ending $ 4 $ 4 $ EA 5 31 31 *Interest will total $1,000 for the year.arrow_forwardDengerarrow_forward

- Please do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.arrow_forwardThe company provides the following information regarding the cash budget for next year: Quarter 1 Quarter 2 Quarter 3 Quarter 4 Beginning cash balance $5,000 $5,000 $5,000 $5,000 Excess (Deficiency) ($3,000) $2,000 ($2,500) $1,000 The company's policy is to start each quarter with a cash balance of $5,000.The company has access to a line of credit in the amount of $50,000 for any short term borrowing needs and pays the loans off as quickly as possible.The company assumes the cash budget for the year will begins with no loans.What is the expected loan balance at the end of Quarter 2 (ignore interest)?arrow_forwardbapuarrow_forward

- c. Prepare a monthly cash budget with borrowings and repayments for January, February, and March. Note: Negative amounts should be indicated by a minus sign. Assume the January beginning loan balance is $0. Leave no cells blank be certain to enter O wherever required. Total cash receipts Total cash payments Net cash flow Beginning cash balance Cumulative cash balance Monthly loan (or repayment) Ending cash balance Cumulative loan balance Jayden's Carryout Stores. Cash Budget January 0 0 0 February 0 0 0 March 0 0arrow_forwardA cash budget, by quarters, is given below for a retail company (000 omitted). The company requires a minimum cash balance of $8,000 to start each quarter.Required:Fill in the missing amounts. Note: Enter your answers in thousands of dollars. Cash deficiencies and Repayments should be indicated by a minus sign. Prev Question 10 of 10 Total 10 of 10 Visit question mapThis is the last question in the assignment. To submit, use Alt + S. To access other questions, proceed to the question map button.Next McGraw Hillarrow_forwardPlease don't give image based answerarrow_forward

- Please don't provide answer in image format thank you. Show Excel working sheet and formulaarrow_forwardA cash budget, by quarters, is given below for a retail company (000 omitted). The company requires a minimum cash ba of $7,000 to start each quarter. Required: Fill in the missing amounts. Note: Enter your answers in thousands of dollars. Cash deficiencies and Repayments should be indicated by a minus Quarter (000 omitted) (000 omitted) 1 2 3 4 Year Cash balance, beginning $ 7 $ 7 Add collections from customers 84 88 105 378 Total cash available 91 95 Less disbursements: Purchase of inventory 44 54 28 Selling and administrative expenses Equipment purchases 41 32 30 124 8 8 19 45 Dividends 2 2 2 2 Total disbursements 95 96 Excess (deficiency) of cash available over disbursements (2) (1) 12arrow_forwardA cash budget, by quarters, is given below for a retail company (000 omitted). The company requires a minimum cash balance of at least $3,000 to start each quarter. Required: Fill in the missing amounts. (Enter your answers in thousands of dollars. Cash deficiencies and Repayments should be indicated by a minus sign.) Cash balance, beginning Add collections from customers Total cash available Less disbursements: Purchase of inventory Selling and administrative expenses Equipment purchases Dividends Total disbursements Excess (deficiency) of cash available over disbursements Financing: Borrowings Repayments (including interest)* Total financing Cash balance, ending *Interest will total $1,000 for the year. Quarter 1 (000 omitted) $ 9 97 54 7 2 (5) Quarter 2 (000 omitted) 64 45 9 2 120 12 Quarter 3 (000 omitted) 124 30 29 2 12 Quarter 4 (000 omitted) 30 2 (12) Year (000 omitted) 431 137 55arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education