FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

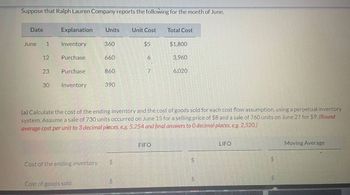

Transcribed Image Text:Suppose that Ralph Lauren Company reports the following for the month of June.

Date

June 1

12

23

30

Explanation Units

Inventory

Purchase

Purchase

Inventory

Cost of the ending inventory

360

Cost of goods sold

660

860

390

+A

Unit Cost

LA

$5

6

7

(a) Calculate the cost of the ending inventory and the cost of goods sold for each cost flow assumption, using a perpetual inventory

system. Assume a sale of 730 units occurred on June 15 for a selling price of $8 and a sale of 760 units on June 27 for $9. (Round

average cost per unit to 3 decimal places, e.g. 5.254 and final answers to O decimal places, e.g. 2,520.)

Total Cost

FIFO

$1,800

3,960

6,020

LA

$

LIFO

LA

$

Moving Average

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ivanhoe Center began operations on July 1. It uses a perpetual inventory system. During July, the company had the following purchases and sales. Date July 1 July 6 July 11 July 14 July 21 July 27 Purchases Units Unit Cost $68 9 5 $76 $83 Sales Units 5 6arrow_forwardSoles during the year were 545 units. Beginning inventory was 430 units at a cost of $6 per unit. Purchase 1 was 215 units at $7 per unit. Purchase 2 was 115 units at $8 per unit. Required: a. Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using FIFO method. b. Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using LIFO method. Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using LIFO method. Note: Enter all values as a positive value. Periodic LIFO Cost of Goods Available for Sale Cost of Goods Sold Inventory Balance Number of unite Cost per Cost of Goods Number Cost Available of unite per Cost of Goods unit Bold unit Sold for Sale Number of units in ending Inventory Cost per unit Ending Inventory Beginning Inventory 430 S 6 S…arrow_forwardFrom the following, calculate the cost of ending inventory and cost of goods sold for the FIFO method, ending inventory is 49 units. (Round your answers to the nearest cent.) Beginning inventoryand purchases Units Unit Cost January 1 5 $2.00 April 10 10 2.50 May 15 12 3.00 July 22 15 3.25 August 19 18 4.00 September 30 20 4.20 November 10 32 4.40 December 15 16 4.80 Cost of ending inventory Cost of goods soldarrow_forward

- The following information is taken from a company's records. Cost Market value per Unit per Unit Inventory Item 1 (8 units) $38 $37 Inventory Item 2 (20 units) 19 19 Inventory Item 3 (13 units) 7 Applying the lower-of-cost-or-market approach, what is the correct value that should be reported on the balance sheet for the inventory? $ %24arrow_forwardHelp mearrow_forwardRequired: Complete the table below to estimate the LIFO cost of ending inventory and cost of goods sold using the information provided. Assume stable retail prices during the period. Note: Round ratio calculation to 2 decimal places (i.e., 0.1234 should be entered as 12.34%.). Enter amounts to be deducted with a minus sign. Beginning inventory Net purchases Net markups Net markdowns Goods available for sale (excluding beginning inventory) Goods available for sale (including beginning inventory) Cost-to-retail percentage (beginning) Cost-to-retail percentage (current) Net sales Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold × Answer is not complete. Cost-to-Retail Cost Retail Ratio $ 190,000 $ 290,000 660,000 865,000 20,000 (5,000) 660,000 880,000 850,000 1,170,000 65.52 % 75.00 % (836,000) $ 334,000 (46,008) Xarrow_forward

- Explain the step by step instructions given the following data for the questions below. Units Price Beginning Inventory 200 $1.20 First Purchase 400 $1.30 Second Purchase 250 $1.40 Sales 550 $2.00 Assuming a FIFO cost flow, the amount of cost of goods sold reported on the income statement would be what? Assuming a LIFO cost flow, the amount of ending inventory reported on the balance sheet would be what? Assuming a weighted average cost flow, the amount of ending inventory reported on the balance sheet would be (round the final answer to the nearest dollar) would be what? In a period of rising prices, which inventory cost flow method results in the lowest balance sheet figure for inventory? In a period of rising prices, which inventory cost flow method results in the lowest income tax liability, all other things being equal?arrow_forwardCan you please answer the ending inventory and the cost of goods sold for FIFO. Thank you!arrow_forwardRequirement 1. Determine the amounts that MusicMagic should report for cost of goods sold and ending inventory. (a) Using the FIFO method, the ending inventory is $ and the cost of goods sold is $ (b) Using the weighted-average-cost method, the ending inventory is $ and the cost of goods sold is $ (Round interim calculations to two decimal places. Round final answers to the nearest dollar.) Requirement 2. MusicMagic uses the FIFO method. Prepare MusicMagic's income statement for the month ended November 30, 2017, reporting gross profit. Operating expenses totalled $260, and the income tax rate was 20%. Begin with the heading, and then select the accounts and enter the amounts in the statement. (Round answers to the nearest dollar. Use parentheses or a minus sign for negative income.) Data Table Date Item Quantity Unit cost Sale Price 1 Balance. 8 Sale. 10 Purchase. 30 Sale. November 12 90 9. 145 16 115 6. 175 Print Donearrow_forward

- Assuming that all net sales figures are at retail and all cost of goods sold figures are at cost, calculate the average inventory (in $) and inventory turnover for the following. If the actual turnover is less than the published rate, calculate the target average inventory necessary to come up to industry standards. If the actual turnover is greater than the published rate, enter "above" for target average inventory. Round inventories to the nearest dollar and inventory turnovers to the nearest tenth Net Sales $580,000 Cost of Goods Sold Beginning Inventory Ending Inventory $139,250 $77,200 Average Inventory $ 108225 Inventory Turnover X Published Rate 4.8 Target Average Inventory $arrow_forwardDetermine the gross profit for April and ending inventory on April 30 using the (a) first-in, first-out (FIF0); (b) last-in, (c) weighted average cost method.arrow_forwardFlint-Mart Centre Inc. opened for business on May 1, and uses a perpetual inventory system. During May, the company had the following purchases and sales for one of its products: Date May 1 3 8 13 15 20 27 Purchases Units 120 100 60 Unit Cost $100 109 114 Units 80 80 60 40 Sales Unit Price $254 278 304 328arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education