Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

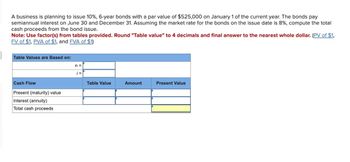

Transcribed Image Text:A business is planning to issue 10%, 6-year bonds with a par value of $525,000 on January 1 of the current year. The bonds pay

semiannual interest on June 30 and December 31. Assuming the market rate for the bonds on the issue date is 8%, compute the total

cash proceeds from the bond issue.

Note: Use factor(s) from tables provided. Round "Table value" to 4 decimals and final answer to the nearest whole dollar. (PV of $1,

FV of $1, PVA of $1, and FVA of $1)

Table Values are Based on:

Cash Flow

Present (maturity) value

Interest (annuity)

Total cash proceeds

n =

Table Value

Amount

Present Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Spiller Corporation plans to issue 10%, 8-year, $600,000 par value bonds payable that pay interest semiannually on June 30 and December 31. The bonds are dated January 1 of the current year and are issued on that date. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your "Table value" to 4 decimal places and final answers to nearest whole dollar.) If the market rate of interest for the bonds is 8% on the date of issue, what will be the total cash proceeds from the bond issue? Table Values are Based on: Cash Flow Present (maturity) value Interest (annuity) Total cash proceeds n = =! Table Value Amount Present Valuearrow_forwardProblem Tower Inc. issues $40,000, 10%, 10-year bonds at January 1, 2020. Interest is paid semi- annually on June 30 and December 31. On the date of issuance, the bonds sold for 113.5 when the market rate was 8%. 1.) Compute the price of the bonds on their issue date. Round to the whole dollars.arrow_forwardBlueLtd. Issued a $1,164,000, 10-year bond dated January 1, 2020. The bond was sold to yield 12% effective interest. The bond paid 10% interest on January 1 and July 1 each year. The company's year-end was December 31, and Blue followed IFRS. Using 1 factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the amount received for the bond, and any discount or premium on the bond. Click here to view the tactor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITYOF 1 (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answers to 0 decimal places, e.g. 5,275.) Proceeds from sale of bond : on bond Prepare the journal entries for above transactions. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the…arrow_forward

- Monty Corp. invested in a three-year, $100 face value 9% bond, paying $95.11. At this price, the bond will yield a 11% return. Interest is payable annually. Prepare a bond discount amortization table for Monty Corp., assuming Monty uses the effective interest method required by IFRS. (Round answers to 2 decimal places, e.g. 52.75.) Bond Discount Amortization Table Date Cash Received Interest Income Bond Discount Amortization Amortized Cost of Bond Day 1 $enter a dollar amount End Year 1 $enter a dollar amount $enter a dollar amount $enter a dollar amount enter a dollar amount End Year 2 enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount End Year 3 enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount $enter a total amount $enter a total amount $enter a total amount Prepare journal entries to record the initial…arrow_forwardCompute bond proceeds, amortizing discount by interest method, and interest expense Boyd Co. produces and sells aviation equipment. On the first day of its fiscal year, Boyd issued $80,000,000 of five-year, 9% bonds at a market (effective) interest rate of 11%, with interest payable semiannually. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet Compute the following: a. The amount of cash proceeds from the sale of the bonds. Round your answer to the nearest dollar. $ b. The amount of discount to be amortized for the first semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. $ c. The amount of discount to be amortized for the second semiannual interest payment period, using the interest method. Round your answer to the nearest dollar. $ d. The amount of the bond interest expense for the first…arrow_forwardHartford Research issues bonds dated January 1 that pay interest semiannually on June 30 and December 31. The bonds have a $39,000 par value and an annual contract rate of 8%, and they mature in 10 years. (Table B.1, Table B.2, Table B.3, and Table B.4) Note: Use appropriate factor(s) from the tables provided. Round all table values to 4 decimal places, and use the rounded table values in calculations. Required: Consider each separate situation. 1. The market rate at the date of issuance is 6%. (a) Complete the below table to determine the bonds' issue price on January 1. (b) Prepare the journal entry to record their issuance. 2. The market rate at the date of issuance is 8%. (a) Complete the below table to determine the bonds' issue price on January 1. (b) Prepare the journal entry to record their issuance. 3. The market rate at the date of issuance is 10%. (a) Complete the below table to determine the bonds' issue price on January 1. (b) Prepare the journal entry to record their…arrow_forward

- 5 0 V File C13 123456 7 89 Home 18 19 20 Insert Arial X ✓ fx Face amount of bonds Contract rate of interest Draw Term of bonds, years Market rate of interest Interest payment Page Layout く 10 Formulas DATA B ✓ ✓ V Data A B C Compute bond proceeds, amortizing discount by interest method, and interest expense Av $80,000,000 9% 5 11% Semiannual Review Amount ... View Ev ab ≡く D Using formulas and cell references, perform the required analysis, and input your answers into the Amount column. Transfer the numeric results for the green entry cells (C13:C16) into the appropriate fields in CNOWv2 10 for gradina. 11 12 13 a. PV of cash proceeds 14 b. Discount amortized for the 1st interest payment period 15 c. Discount amortized for the 2nd interest payment period 16 d. Interest expense for the 1st year 17 Help Formulas Editing ✓ Currency E $ 500 ✓ C →>>arrow_forwardBuchanan Corporation issues $500,000 of 11% bonds that are due in 10 years and pay interest semi-annually. At the time of issue, the market rate for such bonds is 10%. Calculate the bonds' issue price by using the excel Present Value (PV) function/ financial calculator / PV tables. Round to the nearest dollar.arrow_forwardLisa Anderson Company issued $516,000 of 10%, 20-year bonds on January 1, 2025, at 102. Interest is payable semiannually on July 1 and January 1. Lisa Anderson Company uses the effective-interest method of amortization for bond premium or discount. Assume an effective yield of 9.7705% Click here to view factor tables. Prepare the journal entries to record the following. (Round intermediate calculations to 6 decimal places, eg. 1.251247 and final answer to O decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) a. The issuance of the bonds. b. The payment of interest and related amortization on July 1, 2025. с The accrual of interest and the related amortization on December 31, 2025. Date Account Titles and Explanation Debit Creditarrow_forward

- Subject - account Please help me. Thankyou.arrow_forwardHartford Research issues bonds dated January 1 that pay interest semiannually on June 30 and December 31. The bonds have a $36,000 par value and an annual contract rate of 12%, and they mature in 10 years. (Table B.1, Table B.2, Table B.3, and Table B.4) Note: Use appropriate factor(s) from the tables provided. Round all table values to 4 decimal places, and use the rounded table values in calculations. Required: Consider each separate situation. 1. The market rate at the date of issuance is 10%. (a) Complete the below table to determine the bonds' issue price on January 1. (b) Prepare the journal entry to record their issuance. 2. The market rate at the date of issuance is 12%. (a) Complete the below table to determine the bonds' issue price on January 1. (b) Prepare the journal entry to record their issuance. 3. The market rate at the date of issuance is 14%. (a) Complete the below table to determine the bonds' issue price on January 1. (b) Prepare the journal entry to record their…arrow_forwardVinubhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education