FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

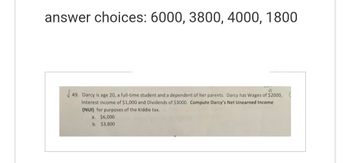

Transcribed Image Text:answer choices: 6000, 3800, 4000, 1800

JJ

√49. Darcy is age 20, a full-time student and a dependent of her parents. Darcy has Wages of $2000,0

Interest income of $1,000 and Dividends of $3000. Compute Darcy's Net Unearned Income

(NUI) for purposes of the Kiddie tax.

a. $6,000

b. $3,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Exercise 12-25 (Algorithmic) (LO. 7) Compute the additional Medicare tax for the following taxpayers. If required, round your answers to the nearest dollar. a. Mario, who is single, earns wages of $490,200. His additional Medicare tax is $ b. George and Shirley are married and file a joint return. During the year, George earns wages of $298,100, and Shirley earns wages of $447,150. Their additional Medicare tax is $ c. Simon has net investment income of $56,880 and MAGI of $284,400 and files as a single taxpayer. Simon's additional Medicare tax is $arrow_forwardCCH Federal Taxation-Comprehensive Topics 35. Beth, who is single, redeems her Series EE . bonds. She receives $12,000, consisting of $8,000 principal and $4,000 interest. Beth's qualified educational expenses total $16,500. Further, Beth's adjusted gross income for the year is $40,000. Determine what, if any, interest income Beth must include in her gross income.arrow_forwardMa2.arrow_forward

- Answer in typingarrow_forwardSubject: accountingarrow_forward6. A married couple are calculating their federal income tax using the tax rate tables: Then Estimated Taxes Are If Taxpayer's Income Is Between So $16,700 $67,900 $137,050 $208,850 $372,950 But Not Over $16,700 $67,900 $137,050 $208,850 $372,950 Base TaxRate $0 10% $1,670.00 15% $9,350.00 25% $26,637.50 28% $46,741.50 33% $100,894.50 35% S0 $16,700 $67,900 $137,050 $208,850 $372,950 How much tax will they have to pay on their taxable income of $202,000? (4arrow_forward

- Paul is head of household with taxable income of $ 68500 He has a $ 7000 entitled tax credit His tax bracket is 15 % up to earning $ 50,800 Standard deduction is $ 9350 exemption is $ 4050 per person what is his tax owedarrow_forwardUS Tax Law Taxpayer is single and has the following items: state taxes withheld, $7,500; property taxes $6,000; DMV, $500. His state tax deduction on schedule A would be A. $14,000 B. $13,500 C. $6500 D. $10,000 E. Some other amountarrow_forwardI need help on question 21arrow_forward

- M8arrow_forward28. Using the tax table provided, compute the income tax due for Susie and Josh Adams whose taxable income for the past year is $181,050. Income Tax Not Of the Amount Over The Tax is: Over Over $- $19,750 $0 10% $- + 19,750 80,250 1,975 12% 19,750 80,250 171,050 9,235 22% 80,250 + 171,050 326,600 29,211 + 24% 171,050 326,600 414,700 66,543 + 32% 326,600 414,700 622,050 94,735 + 35% 414,700 622,050 167,308 + 37.0% 622,050arrow_forward11.A taxpayer is claiming tax preparation expense as a legal and professional fee. They paid $430 at your office last year. The forms breakdown by cost is as follows: Form 1040- $100 Form Sch. C- $125 Form SE- $55 Form 8867- $75 Form 8863- $75 What is the correct amount that can be deducted on their Schedule C for the current year? Choose one answer. a. $280 b. $180 c. $355 d. $430arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education