Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

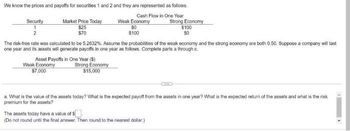

Transcribed Image Text:We know the prices and payoffs for securities 1 and 2 and they are represented as follows.

Security

Cash Flow in One Year

Strong Economy

Market Price Today

$25

$70

Asset Payoffs in One Year ($)

Weak Economy

$7,000

Weak Economy

Strong Economy

$15,000

$0

$100

The risk-free rate was calculated to be 5.2632%. Assume the probabilities of the weak economy and the strong economy are both 0.50. Suppose a company will last

one year and its assets will generate payoffs in one year as follows. Complete parts a through c.

$100

$0

a. What is the value of the assets today? What is the expected payoff from the assets in one year? What is the expected return of the assets and what is the risk

premium for the assets?

The assets today have a value of $

(Do not round until the final answer. Then round to the nearest dollar)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The net present value is ... O A. The return which is required for an investment O B. The current worth of a future stream of cash O C. The length of time it takes to recover the initial investment of a project O D. The sum of a time series of discounted cash inflows and outflowsarrow_forwardWhat does the rate of return on total assets measure, and how is it calculated?arrow_forward1. What are the values of the unit claims (C1 and C2)? 2. What is the risk free rate implied by these assets?arrow_forward

- 18. How should internal rate of return be calculated in terms of Net Present Value?arrow_forwardWhich of the following methods should be used when the expected benefits to be received from an asset will decline each period? a. Straight-line b. Units-of-production c. Sum-of-the-years'-digits d. Compound-interestarrow_forwardFinancial assets management decision-making often involves determination of the Present Value (PV) of the flow of money over time. If a monetary PV is given by: PV = Gt/(1+m)t (i) Identify and explain each of the variables: G, m, and t. (ii) Explain how an increase in m would impact the PV of this financial asset. (iii) Find how much would be required to generate a PV of 890, over a 5 years period, at a constant annual interest rate of 4 percent.arrow_forward

- PV = Cash Flow/Interest Rate is the present value shortcut formula for which of the following: * A perpetuity A single cash flow in the future A growing perpetuity An annuityarrow_forwardWhich type of average rate of return best describes the average annual rate of return earned over the period (the arithmetic or geometric)? Why?arrow_forwardHow do you measure returns to real estate investments?arrow_forward

- 26.1 (d, e, f)arrow_forwardAnnuity Present Value Inputs Payment Discount Rate/Period Number of Periods Present Value using a Time Line Period Cash Flows Present Value of Each Cash Flow Present Value Annuity Present Value using the Formula Present Value Annuity Present Value using the PV Function Present Valuearrow_forwardWhat is future value of annuity, FVA?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education