Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

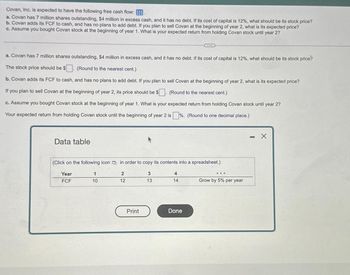

Transcribed Image Text:Covan, Inc. is expected to have the following free cash flow:

a. Covan has 7 million shares outstanding, $4 million in excess cash, and it has no debt. If its cost of capital is 12%, what should be its stock price?

b. Covan adds its FCF to cash, and has no plans to add debt. If you plan to sell Covan at the beginning of year 2, what is its expected price?

c. Assume you bought Covan stock at the beginning of year 1. What is your expected return from holding Covan stock until year 2?

a. Covan has 7 million shares outstanding, $4 million in excess cash, and it has no debt. If its cost of capital is 12%, what should be its stock price?

The stock price should be $

(Round to the nearest cent.)

b. Covan adds its FCF to cash, and has no plans to add debt. If you plan to sell Covan at the beginning of year 2, what is its expected price?

If you plan to sell Covan at the beginning of year 2, its price should be $

(Round to the nearest cent.)

c. Assume you bought Covan stock at the beginning of year 1. What is your expected return from holding Covan stock until year 2?

Your expected return from holding Covan stock until the beginning of year 2 is %. (Round to one decimal place.)

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Year

FCF

1

10

2

12

Print

3

13

4

14

Done

...

Grow by 5% per year

- X

-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- aj.4arrow_forward4. Target Inc. has just paid a dividend of $4 per share and has announced that it will increase the dividend by $2 per share for each of the next four years, and then never pay another dividend. If you require an 8% return on the company’s stock, how much will you pay for a share today? (show work)arrow_forwardHelparrow_forward

- LL corporation has $500M of excess cash. The firm has no debt and 1K shares outstanding with a current market price of $20 per share. LL’s board has decided to pay out this cash as a one time dividend. What is the ex-dividend price of a share in a perfect capital market?arrow_forwardCaspian Water needs to raise $59.00 million by issuing additional shares of stock. If the market estimates Caspian Water will pay a dividend of $2.12 next year (D1 2.12), which will grow at 3.99% forever and the cost of equity to be 12.82%then how many shares of stock must the firm sell? 1 ) None of the answers in this list is within 100 shares of the correct answer 2) 312,890 3) 2,457,406 4 ) 4,128,970 5 ) 915,939 6 ) 2.975,934arrow_forwardwhich option is correctarrow_forward

- An all-equity firm has expected earnings of $14,200 and a market value of $82,271. The firm is planning to issue $15,000 of debt at 6.3 percent interest and use the proceeds to repurchase shares at their current market value. Ignore taxes. What will be the cost of equity after the repurchase?arrow_forward7. Doctors' Inc. just paid an annual dividend of $2.00 last week and is currently selling for $25 per share (not necessarily the value). Its dividends are expected to increase by 5% annually. Based on the riskiness of Doctors' Inc's stock, your required rate of return is 15%. What should be your trading strategy on this stock? a. b. C. d. e. Buy the stock at $25.00 if you don't own it as it is worth $21.00 per share. Sell the stock if you own it at $25.00 as it is worth $21.00 per share. Buy the stock at $25.00 if you don't own it as it is worth $28.00 per share. Sell the stock if you own it at $25.00 as it is worth $13.50 per share. Nothing, the stock is fairly priced at $25.00 per share.arrow_forwardA firm has 5 million shares outstanding with a market price of $35 per share. The firm has $10 million in extra cash (short-term investments) that it plans to use in a stock repurchase; the firm has no other financial investments or any debt. What is the firm's value of operations after the repurchase? Enter your answer in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answer to two decimal places. $ million How many shares will remain after the repurchase? Round your answer to the nearest whole number. sharesarrow_forward

- Sunnyfax Publishing pays out all its earnings and has a share price of $37.00. In order to expand, Sunnyfax Publishing decides to cut its dividend from $3.00 to $2.00 per share and reinvest the retained funds. Once the funds are reinvested, they are expected to grow at a rate of 14%. If the reinvestment does not affect Sunnyfax's equity cost of capital, what is the expected share price as a consequence of this decision? O $45.87 $40.14 $68.81 $57.34 Suppose a ten-year, $1,000 bond with an 8.6% coupon rate and semiannual coupons is trading for $1,035.39. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? 8.08% O4.04% O 5.36% O 10.72%arrow_forwardCovan, Inc. is expected to have the following free cash flow: a. Covan has 8 million shares outstanding, $3 million in excess cash, and it has no debt. If its cost of capital is 11%, what should be its stock price? b. Covan adds its FCF to cash, and has no plans to add debt. If you plan to sell Covan at the beginning of year 2, what is its expected price? c. Assume you bought Covan stock at the beginning of year 1. What is your expected return from holding Covan stock until year 2? a. Covan has 8 million shares outstanding, $3 million in excess cash, and it has no debt. If its cost of capital is 11%, what should be its stock price? The stock price should be $ (Round to the nearest cent.) A b. Covan adds its FCF to cash, and has no plans to add debt. If you plan to sell Covan at the beginning of year 2, what is its expected price? If you plan to sell Covan at the beginning of year 2, its price should be $ (Round to the nearest cont.) c. Assume you bought Covan stock at the beginning of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education