EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

None

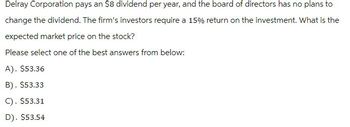

Transcribed Image Text:Delray Corporation pays an $8 dividend per year, and the board of directors has no plans to

change the dividend. The firm's investors require a 15% return on the investment. What is the

expected market price on the stock?

Please select one of the best answers from below:

A). $53.36

B). $53.33

C). $53.31

D). $53.54

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- I need help with these questions please. Thank you!arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardplease help i cant fogure what im doing wrong for the last questionarrow_forward

- Suppose you purchase one share of the stock of Volatile Engineering Corporation at the beginning of year 1 for $36. At the end of year 1, you receive a $2 dividend and buy one more share for $30. At the end of year 2, you receive total dividends of $4 (i.e., $2 for each share) and sell the shares for $36.45 each. The dollar- weighted return on your investment is Answers: А. -1.75%. B. 8.00%. C. 4.08%. D. 8.53%. Е. 12.35%.arrow_forwardSolve the question step-by-step with comprehensive explanation where required.arrow_forwardSuppose that you sell short 1,000 shares of Xtel, currently selling for $20 per share, and give your broker $15,000 to establish your margin account.a. If you earn no interest on the funds in your margin account, what will be your rate of return after one year if Xtel stock is selling at: (i) $22; (ii) $20; (iii) $18? Assume that Xtel pays no dividends.b. If the maintenance margin is 25%, how high can Xtel’s price rise before you get a margin call?c. Redo parts (a) and (b), but now assume that Xtel also has paid a year-end dividend of $1 per share. The prices in part (a) should be interpreted as ex-dividend, that is, prices after the dividend has been paid.arrow_forward

- .Suppose that you sell short 1,000 shares of Xtel, currently selling for $20 per share, and give your broker $15,000 to establish your margin account. a.If you earn no interest on the funds in your margin account, what will be your rate of return after one year if Xtel stock is selling at: (i) $22; (ii) $20; (iii) $18? Assume that Xtel pays no dividends. b.If the maintenance margin is 25%, how high can Xtel’s price rise before you get a margin call? c.Redo parts (a) and (b), but now assume that Xtel also has paid a year-end dividend of $1 per share. The prices in part (a) should be interpreted as ex-dividend, that is, prices after the dividend has been paid.13.arrow_forwardJersey Medical earns $12.50 a share, sells for $100, and pays a $6 per share dividend. The stock is split two for one and a $3 per share cash dividend is declared. a. What will be the new price of the stock? Round your answer to the nearest dollar. $ b. If the firm's total earnings do not change, what is the payout ratio before and after the stock split? Round your answers to one decimal place. Payout ratio before the split: Payout ratio after the split: % %arrow_forwardC) usually with the assistance of an investment banker. D) A and B. E) B and C. 2. You purchased 100 shares of ABC common stock on margin at $70 per share. Assume the initial margin is 50% and the maintenance margin is 30%. Below what stock price level would you get a margin call? Assume the stock pays no dividend; ignore interest on margin. A) $21 B) $50 C) $49 D) $80 E) none of the above 3. Assume you sell short 100 shares of common stock at $45 per share, with initial margin at 50%. What would be your rate of return if you repurchase the stock at $40/share? The stock paid no dividends during the period, and you did not remove any money from the account before making the offsetting transaction. A) 20% B) 25% C) 22% D) 77% E) none of the above 4. You purchased 1000 shares of common stock on margin at $30 per share. Assume the initial margin is 50% and the stock pays no dividend. What would the maintenance margin be if a margin call is made at a stock price of $24?arrow_forward

- What is the answers and the workingarrow_forwardIOP will pay a dividend of $4.10, $8.20, $11.05, and $12.80 per share for each of the next four years, respectively. The company will then close its doors. If investors require a return of 9.3 percent on the company's stock, what is the stock price? Multiple Choice O O O $34.10 $32.58 $28.05 $38.92 $30.25arrow_forwardThe Turnip Company plans to issue preferred stock. Currently, the company’s stock sells for $115. Once new stock is issued, the Turnip Company would receive only $95. The dividend rate is 7.5%, and the par value of the stock is $105. Compute the cost of capital of the stock to your firm. Show all work please.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT