Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

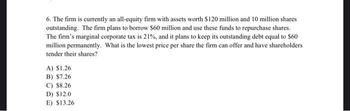

Transcribed Image Text:6. The firm is currently an all-equity firm with assets worth $120 million and 10 million shares

outstanding. The firm plans to borrow $60 million and use these funds to repurchase shares.

The firm's marginal corporate tax is 21%, and it plans to keep its outstanding debt equal to $60

million permanently. What is the lowest price per share the firm can offer and have shareholders

tender their shares?

A) $1.26

B) $7.26

C) $8.26

D) $12.0

E) $13.26

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The asset of a firm is financed by $100,000 Common Equity, $100,000 Preferred Stock, and $300,000 Bonds. The Weighted Average Cost of Capital (WACC) is 10%. Given that the asset is likely to generate Net Operating Profit After Tax of $100,000. What would be the firm’s EVA? Question 5 options: 1) $5,000 2) $50,000 3) $20,000 4) None of the above.arrow_forwardA firm is currently an all equity firm that has 395,000 shares of stock outstanding with a market price of $19.50 a share. The current cost of equity is 15.5% and the tax rate is 24%. The firm is considering adding $925,000 of debt with a coupon rate of 8% to it's capital structure. The debt will be sold at par value. What is the leveled value of the equity? A) 7,349,475 B) 8 716,950 C) 6,999,500 D) 7,528,275 E) 7,132,050arrow_forward7.arrow_forward

- Stepwise pls and correct only The firm is an all-equity firm with assets worth $500 million and 100 million shares outstanding. It plans to raise $200 million and use these funds to repurchase shares. The firm’s marginal corporate tax is 21%, and it plans to keep its outstanding debt equal to $200 million permanently. What is the value of equity for the leveraged firm? Assuming no financial distress or bankruptcy cost. A) $542 million B) $458 million C) $342 million D) $300 million E) $158millionarrow_forwardA1. Payout policy (Answer all parts of this question.) (a) , What is the main theorem of Modigliani and Miller regarding the payout policy of firms? Explain. 1 (b) List four assumptions that must hold for the Modigliani-Miller theorem to be valid. (c) Consider a company that has 100 million shares outstanding. The market value of the company is currently at GBP 5 billion. Last year, the company paid out an annual dividend of GBP 2 per share. This year, the company intends to double the dividend to shareholders, but since the company has not enough cash, the company intends to raise the additional money required to pay the dividend in rights issue. i. ( If the price of a new share offered is GBP 25, what is the fair value of a right to buy a new share? Hint: The company first pays the dividends, and then raises the capital. ii. ( ) Contrary to theory, however, as soon as the company announces the rights issue, the share price drops. Why? Think of a reason why this transaction, i.e.,…arrow_forward6 Please show work in Excel format, thanks!arrow_forward

- 34.) You were hired as a consultant to Giambono Company, whose target capital structure is 40% debt, 10% preferred, and 50% common equity. The after-tax cost of debt is 6.00%, the cost of preferred is 7.50%, and the cost of retained earnings is 12.75%. The firm will not be issuing any new stock. What is its WACC?Group of answer choices 8.75% 9.55% 9.26% 9.53% 8.98%arrow_forward23) can i please get help?arrow_forwardABC is an unlevered firm with EBIT of $12,257 per year forever. Its unlevered cost of equity is 11%. It plans to borrow $36,348 perpetual debt at 6% to buy back shares. If the corporate tax is 26%, what is the firm value after the recapitalization?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education