FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Can you help me with #5- #18

Transcribed Image Text:Number of days"

sales in receivables

5.

inancial Statement Analysis

6.

Inventory tumover

6. Inventory turnover

Number of days"

sales in inventory

7.

7. Number of days' sales in inventory

8. Ratio of fixed assets to long-term liabilities

9. Ratio of liabilities to stockholders' equity

8.

Ratio of Fixed assets to

long-tem liabilities

9.

Ratio of liabilities to

stockholders' equity

10. Times interest earned

10.

Times interest eamed

11. Asset turnover

11.

Asset tumover

12. Return on total assets

12.

Retum on total assets

13. Return on stockholders' equity

Retum on stockholders

13.

equity

14. Return on common stockholders' equity

14.

Retum on common

15. Earnings per share on common stock

stockholders' equity

16. Price-earnings ratio

17. Dividends per share of common stock

15.

Eamings per share

on common stock

16.

Price eamings ratio

18. Dividend yield

17.

Dividends per share

of common stock

18.

Dividend yield

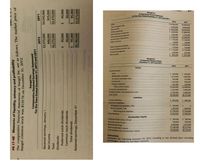

Transcribed Image Text:For the Years Ended December 31, 20Y2 and 20Y1

aiysis

877

Stargel Inc.

Comparative Income Statement

for the Years Ended December 31, 20Y2 and 20Y1

20Υ2

20Υ1

Sales...*

$10,000,000

$9,400,000

Cost of goods sold.

Gross profit

Selling expenses...

Administrative expenses.

Total operating expenses

Income from operations.

Other revenue....

5,350,000

4,950,000

$ 4,650,000

$ 2,000,000

$4,450,000

$1,880,000

1,500,000

$ 3,500,000

$ 1,150,000

1,410,000

$3,290,000

$1,160,000

150,000

140,000

$ 1,300,000

$1,300,000

Other expense (interest)

Income before income tax

Income tax expense.

170,000

$ 1,130,000

150,000

$1,150,000

230.000

225,000

Net income

$ 900,000

24925,000

Stargel Inc.

Comparative Balance Sheet

December 31, 20Y2 and 20Y1

20Υ2

20Υ1

Assets

Current assets:

Cash

$ 500,000

$ 400,000

Marketable securities..

1,010,000

1,000,000

Accounts receivable (net)

740,000

510,000

Inventories

1,190,000

950,000

Prepaid expenses

250,000

229,000

$3,089,000

Total current assets..

$3,690,000

Long-term investments

Property, plant, and equipment (net)

Total assets.

2,350,000

2,300,000

3,740,000

3,366,000

$9,780,000

$8,755,000

Liabilities

Current liabilities.

$ 900,000

$ 880,000

Long-term liabilities:

Mortgage note payable, 10%.

Bonds payable, 10%....

$ 200,000

1,500,000

1,500,000

$1,500,000

Total long-term liabilities

Total liabilities........

$1,700,000

$2,600,000

$2,380,000

Stockholders' Equity

$ 500,000

Preferred $0.90 stock, $10 par

Common stock, $5 par.

$ 500,000

500,000

500,000

Retained earnings.

6,180,000

$7,180,000

5,375,000

Total stockholders' equity...

Total liabilities and stockholders' equity

$6,375,000

$9,780,000

$8,755,000

Instructions

Determine the following measures for 20Y2, rounding to one decimal place including

percentages, except for per-share amounts:

PR 17-4B Measures of liquidity, solvency and profitability

The comparative financial statements of Stargel Inc. are as follows. The market price of

Stargel common stock was $119.70 on December 31, 20Y2.

Stargel Inc.

Comparative Retained Earnings Statement

For the Years Ended December 31, 20Y2 and 20Y1

Retained earnings, January

Net income

Total

Dividends:

Preferred stock dividends

Common stock dividends.

Total dividends.

Retained earnings, December 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ect p.mheducation.com/ext/map/index.html?_con3con&external_browser%3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-group/... * D B homework i Saved Help Save & Exit Submit Check my work Required information [The following information applies to the questions displayed below.] Altira Corporation provides the following information related to its merchandise inventory during the month of August 2021: Aug.1 Inventory on hand–2,000 units; cost $5.30 each. 8 Purchased 8,000 units for $5.50 each. 14 Sold 6,000 units for $12.00 each. 18 Purchased 6,000 units for $5.60 each. 25 Sold 7,000 units for $11.00 each. 28 Purchased 4,000 units for $5.80 each. 31 Inventory on hand-7,000 units. Required: 1. Using calculations based on a perpetual inventory system, determine the inventory balance Altira would report in its August 31, 2021, balance sheet and the cost of goods sold it would report in its August 2021 income statement using the FIFO method. Cost of Goods…arrow_forwardAnswer questions 8. And 9.arrow_forwardIs there a way you can provide an example for number 3?arrow_forward

- Not a previously submitted question. Thank youarrow_forwardWould you please provide the answer for #4 as well? Thank you!arrow_forward5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education