FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

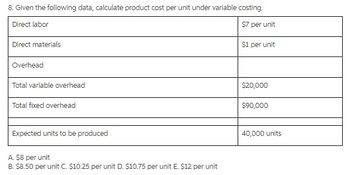

Transcribed Image Text:8. Given the following data, calculate product cost per unit under variable costing.

Direct labor

$7 per unit

Direct materials

$1 per unit

Overhead

Total variable overhead

$20,000

Total fixed overhead

$90,000

Expected units to be produced

40,000 units

A. $8 per unit

B. $8.50 per unit C. $10.25 per unit D. $10.75 per unit E. $12 per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The XYZ Company uses Standard costing system. Following data are taken from its cost record.STANDARD ACTUALDirect Material Rate per unit Rs. 10 Rate per unit Rs. 12Total Cost Rs. 80,000 Quantity 8,600 unitsDirect Labour Wages per hour Rs. 40 Wages per hour Rs. 30Total labour hours 600 Total labour cost Rs. 16,500Factory Overhead 90% of Direct labour Rs. 20,000Required:1] Compute the Following. a) Material Price Varianceb) Material Quantity Variance c) Labour Rate Varianced) Labour efficiency variance e) Overhead Variancearrow_forwardSchwiesow Corporation has provided the following information: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Multiple Choice O $14,750 Variable administrative expense Fixed selling and administrative expense If 4,500 units are produced, the total amount of manufacturing overhead cost is closest to:arrow_forwardThe following data was prepared by the Sandhill Company. Total Variable Fixed $ 24/unit Sales price $ 78, 750 Direct materials used Direct labor $91,000 $ 110, 750 $ 13,850 $ 96.900 Manufacturing overhead $ 22,000 $ 12,600 $9,400 Selling and administrative expense 25,500 units Units manufactured 20, 800 units Beginning Finished Goods Inventory 9,000 units Ending Finished Goods Inventory Under variable costing, what is the unit product cost?arrow_forward

- narubhaiarrow_forwardUsing this information from Planters, Inc., what is the cost per unit under absorption costing? Round to the nearest penny, two decimal places. Planters, Inc data Cost Production Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Amount 10,348 units $248 293 103 1,008,619arrow_forwardFor each variable cost per unit listed below, determine the total variable cost when units produced and sold are 25, 50, and 100 units. Direct materials $ 40 Direct labor 80 Variable overhead 9 Sales commission 12arrow_forward

- Direct materials = $10 per unitDirect labor = $5 per unitVariable manufacturing overhead = $2 per unitFixed manufacturing overhead = $1,000Units produced is 1,000 units What is the cost per unit using the absorption method? What is the cost per unit using the variable method?arrow_forwardMenk Corporation has provided the following information: Cost per Unit Cost per Period Direct materials $ 6.80 Direct labor $ 3.80 Variable manufacturing overhead $ 2.00 Fixed manufacturing overhead $ 20,200 Sales commissions $ 0.50 Variable administrative expense $ 0.40 Fixed selling and administrative expense $ 10,100 Required: a. If 5,220 units are sold, what is the variable cost per unit sold? Note: Round "Per unit" answer to 2 decimal places. b. If 5,220 units are sold, what is the total amount of variable costs related to the units sold? c. If 5,220 units are produced, what is the total amount of manufacturing overhead cost incurred? a. Variable cost per unit sold b. Total variable costs c. Total manufacturing overhead costarrow_forwardTotal product cost per unit under absorption costing = Units produced = 1000Direct Materials = $ 6Direct Labor = $10Fixed overhead =$ 6000Variable overhead = $ 6Fixed Selling & Admin = $ 2000Variable Selling & Admin $ 2arrow_forward

- Given the following data, calculate product cost per unit under absorption costing. Direct labor Direct materials Variable overhead Fixed overhead Units produced per year Multiple Choice $28.00 per unit $28.60 per unit $30.00 per unit $30.90 per unit $ 17.00 per unit $ 11.00 per unit $ 0.90 per unit $ 100,000 50,000 unitsarrow_forward2. Baxter Company has a relevant range of production between 15,000 and 30,000 units. The following cost data represents average variable costs per unit for 25,000 units of production. Average Cost per Unit Direct Materials $10.00 Direct Labor $9.00 Variable Manufacturing Overhead $5.00 Variable Sales Commission $14.00 Fixed Selling & Administrative Expenses $8.00 Fixed Manufacturing Overhead $6.00 PLEASE NOTE #1: Costs per unit dollar amounts will be rounded to two decimal places and shown with "$" and commas as needed (i.e. $1,234.56). PLEASE NOTE #2: Total costs dollar amounts will be whole dollars and shown with "$" and commas as needed (i.e. $12,345). Using the costs data from Baxter Company, answer the following questions: If 15,000 units are produced, what is the variable cost per unit? If 28,000 units are produced, what is the variable cost per unit? If 21,000 units are produced, what are the total variable costs? If 29,000 units are…arrow_forwardFor each variable cost per unit listed below, determine the total variable cost when units produced and sold are 40, 80, and 160 units. Direct materials $ 35 Direct labor 55 Variable overhead Sales commission 11 12 Begin by calculating the total variable cost for each variable cost per unit listed, and the total variable cost when sales are 40 units. Then calculate the total variable cost when sales are 80 and 160 units, respectively Variable cost per unit Variable Cost at 40 Units Direct materials Direct labor Variable overhead $ 35 55 11 Sales commission 12 Total variable costarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education