Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

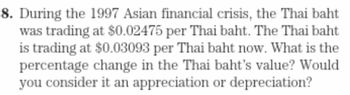

Transcribed Image Text:8. During the 1997 Asian financial crisis, the Thai baht

was trading at $0.02475 per Thai baht. The Thai baht

is trading at $0.03093 per Thai baht now. What is the

percentage change in the Thai baht's value? Would

you consider it an appreciation or depreciation?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- What is the likely frequency of the data (daily, monthly, yearly)? Compare to historical historical data in the picture to justify the answer.arrow_forwardThe total in rate sensitive assets for a financial institution is $120 million and the total in rate sensitive liabilities is $95 million. What is the cumulative pricing gap (CGAP) and what is the interest rate sensitivity gap ratio if total assets equals $195 million? What would the projected change to net income be if interest rates rose by 2% on both assets and liabilities? What would the projected change to net income be if interest rates declined by 2% on both assets and liabilities? What would the projected change to net income be if interest rates rose by 1.8% on assets and 1.5% on liabilities? What would the projected change to net income be if interest rates declined by 1.8% on assets and 1.5% on liabilities?arrow_forwardWhat is the discount rate at which the following cash flows have a NPV of $0? Answer in %, rounding to 2 decimals.Year 0 cash flow = -116,000Year 1 cash flow = 28,000Year 2 cash flow = 43,000Year 3 cash flow = 38,000Year 4 cash flow = 41,000Year 5 cash flow = 40,000Year 6 cash flow = 37,000arrow_forward

- Listen The future value of $100 deposited today (assuming positive interest rates and a time difference between the present and the future): 1) will always be less than $100. 2) will always be equal to $100. 3) will always be greater than $100. depending on the exact interest rate and on the precise amount of time difference between the present and the future, can be less than $100, greater than $100, or equal to $100. 5) None of the statements above are correct. 4)arrow_forwardEf 06.arrow_forwardWhat are some benefits of holding FX reserves (recall the Asian financial crisis of 1997)? Are there any costs and problems associated with holding too many FX reserves?arrow_forward

- Peder Mueller-UIA (B). Peder Mueller is a foreign exchange trader for a bank in New York. Using the values and assumptions here,, he decides to seek the full 4.802% return available in U.S. dollars by not covering his forward dollar receipts an uncovered interest arbitrage (UIA) transaction. Assess this decision. The uncovered interest arbitrage (UIA) profit amount is Data table (Round to the nearest cent.) (Click on the following icon in order to copy its contents into a spreadsheet.) Arbitrage funds available USD1,000,000 Spot exchange rate (CHF = USD1.00) 1.2813 3-month forward rate (CHF = USD1.00) 1.2745 Expected spot rate in 3 months (CHF = USD1.00) 1.2699 U.S. dollar 3-month interest rate 4.802% Swiss franc 3-month interest rate 3.198% Xarrow_forwardIn 2018, the yen went from $0.00887619 to $0.00906626. • By how much did the yen appreciate against the dollar? • By how much has the dollar depreciated against the yen?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education