Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

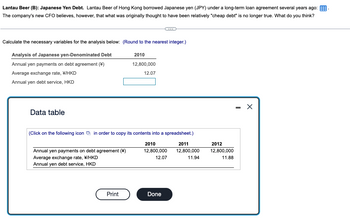

Transcribed Image Text:Lantau Beer (B): Japanese Yen Debt. Lantau Beer of Hong Kong borrowed Japanese yen (JPY) under a long-term loan agreement several years ago: .

The company's new CFO believes, however, that what was originally thought to have been relatively "cheap debt" is no longer true. What do you think?

Calculate the necessary variables for the analysis below: (Round to the nearest integer.)

Analysis of Japanese yen-Denominated Debt

Annual yen payments on debt agreement (¥)

Average exchange rate, \/HKD

Annual yen debt service, HKD

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

2011

12,800,000

11.94

Annual yen payments on debt agreement (*)

Average exchange rate, */HKD

Annual yen debt service, HKD

2010

12,800,000

12.07

Print

2010

12,800,000

12.07

Done

2012

12,800,000

11.88

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Using the currency cross rate table, convert C$300.00 to Japanese yen. Canadian dollar U.S. dollar Euro Japanese yen British pound Australian dollar Canadian U.S. Euro Japanese British Australian dollar dollar yen pound dollar 1.5792 0.0129 2.2735 1.1601 0.0078 1.6624 0.0083 1.4355 197.1834 1.4103 0.7091 0.6332 0.8620 77.5194 128.2051 120.4819 0.4399 0.6015 0.6966 1.1012 1.4945 1.7319 C$300.00 will purchase Japanese yen. (Round to the nearest yen as needed.) 0.0051 0.0126 2.4907 0.9081 0.6691 0.5774 79.4098 0.4015arrow_forwardNonearrow_forwardOn July 1, 2020, Mifflin Company borrowed 200,000 euros from a foreign lender evidenced by an interest-bearing note due on July 1, 2021. The note is denominated in euros. The U.S. dollar equivalent of the note principal is as follows: LO 9-2 LO 9-2 LO 9-2 LO 9-2, 9-3 Problems 1. Which of the following combinations correctly describes the relationship between foreign currency transactions, exchange rate changes, and foreign exchange gains and losses? LO 9-1 Type of Transaction Foreign Currency Foreign Exchange Gain or Loss a. Export sale Appreciates Loss b. Import purchase Appreciates Gain c. Import purchase Depreciates Gain d. Export sale Depreciates Gain Date Amount July 1, 2020 (date borrowed). . . . . . . . . . . . . . . . . . . . . . . . . $225,000 December 31, 2020 (Mifflin’s year-end). . . . . . . . . . . . . . . . 220,000 July 1, 2021 (date repaid). . . . . . . . . . . . . . . . . . . . . . . . . . . . 210,000 In its 2021 income statement, what amount should Mifflin include as a…arrow_forward

- Typed plz and Asap thanksarrow_forwardUse the information below to answer the questions that follow. Japanese yen Japanese yen 6 month Australian dollar Australian dollar 3 month U.S. $ EQUIVALENT .00916 .00899 .7748 .7751 a. Yen b. Australian dollar c. Dollar relative to yen d. Dollar relative to A$ CURRENCY PER U.S. $ 109.20 111.21 1.2907 1.2902 a. Is the yen selling at a premium or a discount? b. Is the Australian dollar selling at a premium or a discount? c. Do you expect the value of the dollar to increase or decrease relative to the value of the yen? d. Do you expect the value of the dollar to increase or decrease relative to the value of the Australian dollar?arrow_forwardSuppose the annual rate of inflation in Taiwan is 6.66%, and the annual rate of inflation in Mexico is 5.99%. If the Mexican peso depreciates relative to the Taiwan dollar by 4% in real terms, then which of the following would be correct? a, Nominal exchange rate appreciation by 4.825%. b. Nominal exchange rate depreciation by 3.393%. c. Nominal exchange rate appreciation by 3.512%. d. Nominal exchange rate depreciation by 4.603%. e. There is no change in the nominal exchange rate.arrow_forward

- Suppose you observe the following direct spot quotations in New York and Toronto,respectively: USD 0.8000-50 and CAD 1.2500-60. What are the arbitrage pr()fits per USD Imn?arrow_forward1) The difference between direct and indirect quotes: What is a direct pound for euro quote? What is a direct dollar quote for pound? What is an indirect dollar quote for yen? What is the indirect Swiss franc for pound quote? 2) Nominal annualized realized appreciation: Two months ago the price of a dollar in Tokyo was 95.6789. Today it is 93.5432. What is annualized realized yen appreciation? Four months ago direct dollar quote for pound was 1.2468. Today it is 1.1357. What is annualized realized pound appreciation? 3) Appreciation vs depreciation: How much did the dollar appreciate if the euro depreciated 3.5778% against the dollar? 4) Buying and selling For-Ex with bid-as quotes: How many dollars do you need to buy 3 million euros if the indirect dollar quote for euro is 0.8972-13? How many Swiss francs will you get from one billion yen if the price of Swiss franc in Tokyo is 101.3050-15? How many dollars will you get from 6 million pounds if the direct dollar quote for…arrow_forwardGanado Europe (A). Using facts in the chapter for Ganado Europe, assume the exchange rate on January 2, 2016, in Exhibit 11.5 dropped in value from $1.1400/€ to $0.8700/€. Recalculate Ganado Europe's translated balance sheet for January 2, 2016, with the new exchange rate using the current rate method as shown in the popup window,. What is the amount of translation gain or loss? a. What is the amount of translation gain or loss? Enter a positive number for a gain and negative for a loss. $ (Round to the nearest dollar.) Where should it appear in the financial statements? The translation gain (loss) for the year is added to the balance in the Cumulative Translation Adjustment (CTA) account.arrow_forward

- Given the following data: R = $1.00/110 F = $1.00/Y95 ¡u.s. = 5% If the interest parity condition is expected to hold, interest rates in Japan (Japan) should equal % (enter your answer as a percentage rounded to two decimal places).arrow_forwardSuppose that today is 13 August 2019 and the current exchange rate is HKD 6.20 per AUD 1.00. The figure below shows your prediction with respect to the HKD's movements relative to the AUD between now and mid-September 2019. HKD per AUD 7.2 6.8 6.4 6.0 13/08 18/08 23/08 28/08 2/09 7/09 12/09 today Note: HKD = Hong Kong Dollar; AUD = Australian Dollar. %3D %3D You intend to capitalize on your prediction by using the 15/9/2019-maturity forward contract, which is currently priced at HKD 6.00 per AUD 1.00. Which of the following are you most likely to undertake today to capitalize on your prediction? (Select the best answer.) O a. Long forward contract to buy AUD O b. Short forward contract to sell AUD O C. Long forward contract to sell HKD O d. Either (a) or (c) will workarrow_forwardThe table below shows the -day forward rate on the Ghana cedi per Pound Sterling. Currency Spot Rate 1 month 3 month Ghana cedi 7.7840 7.9330 7.9218 Note: The exchange rate quote in the above table is a direct quote for Ghana cedi. i) Is the Pound Sterling at a forward discount or premium on the Ghana cedi? Justify ii) Suppose that you expect to receive 150,000 cedis in three months, determine how many pound sterling this is likely to be worth?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education