ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

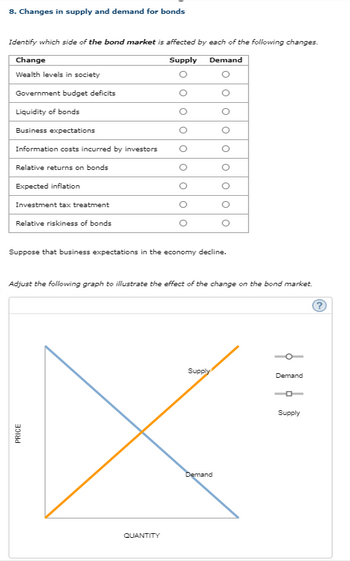

Transcribed Image Text:8. Changes in supply and demand for bonds

Identify which side of the bond market is affected by each of the following changes.

Change

Wealth levels in society

Government budget deficits

Liquidity of bonds

Business expectations

Information costs incurred by investors

Relative returns on bonds

Expected inflation

Investment tax treatment

Relative riskiness of bonds

Supply

Demand

00

о

Suppose that business expectations in the economy decline.

Adjust the following graph to illustrate the effect of the change on the bond market.

PRICE

QUANTITY

Supply

Demand

Demand

Supply

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 15. The Fisher effect Suppose inflationary expectations in the economy decrease. The following graph shows the market for bonds in the U.S. The upward-sloping orange line represents the supply of bonds, and the downward- sloping blue line represents the demand for bonds. Adjust the following graph to show the effect of decreased inflationary expectations on the bond market. BOND PRICE The Bond Market QUANTITY OF BONDS Supply Demand Demand Supply (?)arrow_forwardLabel each of the following statements true, false, or uncertain. Explain briefly.a) The term investment, as used by economists, refers to the purchase of bonds andshares of stock b) The central bank can increase the supply of money by selling bonds in the marketfor c) Bond prices and interest rates always move in opposite directions. d) If government spending and taxes increase by the same amount, the IS curve doesnot shift. e) When banks hold only a fraction of deposits in reserve, banks create money. At theend of this process of money creation, the economy is more liquid in the sense that thereis more of the medium of exchange, and the economy is wealthier than before.arrow_forward9. The discount rate and the federal funds rate The discount rate is the interest rate on loans that the Federal Reserve makes to banks. Banks occasionally borrow from the Federal Reserve when they find themselves short on reserves. A lower discount rate banks' incentives to borrow reserves from the Federal Reserve, thereby the quantity of reserves in the banking system and causing the money supply to The federal funds rate is the interest rate that banks charge one another for short-term (typically overnight) loans. When the Federal Reserve uses open-market operations to sell government bonds, the quantity of reserves in the banking system banks' need to borrow from each other and the federal funds ratearrow_forward

- Table 5.1 1 year 2 years З years 1.50% 2.25% 3.25% Table 5.1 shows the interest rates for Treasury securities of different maturities. Assume that the liquidity premium theory is correct. 103) Refer to Table 5.1 On this day, what did investors expect the interest rate to be on the one -year 103) Treasury bill in two years if the term premium on a two-year Treasury note is 0.25%? A) 1.875% B) 2.25% C) 2.375% D) 2.5% 104) Refer to Table 5.1 On this day, what did investors expect the interest rate to be on the one-year Treasury bill in two years if the term premium on a two-year Treasury note is 0.25% and the term premium on a three-year Treasury note is 0.75%? A) 2.375% 104) B) 3.25% C) 3.50% D) 4.75%arrow_forward1. Microsoft company is considering an investment project which costs $3 million today and it's payoff would be $5 at the end of year 7. If the interest rate is 9%, should Microsoft incest in the new project? 2. Using a graph of money market demonstrate what happens to the value of money and the price level if: a) The Fed sells government bonds in open-market operations. b) A decrease in real GDP decreases the demand for moneyarrow_forward4. Bond prices and interest yields Consider a bond without expiration date that makes a fixed interest payment of $90 per year. Complete the following table by calculating the interest rate on the bond at different sale prices. (Hint: The effective interest rate on a bond is a ratio of the interest payment to the sale price of the bond times 100.) Price of Bond (Dollars) 1,200 1,000 750 600 Use the blue points (circle symbol) and the preceding table to plot the relationship between bond prices and interest rates on the following graph. Interest Rate (Percent) Note: Plot your points in the order in which you would like them connected. Line segments will connect the points automatically. 15.0 13.5 12.0 10.5 9.0 7.5 6.0 4.5 3.0 1.5 0 500 Interest Rate (Percent) 7.5 9 600 12 15 700 800 900 1000 1100 1200 1300 Price of Bond (Dollars) Relationship (?) The line showing the relationship between bond prices and interest rates has a other words, there is relationship between bond prices and…arrow_forward

- 4. A common rule used for describing the conduct of monetary policy is the Taylor π = r + 0.5 (²-³) + 0.5(π — ñ), where r is the real rate of rule, given by i interest and it is a target rate of inflation. Assume that the real interest rate at full employment to be constant at 2%. Assume also that the same 2% represents target inflation. a. What is the nominal interest rate i when inflation and output are at their equilibrium target level? b. Suppose that the central bank observes a rate of inflation of 4%. With all other variables at the same level. What is the nominal interest rate the central bank would target according to the Taylor rule?arrow_forwardThank Youarrow_forward7. Draw a yield curve where the short-term interest rate is expected to remain constant in the near term, and then fall later on (use the liquidity preference theory).arrow_forward

- 11. If a yield curve looks like the one shown in the figure below, what is the market predicting about the movement of future short-term interest rates? What might the yield curve indicate about the market's predictions for the inflation rate in the future? Yield to Maturity Term to Maturityarrow_forward1. Which do you think would be more harmful to the economy—an inflation rate that averages 5 percent a year that has a high standard deviation or an inflation rate of 7 percent that has a standard deviation close to zero? 2. Suppose a major bank needs to borrow $20 billion overnight that it cannot obtain from private creditors. The Fed is willing to make a discount loan of $20 billion provided that it will not alter the aggregate supply of reserves to the banking system. How can it do so?arrow_forward7. Suppose the Federal Reserve wants to stimulate the economy, thereby increasing GDP. Which of the following policy change should be implemented? Raising the reserve requirement ratio Sell bonds through open market operations Lower the discount rate Only a & c are correctarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education