ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

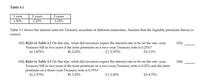

Transcribed Image Text:Table 5.1

1 year

2 years

З years

1.50%

2.25%

3.25%

Table 5.1 shows the interest rates for Treasury securities of different maturities. Assume that the liquidity premium theory is

correct.

103) Refer to Table 5.1 On this day, what did investors expect the interest rate to be on the one -year

103)

Treasury bill in two years if the term premium on a two-year Treasury note is 0.25%?

A) 1.875%

B) 2.25%

C) 2.375%

D) 2.5%

104) Refer to Table 5.1 On this day, what did investors expect the interest rate to be on the one-year

Treasury bill in two years if the term premium on a two-year Treasury note is 0.25% and the term

premium on a three-year Treasury note is 0.75%?

A) 2.375%

104)

B) 3.25%

C) 3.50%

D) 4.75%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2.The present value (PV) of a certain monetary investment asset Mo, with yield Mt over a time period t, is given by the relationship: PV = Mt/(1+n)'. Explain the role that the parameter n plays in determining the eventual terminal value of this monetary investment.arrow_forward18) If a bank has $100 million in total assets with $40 million in rate-sensitive assets, and $90 million in total liabilities with $50 million in rate-sensitive liabilities, then what will happen to the net interest margin (NIM) if interest rates rise by 5 percentage points, say from 10 to 15%? A) increase by 2% C) decline by $0.5 million B) decline by 0.5% D) increase by $2 millionarrow_forwardInterest rates and bond prices vary directly during inflation and inversely during recessions. 1) True 2) Falsearrow_forward

- The table below shows current and expected future one-year interest rates, as well as current interest rates on multiyear bonds. Use the table to calculate the liquidity premium for each multiyear bond. One-Year Bond Rate 2.00% 5.00% 8.00% 11.00% 13.00% The liquidity premiums for each year are given as: (Enter your responses rounded to two decimal places.) 131 = = 151 = % % % % Year 1 2345 2 Multiyear Bond Rate 2.00% 5.00% 6.00% 8.00% 10.00%arrow_forward. A well-known bank has specialized in adjustable-rate mortgages. They have originated 7 billion USD in adjustable-rate mortgages. This bank generally raises money by borrowing with shorter term loans and issuing fixed-interest rate Certificates of Deposit. The bank has 6 billion in short-term adjustable-rate loans to partly help fund the loan portfolio. The federal reserve has announced an increase in their target interest rate of 50 basis points (0.5%). What is the equation and solution.arrow_forwardE3 The demand curve and supply curve for one-year discount bonds were estimated using the following equations: Bd Price=-2/5Quantity+990 Bs Price=Quantity+500 As the stock market continued to rise, the Federal Reserve felt the need to increase the interest rates. As a result, the new market interest rate increased to 19.65%, but the equilibrium quantity remained unchanged. What are the new demand and supply equations? Assume parallel shifts in the equationsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education