FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

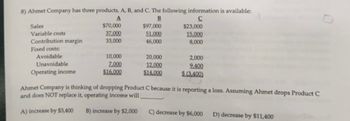

Transcribed Image Text:8) Ahmet Company has three products, A, B, and C. The following information is available:

A

B

с

Sales

Variable costs

Contribution margin

Fixed costs:

Avoidable

Unavoidable

Operating income

$70,000

37,000

33,000

10,000

7.000

$16,000

$97,000

51.000

46,000

20,000

12,000

$14.000

$23,000

15,000

8,000

2,000

9.400

$ (3,400)

Ahmet Company is thinking of dropping Product C because it is reporting a loss. Assuming Ahmet drops Product C

and does NOT replace it, operating income will

A) increase by $3,400

B) increase by $2,000

C) decrease by $6,000 D) decrease by $11,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rings company has three product lines A, B and C. The following financial information is available:arrow_forwardPlease do not give solution in image format thankuarrow_forward8.45 Petoskey Company produces three products: Alanson, Boyne, and Conway. A segmented income statement, with amounts given in thousands, follows: Alanson Boyne Conway Total Sales revenue $1,280 $185 $300 $1,765 Less: Variable expenses 1,115 45 240 1,400 Contribution margin $165 $140 $60 $365 Less direct fixed expenses: Depreciation 50 15 10 75 Salaries 95 85 76 256 Segment margin $20 $40 $(26) $34 Direct fixed expenses consist of depreciation and plant supervisory salaries. All depreciation on the equipment is dedicated to the product lines. None of the equipment can be sold. Assume that, each of the three products has a different supervisor whose position would be eliminated if the associated product were dropped. Assume that 20% of the Alanson customers choose to buy from Petoskey because it offers a full range of products, including Conway. If Conway were no longer available from Petoskey,…arrow_forward

- The following information is for Bullwinkle Industries Inc.: Line Item Description East West Sales volume (units): Product Alpha 45,000 38,000 Product Omega 60,000 50,000 Sales price: Product Alpha $500 $600 Product Omega $250 $225 Variable cost per unit: Product Alpha $275 $275 Product Omega $140 $140 a. Determine the contribution margin for the East Region and West Region.East Region: fill in the blank 1 of 2$West Region: fill in the blank 2 of 2$ b. Determine the contribution margin ratio for the East Region and West Region. Round the contribution margin ratio to one-tenth of a percent.East Region: fill in the blank 1 of 2%West Region: fill in the blank 2 of 2%arrow_forwarddon't give answer in image formatarrow_forwardDetermine the missing amounts. 1. 2. 3. $ Unit Selling Price $800 $350 (e) $ $ Unit Variable Costs $336 (c) (f) $ Unit Contribution Margin $147 $800 (a) Contribution Margin Ratio % (b) % (d) 40 %arrow_forward

- Donnelly Company has three products, R2, R4, and R2D2. The following information is available: Product R2 Product R4 Product R2D2 Sales $30,000 $45,000 $12,000 Variable Costs 18,000 24,000 7,500 Contribution Margin 12,000 21,000 4,500 Fixed Costs: Avoidable 4,500 9,000 3,000 Unavoidable 3,000 4,500 2,700 Operating Income $4,500 $7,500 $(1,200) Donnelly Company is thinking of dropping Product R2D2 because it is reporting a loss. Assuming Donnelly drops Product R2D2 and does not replace it, what will happen to operating income?arrow_forwardA. Determine the missing amounts S.No Unit Selling Price Unit Variable Cost Contribution Margin per unit Contribution Margin Ratio 1 2 3 550 1500 (e) 370 (c) (f) (a) 600 900 (b) (d) 30 B. For Al Farabi Company, variable costs are 75% of sales, and fixed costs are $210,000.Management’snet income goal is $70,000. Compute the required sales needed to achieve management’s target net income of $70,000. (Use the mathematical equation approach.) C. Company A’s costs are mostly variable, whereas Company B’s costs are mostly fixed. When sales increase, which company will tend to realize the greatest increase in profits? Explain.arrow_forwardDetermine the missing amounts. elling te $640 $300 1300 (e) LA MA $ Unit Variable Costs $352 207 (c) 975 (f) Unit Contribution Margin 288 $93 $325 (a) Contribution Margin Ratio 1 % (b) % (d) 25 %arrow_forward

- (e) Product Blue Product Red Selling $12.00 $24.00Variable cost $4.00 $8.00Contribution margin $8.00 $16.00Fixed costs apportioned $200,000 $400,00Budgeted Sales Units 140,000 60,000 Calculate the breakeven points, for each product and the company as a whole and comment on your findings f)Discuss the merits and demerits of the cost volume profit analysis (CVP)arrow_forward2. From the following details find out (a) Profit volume ratio, (b) BEP, (c) Margin of safety. SR 250,000 Fixed Costs Sales SR 50,000 Total Costs Solution: SR 150,000 Net Profit SR 50,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education