ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

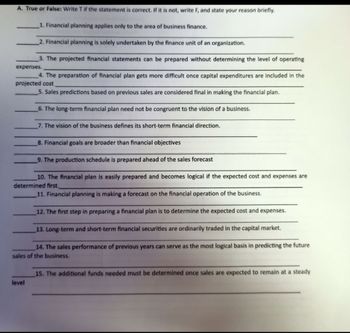

Transcribed Image Text:A. True or False: Write T if the statement is correct. If it is not, write F, and state your reason briefly.

1. Financial planning applies only to the area of business finance.

2. Financial planning is solely undertaken by the finance unit of an organization.

3. The projected financial statements can be prepared without determining the level of operating

expenses.

4. The preparation of financial plan gets more difficult once capital expenditures are included in the

projected cost

5. Sales predictions based on previous sales are considered final in making the financial plan.

6. The long-term financial plan need not be congruent to the vision of a business.

7. The vision of the business defines its short-term financial direction.

8. Financial goals are broader than financial objectives

9. The production schedule is prepared ahead of the sales forecast

10. The financial plan is easily prepared and becomes logical if the expected cost and expenses are

determined first.

11. Financial planning is making a forecast on the financial operation of the business.

12. The first step in preparing a financial plan is to determine the expected cost and expenses.

13. Long-term and short-term financial securities are ordinarily traded in the capital market.

14. The sales performance of previous years can serve as the most logical basis in predicting the future

sales of the business.

level

15. The additional funds needed must be determined once sales are expected to remain at a steady

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Question 4. Working with Numbers and Graphs Q4 The face value of a bond is $6,000, and the annual coupon payment is $180. The coupon rate is_arrow_forwardWhat is the role of financial planning in an organization? Edit View Insert Format Tools Table 12m V Paragraph y A V B T U A -2 ✓ T² Varrow_forward3. Which of the following must be included in an organization’s statement of accounting profits for the statement to be of use?a. the estimated amount the organization could have earned pursuing other optionsb. the extent to which technological improvements increased productivityc. the percentages planned for reinvestment or distribution to investorsd. the period in which the profit was earned, such as a year or a quarterarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education