FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

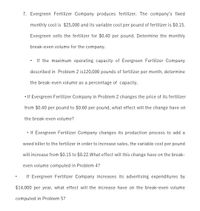

Transcribed Image Text:7. Evergreen Fertilizer Company produces fertilizer. The company's fixed

monthly cost is $25,000 and its variable cost per pound of fertilizer is $0.15.

Evergreen sells the fertilizer for $0.40 per pound. Determine the monthly

break-even volume for the company.

If the maximum operating capacity of Evergreen Fertilizer Company

described in Problem 2 is120,000 pounds of fertilizer per month, determine

the break-even volume as a percentage of capacity.

• If Evergreen Fertilizer Company in Problem 2 changes the price of its fertilizer

from $0.40 per pound to $0.60 per pound, what effect will the change have on

the break-even volume?

• If Evergreen Fertilizer Company changes its production process to add a

weed killer to the fertilizer in order to increase sales, the variable cost per pound

will increase from $0.15 to $0.22.What effect will this change have on the break-

even volume computed in Problem 4?

If Evergreen Fertilizer Company increases its advertising expenditures by

$14,000 per year, what effect will the increase have on the break-even volume

computed in Problem 5?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A manufacturing company has to produce and sell 229 items every month to break even. The company's fixed costs are $2,281.50 per month and variable costs are $12.00 per item. a. What is the total revenue at the break-even point? Round to the nearest cent b. What is the selling price per item? Round to the nearest centarrow_forward6. Dimitri Designs has capacity to produce 30,000 desk chairs per year and is currently selling all 30,000 for $240 each. Country Enterprises has approached Dimitri to buy 800 chairs for $210 each. Dimitri’s normal variable cost is $165 per chair, including $50 per unit in direct labor per chair. Dimitri can produce the special order on an overtime shift, which means that direct labor would be paid overtime at 150% of the normal pay rate. The annual fixed costs will be unaffected by the special order and the contract will not disrupt any of Dimitri’s other operations. PLEASE NOTE: All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). If Dimitri accepts the offer, what will be the impact on profits of accepting the order. Incremental dollar amount = ? . Increase or Decrease? . Please note: Your answer is either "Increase" or "Decrease" - capital first letters and no quotes.arrow_forwardLush Lawn, Incorporated produces and sells electric lawn trimmers for $150 each. The variable costs of each mower total $110 while total monthly fixed costs are $6,240. Current monthly sales are $51,000. The company is considering a proposal that will decrease the selling price by 10%, increase monthly fixed costs by 50%, and increase unit sales to 500 units per month. Required: a. Compute the company's current break-even point in units and dollars. b. What is the company's current margin of safety in units, dollars, and percentage? a. Break-even point a. Break-even sales b. Margin of safety b. Margin of safety in dollars b. Margin of safety in ratio units unit %arrow_forward

- Herro, Inc. sells Product TH14 for $57.00 per unit. Variable costs for Product TH14 are $41.00 per unit, and monthly fixed costs are $467,000. If Herro desires a monthly net income of $14,000, how many units of Product TH 14 must be sold per month?arrow_forwardHawk Homes, Ic., makes one type of birdhouse that it sells for $30.00 each. Its variable cost is $13.50 per house, and its fixed costs total $14,239.50 per year. Hawk currently has the capacity to produce up to 2,800 birdhouses per year, so its relevant range is 0 to 2,800 houses. Required: 1. Prepare a contribution margin income statement for Hawk assuming it sells 1,110 birdhouses this year. 2. Without any calculations, determine Hawk's total contribution margin if the company breaks even. 3. Calculate Hawk's contribution margin per unit and its contribution margin ratio. 4. Calculate Hawk's break-even point in number of units and in sales revenue. 5. Suppose Hawk wants to earn $21,000 this year. Determine how many birdhouses it must sell to generate this amount of profit. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Prepare a contribution margin income statement for Hawk assuming it sells 1,110 birdhouses…arrow_forwardA company has monthly fixed costs of $135,000. The variable costs are $5 per unit. If the sales price of a unit is $12 and we sell 7,500 units, the company's average fixed costs per unit will be OA. $23 per unit. OB. $7 per unit. OC. $18 per unit. OD. $5 per unit.arrow_forward

- A company sells one of its products for $13.80 per unit. Its fixed costs are $1,080.00 per month, and the variable cost per unit is $4.80. The production capacity is 625 units per month. (a) The break-even volume, i.e., the level of output at break-even, is per month. (If necessary, round up to the next whole number of units.) (b) The break-even volume as a percent of capacity is your answer to two decimal places.) units (d) The net income at the break-even level of output is $ %. (If necessary, round (c) The break-even revenue, i.e., the total revenue at the break-even level of output, is $ per month.arrow_forwardFinley Corporation has monthly fixed costs of $240,000. It sells two products for which it has provided the following information. Sales Price Product 1 $ Product 2 35 40 Contribution Margin $ 21 10 a. What total monthly sales revenue is required to break even if the relative sales mix is 20 percent for Product 1 and 80 percent for Product 2? (Hint: Determine the contribution margin ratio for each product.) b. What total monthly sales revenue is required to earn a monthly operating income of $105,000 if the relative sales mix is 60 percent for Product 1 and 40 percent for Product 2?arrow_forwardOutback Outfitters sells a small camp stove for $150 per unit. Variable expenses are $105 per unit, and fixed expenses total $184,500 per month. Required: 1. What is the break-even point in unit sales and in dollar sales? 2. If the variable expenses per stove increase as a percentage of the selling price, will it result in a higher or a lower break-even point? (Assume the fixed expenses remain unchanged.) 3. At present, the company is selling 10,000 stoves per month. The sales manager is convinced a 10% reduction in the selling price would result in a 25% increase in unit sales. Prepare two contribution format income statements, one under present operating conditions, and one as operations would appear after the proposed changes. 4. Refer to the data in Required 3. How many stoves would have to be sold at the new selling price to attain a target profit of $79,000 per month? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Break-even…arrow_forward

- Munabhaiarrow_forward2. An audio equipment manufacturer produced and sold 725 sound systems and made a net income of $50, 000 last year, with a total revenue of $1, 015, 000. The manufacturer's break-even volume is 600 units. a. Calculate the selling price of each sound system. b. Calculate the variable costs for each sound system. c. Calculate the fixed costs per year.arrow_forwardLusk Corporation produces and sells 14,300 units of Product X each month. The selling price of Product X is $25 per unit, and variable expenses are $19 per unit. A study has been made concerning whether Product X should be discontinued. The study shows that $72,000 of the $102,000 in monthly fixed expenses charged to Product X would not be avoidable even if the product was discontinued. If Product X is discontinued, the monthly financial advantage (disadvantage) for the companyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education