FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

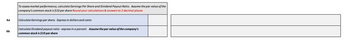

I need help to determine the following;

6. For P & B Manufacturing to assess its market performance, I need help to calculate the earnings per share AND the dividend payout ratio (the par value of the company’s common stock is $10 per share). Include calculations and round answers to 2 decimal places.

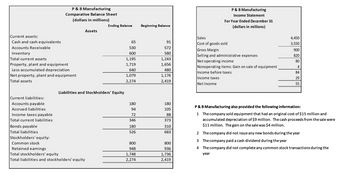

Transcribed Image Text:Current assets:

Cash and cash equivalents

Accounts Receivable

Inventory

Total current assets

Property, plant and equipment

Less accumulated depreciation

Net property, plant and equipment

Total assets

Current liabilities:

Accounts payable

Accrued liabilities

Income taxes payable

Total current liabilities

P & B Manufacturing

Comparative Balance Sheet

(dollars in millions)

Bonds payable

Total liabilities

Stockholders' equity:

Common stock

Retained earnings

Assets

Ending Balance

Liabilities and Stockholders' Equity

Total stockholders' equity

Total liabilities and stockholders' equity

65

530

600

1,195

1,719

640

1,079

2,274

180

94

72

346

180

526

800

948

1,748

2,274

Beginning Balance

91

572

580

1,243

1,656

480

1,176

2,419

180

105

88

373

310

683

800

936

1,736

2,419

P & B Manufacturing

Income Statement

For Year Ended December 31

(dollars in millions)

Sales

Cost of goods sold

Gross Margin

Selling and administrative expenses

Net operating income

Nonoperating items: Gain on sale of equipment

Income before taxes

Income taxes

Net Income

4,450

3,550

900

820

80

4

84

29

55

P & B Manufacturing also provided the following information:

1 The company sold equipment that had an original cost of $15 million and

accumulated depreciation of $9 million. The cash proceeds from the sale were

$11 million. The gain on the sale was $4 million.

2

The company did not issue any new bonds during the year

3

The company paid a cash dividend during the year

4 The company did not complete any common stock transactions during the

year

Transcribed Image Text:6a

6b

To assess market performance, calculate Earnings Per Share and Dividend Payout Ratio. Assume the par value of the

company's common stock is $10 per share Round your calculations & answers to 2 decimal places

Calculate Earnings per share. Express in dollars and cents

Calculate Dividend payout ratio - express in a percent. Assume the par value of the company's

common stock is $10 per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Required Prepare a vertical analysis of both the balance sheets and income statements for Year 4 and Year 3. Complete this question by entering your answers in the tabs below. Analysis Bal Analysis Inc Sheet Stmt Prepare a vertical analysis of the balance sheets for Year 4 and Year 3. (Percentages may not add exactly due to rounding. Round your answers to 2 decimal places. (i.e., .2345 should be entered as 23.45).) PEREZ COMPANY Vertical Analysis of Balance Sheets Year 4 Year 3 Percentage of Total Percentage of Total Amount Amount Assets Current assets Cash $ 17,400 % $ 12,600 % Marketable securities 21,000 7,600 Accounts receivable (net) 54,700 46,900 Inventories 136,200 144,400 Prepaid items 25,700 11,800 Total current assets 255,000 223,300 Investments 28,100 21,000 Plant (net) 270,500 255,100 Land 29,700 24,900 Total long-term assets 328,300 301,000 Total assets $ 583,300 $ 524,300 Liabilities and stockholders' equity Liabilities Current liabilities Notes payable $ 16,100 $ 5,000…arrow_forwardDuPont system of analysis Use the following financial information for AT&T and Verizon to conduct a DuPont system of analysis for each company. Sales Earnings available for common stockholders Total assets Stockholders' equity a. Which company has the higher net profit margin? Higher asset turnover? b. Which company has the higher ROA? The higher ROE? c. Which company has the higher financial leverage multiplier? a. Net profit margin (Round to three decimal places.) AT&T Net profit margin AT&T $164,000 13,333 403,921 201,934 Verizon Verizon $126,280 13,608 244,280 24,232arrow_forwardHello Bartleby Experts. Need help figuring out this question. See screenshot attached. Thanks so much for your kind assistance :-) The question is: What is the Dividend you expect Yum! Brand can pay in FY T+1? The balance sheet and income statement is attached.arrow_forward

- Easter Egg and Poultry Company has $1,700,000 in assets and $681,000 of debt. It reports net income of $148,000. a. What is the firm's return on assets? Note: Enter your answer as a percent rounded to 2 decimal places. Return on assets b. What is its return on stockholders' equity? Note: Enter your answer as a percent rounded to 2 decimal places. Return on equity ......... Profit margin % c. If the firm has an asset turnover ratio of 1 times, what is the profit margin (return on sales)? Note: Enter your answer as a percent rounded to 2 decimal places. % %arrow_forward(b) Use Allscripts Healthcare and McKesson as comparables, along with the price to NOA ratios from part a, and then estimate for Cerner its company intrinsic value, its equity intrinsic value, and its equity intrinsic value per share. (Round the intrinsic value and equity intrinsic value to the nearest million and the value per share to the nearest cent.)Average of the two rounded ratios in (a) aboveAnswer (Round to two decimal places.) Using the rounded average calculation above, calculate the following:Intrinsic valuearrow_forwardAssume that you are a consultant to Morton Inc., and you have been provided with the following data: D0 - $1.4: PO - $36; and g - 4.8% (constant). What is the cost of equity from retained earnings based on the DCF approach? OO Ⓒ948% 8.88% Go httarrow_forward

- If Rogers, Incorporated, has an equity multiplier of 1.57, total asset turnover of 1.70, and a profit margin of 6.7 percent, what is its ROE? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardChapter 14, Question 5. This is part of the question. Am asking another question on Bartleby for the second part. Attached is a similar question with answers. Please answer the new question in the same format :)arrow_forwardGardial & Son has an ROA of 11%, a 4% profit margin, and a return on equity equal to 20%. What is the company's total assets turnover? What is the firm's equity multiplier? Do not round intermediate calculations. Round your answers to two decimal places.arrow_forward

- International Business Machines (IBM) has earnings per share of $6.85 and a P/E ratio of l15.19. What is the stock price?arrow_forwardIf Roten Rooters, Inc., has an equity multiplier of 1.27, total asset turnover of 2.10, and a profit margin of 6.1 percent, what is its ROE? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardPhone, Inc., has an equity multiplier of 1.36, total asset turnover of 165, and a profit margin of 8 percent. What is the company's ROE? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) ROarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education