Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:### Bond Valuation and Yield to Maturity (YTM) Calculation

#### Bond Information:

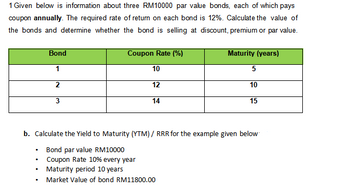

Given below is information about three RM10,000 par value bonds, each of which pays a coupon **annually**. The required rate of return on each bond is 12%. Calculate the value of the bonds and determine whether the bond is selling at discount, premium, or par value.

| **Bond** | **Coupon Rate (%)** | **Maturity (years)** |

|----------|----------------------|----------------------|

| 1 | 10 | 5 |

| 2 | 12 | 10 |

| 3 | 14 | 15 |

#### Yield to Maturity (YTM) Calculation:

Calculate the Yield to Maturity (YTM) / Required Rate of Return (RRR) for the example given below:

- **Bond par value:** RM10,000

- **Coupon Rate:** 10% every year

- **Maturity period:** 10 years

- **Market Value of bond:** RM11,800.00

This data provides the necessary information to analyze the bond values and predict their performance in the market, aiding in investment decision-making.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculate the total annual interest, total cost, and current yield for the bond. (Round the "Current yield" to the nearest tenth percent and other answers to the nearest whole dollar.) Number of bonds Total annual Bond Selling price Total cost Current yield purchased interest Wang 6 1/2% 26 4. 68.125 % 96 Prev 9 of 18 Next > Marrow_forwardThe following table gives the prices of bonds Bond Principal ($) Time to maturity Annual coupon ($) Bond Price ($) 100 (years) 0.5 100 1 100 100 1.5 2 The bonds provide coupon are semiannual coupon bond a. Calculate 6-month, 12-month, 18-month and 24-month zero rates. 1567 0 98 100 100 101 b. What is the forward rate for the six-month period beginning in 12 months. c. Estimate the price of a two-year bond providing annual coupon of 7% annually.arrow_forwardFind the total return earned by the bond with the characteristics shown in the table. Face Value $14,000 Annual Interest Rate 6.09% Term to Maturity 4 months What is the total return earned by this bond? $ (Round to the nearest cent as needed.)arrow_forward

- Calculate the prices of the following bonds. Assume the face value in each case is $1 000. c)A 12% p.a. coupon rate, 20 years to maturity and a yield of 10% p.a.arrow_forwardCalculate the value of a bond given: Coupon Interest Payments (C) is $50; Capitalization Rate (K) is 17%; Years to Maturity (n) is 5; Par Value at Maturity (P) is $5,000; Compounded Semiannually. 2,539.49 OR 4539.49?arrow_forward3. Bond Valuation Calculate the value of each of the bonds shown in the following table, all of which pay interest annually. Bond Par Value Coupon Rate Years to Maturity Required Return A $1000 20 B $1000 14 с $500 12 D $100 12 12% 10% 8% 7% 15% 10% 9% 6%arrow_forward

- Please see attached. Definition: Coupon is the regular interest payment of a bond.arrow_forwardRefer to Table 10-2. a. Assume the interest rate in the market (yield to maturity) goes down to 8 percent for the 10 percent bonds. Using column 2, indicate what the bond price will be with a 10-year, a 20-year, and a 25-year time period. b. Assume the interest rate in the market (yield to maturity) goes up to 12 percent for the 10 percent bonds. Using column 3, indicate what the bond price will be with a 10-year, a 20-year, and a 25-year period. c. Assume the interest rate in the market (yield to maturity) goes down to 8 percent for the 10 percent bonds. If interest rates in the market are going down, which bond would you choose to own? multiple choice 1 10 Years 20 Years 25 Years d. Assume the interest rate in the market (yield to maturity) goes up to 12 percent for the 10 percent bonds. If interest rates in the market are going up, which bond would you choose to own? multiple choice 2 10 Years 20 Years 25 Yearsarrow_forwardA Treasury bond that matures in 10 years has a yield of 4.75%. A 10-year corporate bond has a yield of 9.25%. Assume that the liquidity premium on the corporate bond is 0.60%. What is the default risk premium on the corporate bond? Round your answer to two decimal places. %arrow_forward

- A Treasury bond has a face value of $100, a maturity of 20 years, a coupon of 4%, and pays the coupon every six months, at the end of each six month period. The price of the bond is $105. What is the yield of this bond? a. 3.65% b. 1.8% C. 1.7% d. 3.8%arrow_forwardIf the annual interest rate printed on the face of a bond is 10 percent, the face value of the bond is $1,000, and you purchase the bond for $1,250, what is the current yield on the bond? O A. 5 percent. O B. 6 percent. OC. 12.5 percent. O D.8 percent.arrow_forwardCalculate the annual interest (in $) and current yield (as a %) of the bond. (Round your percentage to one decimal place.) Company Coupon Rate Annual Interest Company 5 8.25% +A Market Price 104.00 Current Yield %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education