ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

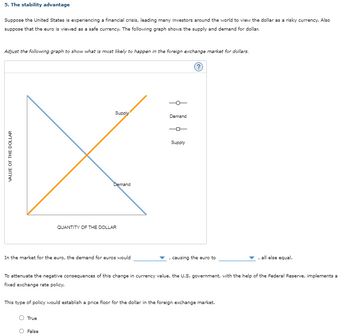

Transcribed Image Text:5. The stability advantage

Suppose the United States is experiencing a financial crisis, leading many investors around the world to view the dollar as a risky currency. Also

suppose that the euro is viewed as a safe currency. The following graph shows the supply and demand for dollar.

Adjust the following graph to show what is most likely to happen in the foreign exchange market for dollars.

VALUE OF THE DOLLAR

Supply

Demand

In the market for the euro, the demand for euros would

True

QUANTITY OF THE DOLLAR

False

ģ

Demand

0

Supply

, causing the euro to

To attenuate the negative consequences of this change in currency value, the U.S. government, with the help of the Federal Reserve, implements a

fixed exchange rate policy.

This type of policy would establish a price floor for the dollar in the foreign exchange market.

all else equal.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 17. Question 17 options: ---------- is the technique of protecting against the potential losses that result from adverse changes in exchange ratesarrow_forward5. Balance of payments and the foreign exchange market The following graph shows the market for euros in terms of dollars. The market is initially in equilibrium at $1.00 per euro and 4 billion euros. Suppose an economic expansion in the United States leads to an increase in the incomes of American households, causing imports from Europe to rise. On the graph, show the effect of an expansion in the United States that leads to an increase in American incomes.arrow_forwardUsing Demand and Supply Analysis. Use the line drawing tool to show the effects of an increase in Japanese interest rates on the exchange rate between the British pound and the Japanese yen. ¥ The vertical axis will be yen per pound, I Draw and properly label a single line. Carefully follow the instructions above, and only draw the required object. 400- 350- 300- 250- 200- 150- 100- 50- The Market for Pounds Yen per Pound A Pounds SE DE Qarrow_forward

- Explain how monetary considerations, such as currency, exchange rates, and exchange-rate management, would impact the organization’s decision to expand into your selected market, using current exchange rates between China and the United States to support your explanations. Category The U.S. Dollar The Chinese Yuan Exchange Rate 1 USD ≈ 7.24 Yuan 1 Yuan ≈ 0.14 USDarrow_forwardA. Canada produces natural resources (coal, natural gas, and others), the demand for which has increased rapidly as China and other emerging economies expand. i. Explain how growth in the demand for Canada's natural resources would affect the demand for Canadian dollars in the foreign exchange market. Explain how the supply of Canadian dollars would change. ii. iii. Explain how the value of the Canadian dollar would change. iv. Illustrate your answer with a graphical analysis. 1arrow_forwardUse the following information to answer Questions 78 to 80: The Czech Republic, whose own currency is the koruna (Kë) and whose foreign currency is the euro (€), begins to intervene in the exchange market in order to stimulate its exports to the EU. Kč J€ Se {left} {right} De Qe To stimulate its exports the Czech central bank could O neither sell euros O buy eurosarrow_forward

- 3. If interest rates increase in a country with a fixed exchange rate, what will the central bank do? A. Buy the country's currency B. Sell the country's currency C. Engage in contractionary fiscal policy 4. The United States has floating exchange rates. Suppose there is an increase in inflation in the United States. What will happen? A. The U.S. central bank will sell U.S. currency so the exchange rate remains constant B. The U.S. central bank will buy Euros so the exchange rate remains constant C. The exchange rate (price of a dollar) will go up D. The exchange rate (price of a dollar) will go down 5. Belize uses a fixed exchange rate, with one Belize dollar equal to one half of a U.S. dollar. There is an increase in U.S. citizens traveling to Belize on vacation. What will the central bank do? A Buy the country's currency B. Sell the country's currency Sell bonds to banks C.arrow_forwardAt the official exchange rate of 2.5 dirham per euro, the euro is and the Moroccan dirham is that Moroccans pay for European exports than they would with a free-floating exchange rate. At the official dirham price of euros, there is a of euros in the foreign exchange market. which means Suppose the governments of the Eurozone and Morocco reevaluate their currencies so that their official exchange rate is now 1 dirham per 1 euro. This action results in of the euro.arrow_forward36. When a country's goods and services are expensive relative to other countries', we say that its currency is ________ in terms of purchasing power parity. Question 36 options: a) irrational b) rational c) overvalued d) undervaluedarrow_forward

- Paragraph H H Euros per Dollar Quantity of Dollars Styles 1 Title 1. Headline: Fed raises interest rates; attracts foreign investors. Supply of dollars (increase / decrease / stay the same) Demand for dollars (increase / decrease / stay the same) Euros per Dollar (increase / decrease / stay the same) Quantity of Dollars (increase / decrease / stay the same) Select- Editing Create PDF C and Share link Sh A Consider the foreign exchange market for dollars as discussed in Chapter 14, section 3.2 of your text and depicted above. How would the news headlines below affect the market for foreign exchange? Highlight or change the color of your response. 2 Display Settingsarrow_forward5) Indicate whether each of the following creates a demand for or a supply of European euros in foreign exchange markets: a. Liberty purchases an Airbus plane assembled in France b. Mercedes-Benz decides to build an assembly plant in Knoxville c. A Liberty student decides to spend a year studying at the Sorbonne in Paris d. An Italian manufacturer ships machinery from Rome to Venice on an Egyptian freighter e. It is widely expected that the euro will depreciate in the near futurearrow_forward8. Why exchange rates matter Suppose that you go on vacation to Canada every summer. Last year, the hotel room where you stayed cost C$100 per night, and it costs the same this year. The exchange rate was 1.04 US$/C$ last year, and it is 0.95 US$/C$ this year. This means you will pay per night this year than you paid last year. The U.S. dollar-Canadian dollar exchange rate is essentially the price of a Canadian dollar in terms of U.S. dollars. When this price falls, the Canadian dollar is said to depreciate against the U.S. dollar. Thus, from your analysis, you can conclude that when the Canadian dollar depreciates against the U.S. dollar, Canadian goods and services become expensive for Americans. DeutschAuto is a German automaker that pays most of its production costs in euros. Suppose that in 2007, DeutschAuto's cost of producing a car was €23,000 and that the company sold a car in the United States for $36,000. Further, suppose that the dollar-euro exchange rate rose from 1.35$/ €…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education