ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:At the official exchange rate of 2.5 dirham per euro, the euro is

and the Moroccan dirham is

that Moroccans pay for European exports than they would with a free-floating exchange rate.

At the official dirham price of euros, there is a

of euros in the foreign exchange market.

which means

Suppose the governments of the Eurozone and Morocco reevaluate their currencies so that their official exchange rate is now 1 dirham per 1 euro.

This action results in

of the euro.

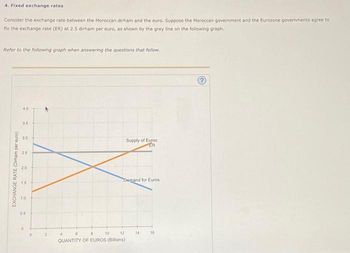

Transcribed Image Text:4. Fixed exchange rates

Consider the exchange rate between the Moroccan dirham and the euro. Suppose the Moroccan government and the Eurozone governments agree to

fix the exchange rate (ER) at 2.5 dirham per euro, as shown by the grey line on the following graph.

Refer to the following graph when answering the questions that follow.

EXCHANGE RATE (Dirham per euro)

4.0

35

30

25

20

15

10

0.5

0

2

Supply of Euros

ÉR

Demand for Euros

4

10

12

QUANTITY OF EUROS (Billions)

14

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The figure below illustrates the market for Bahamian dollars, where the price of the Bahamian dollar is valued in U.S. dollars. Assume that the Bahamian government wants to peg its currency to the U.S. dollar at a 1:1 ratio (one U.S. dollar = one Bahamian dollar). But the current exchange rate is at 90 cents (10 cents below the official peg). What must the Bahamian central bank do to return to the $1 exchange rate A. It would need to reduce the demand for the Bahamlan dollar. B. It would need to reduce the supply of the Bahamian dollar. C. It would need to Increase the supply of the Bahamian dollar. D. It would need to Increase the demand for the Bahamlan dollar. Part 2 Suppose you are a U.S. student and are thinking about visiting the Bahamas for spring break. You would rather the central bank intervened ___ (before or after) spring break. Part 3 Suppose that currently, the exchange rate is 1 Bahamian dollar for 1 U.S. dollar. The price of a Big Mac is $5 in the United States and 3.00…arrow_forwardBased on the Exchange rates above, Which of the following is true? A)More pounds are needed to buy a dollar, so the dollar is appreciating B)The dollar is less expensive in pounds and is depreciating C)The dollar is growing stronger against the pound D)The dollar is more expensive in pounds and is appreciating Year 2014 2015 2016 US $ 1$ 1$ 1$ British Pound .85 .70 .60arrow_forwardIn the pound per euro market an increase in the demand for the euro is also: A) an increase in the supply of pounds B) a decrease in the demand for pounds C) an increase in the supply of euros D) the result of higher UK interest ratesarrow_forward

- Suppose the exchange rate is such that 1 U.S. dollar equals 1 curo in New York and 0.9 euros in Paris. An arbitrageur would sell euros in New York and buy U.S. dollars in Paris in Paris and buy U.S. dollars in New York in New York while buying them in Paris in Paris while buying them in New York at the same price in both citiesarrow_forwardCountry A follows a fixed exchange rate policy that pegs its currency to the currency of country B, which is its main trading partner in a world where international capital is fully mobile. However, due to unresolved structural inefficiencies (for example, excessive bureaucracy), prices in country A tend to increase more than prices in country B. Over time, if nothing else changes, and provided that country A is committed to its current exchange rate policy, which of the following problems is not anticipated for country A? a. Economic recession. O b. Growing deficit in international trade balance. c. Worsening inflation. Od. Decreasing reserve assets. Oe. Growing external indebtedness.arrow_forwardEconomic logic may tell us that a country with a higher interest rate, thus a higher rate of return, should be able to attract foreign capital and that a country with a lower interest rate, thus a lower rate of return, should experience an outflow of capital. If a country is experiencing a large net capital inflow its currency is likely to appreciate, while a country experiencing a large net capital outflow would likely see its currency depreciate (assuming a floating exchange rate). However, according to interest rate parity conditions a country with a higher interest rate would see its currency depreciate, while the currency of the lower interest rate country would appreciate. What is the main reason the outcome under interest rate parity conditions? Question 4 options: The assumption that countries have an identical real interest rate The relative interest rate level is not a factor for investment decisions Investors do not seek…arrow_forward

- Assume that there is a free-floating exchange rate. Interest rates rise in the UK, relative to those abroad. Discuss the effect that you would expect this to have on exchange rates. You should consider the effect on currency supply and demand, and illustrate your answer with a diagram. You should also consider how this relates to the concept of uncovered interest rate parity, and discuss this with the help of an equation.arrow_forwardThe Nominal exchange rate is .8 British pounds per dollar. If a burger in the United States costs $10, how many British pounds must a burger cost in London for purchasing-power parity to hold?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education