ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

5. Balance of payments and the foreign exchange market

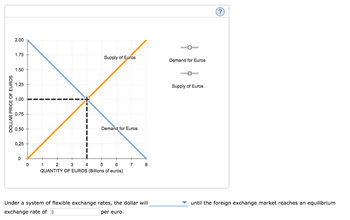

The following graph shows the market for euros in terms of dollars. The market is initially in equilibrium at $1.00 per euro and 4 billion euros. Suppose an economic expansion in the United States leads to an increase in the incomes of American households, causing imports from Europe to rise.

On the graph, show the effect of an expansion in the United States that leads to an increase in American incomes.

Transcribed Image Text:DOLLAR PRICE OF EUROS

2.00

1.75

1.50

1.25

1.00

0.75

0.50

0.25

0

0

Supply of Euros

1

Demand for Euros

4

5

2 3

6

QUANTITY OF EUROS (Billions of euros)

7

8

Under a system of flexible exchange rates, the dollar will

exchange rate of $

per euro.

Demand for Euros

Supply of Euros

until the foreign exchange market reaches an equilibrium

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Number 8arrow_forwardQUESTION 22 3 pol Suppose that • The Elasticity of Imports in the USA in the short Run is 0.5 • The Elasticity of Imports in Japan in the short Run is 0.6 • The Elasticity of Imports in the USA in the long Run is 0.9 The Elasticity of Imports in the Japan in the long Run is 1 According to the Elasticities approach to the Current Account Balance, if the Exchange Rate goes from Yen=$1/100 to Yen $1/50 . O The Current Account Balance will be unchanged • The Current Account Balance in the US will deteriorate in the short run, and improve in the long run O The Current Account Balance in the US will deteriorate in the short run and in the long run O The Current Account Balance in the US will improve both in the short run and in the long runarrow_forward3. The balance of payments The following table shows a hypothetical balance-of-payments statement for the United States. All figures are in billions of dollars. Complete the table by filling in the missing cells. Balance of Payments (Billions of U.S. dollars) Current Account Goods and Services Exports 200 Goods and Services Imports -280 Trade Balance Income (net) Current Account Balance Capital Account U.S. Capital Inflow U.S. Capital Outflow Capital Account Balance Statistical Discrepancy 98 -62 10 According to the table, the United States is running a trade The net balance of payments equals $ billion.arrow_forward

- A. Canada produces natural resources (coal, natural gas, and others), the demand for which has increased rapidly as China and other emerging economies expand. i. Explain how growth in the demand for Canada's natural resources would affect the demand for Canadian dollars in the foreign exchange market. Explain how the supply of Canadian dollars would change. ii. iii. Explain how the value of the Canadian dollar would change. iv. Illustrate your answer with a graphical analysis. 1arrow_forwardSuppose the exchange rate is such that 1 U.S. dollar equals 1 curo in New York and 0.9 euros in Paris. An arbitrageur would sell euros in New York and buy U.S. dollars in Paris in Paris and buy U.S. dollars in New York in New York while buying them in Paris in Paris while buying them in New York at the same price in both citiesarrow_forward18arrow_forward

- The following graph shows the market for euros in terms of dollars. The market is initially in equilibrium at $2.00 per euro and 8 billion euros. Suppose an economic downturn in the United States leads to a drop in American incomes, causing imports from Europe to decline. On the following graph, show the effect in the market for euros of an economic downturn in the United States that leads to a drop in European incomes. DOLLAR PRICE OF EUROS 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0 0 2 Supply of Euros Demand for Euros 4 6 8 10 12 QUANTITY OF EUROS (Billions of euros) 14 Under a system of flexible exchange rates, the dollar will per euro. 16 Increase income taxes in the United States. Lower interest rates by way of monetary policy. Demand for Euros Subsidize the production of certain U.S. exports to Europe. Supply of Euros ? Now suppose that the United States maintains a fixed exchange rate of $2.00 per euro. Which of the following U.S. government policies would keep the balance-of-payments…arrow_forwardplease answer in text form and in proper format answer with must explanation , calculation for each part and steps clearlyarrow_forward5) Indicate whether each of the following creates a demand for or a supply of European euros in foreign exchange markets: a. Liberty purchases an Airbus plane assembled in France b. Mercedes-Benz decides to build an assembly plant in Knoxville c. A Liberty student decides to spend a year studying at the Sorbonne in Paris d. An Italian manufacturer ships machinery from Rome to Venice on an Egyptian freighter e. It is widely expected that the euro will depreciate in the near futurearrow_forward

- 5. Balance of payments and the foreign exchange market The following graph shows the market for euros, which is initially in equilibrium. Suppose an economic expansion in Canada leads to an increase in the incomes of Canadian households, causing imports from Europe to rise. On the graph, illustrate the effect of an economic expansion on the market for euros by shifting the appropriate curve or curves. Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back to its original position, just drag it a little farther. EXCHANGE RATE (Dollars per euro) Supply 1.25 XXX 1.00 0.75 2.00 1.75 1.50 0.50 0.25 0 Demand Supply Flexible exchange rates Fixed exchange rates (?)arrow_forwardEXCHANGE RATE (Dollars per euro) The following graph shows the short-run supply schedule (S,) and demand schedule (D) for the euro. S, denotes the long-run supply schedule of euros. The initial equilibrium exchange rate is $1.20 per euro. Suppose that the demand for euros increases to D,. On the graph, use the tan point (dash symbol) to indicate the short-run equilibrium exchange rate. Then use the grey point (star symbol) to indicate the long-run equilibrium exchange rate. Note: Dashed drop lines will automatically extend to both axes. The following graph shows the short-run supply schedule (So) and demand schedule (Do) for the euro. Si denotes the long-run supply schedule of euros. The initial equilibrium exchange rate is $1.20 per euro. Suppose that the demand for euros increases to D1. On the graph, use the tan point (dash symbol) to indicate the short-run equilibrium exchange rate. Then use the grey point (star symbol) to indicate the long-run equilibrium exchange rate. Note:…arrow_forwardGive all answers and take likearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education