ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

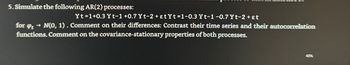

Transcribed Image Text:5. Simulate the following AR(2) processes:

Yt=1+0.3 Yt-1 +0.7 Yt-2+ɛtYt-1-0.3 Yt-1 -0.7 Yt-2+εt

for øpt → N(0, 1). Comment on their differences: Contrast their time series and their autocorrelation

functions. Comment on the covariance-stationary properties of both processes.

41%

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- If the model y = ßo + ß1x1 + ß2x2 + v satisfies the first Gauss-Markov assumptions, then v has: a. a zero mean and is correlated with only x1 b. C. a zero mean and is correlated with x₁ and x2 a zero mean and is correlated with only x2 d. a zero mean and is uncorrelated with X1 and X2 a. a O b. b О с. C ○ d. darrow_forwardUse a software of your own choice to calculate the daily log prices (lp) and daily log returns (Ir) i. Examine the descriptive statistics of both lp and Ir. What do you conclude about the distributions of lp and Ir? Is lp normally distributed? Is Ir normally distributed? Obtain the correlograms, and examine the autocorrelations and partial autocorrelations for both lp and Ir. What do you conclude about the behaviour of lp and Ir? Are they stationary/non-stationary? ii. iii. Are your conclusions about stationary/non-stationary of lp and lr confirmed by appropriate unit root tests?arrow_forwardHow does the particle used in FastSLAM differ from the one used in Monte Carlo localization?arrow_forward

- solve within 30 mins.arrow_forward2. Give an example of the time inconsistency problem applied to the relationship of a married couple.arrow_forwardLet A and B be two independent events such that P(A) = 0.25 and P(B) = 0.55- What is P(A or B)? Your answer should be given to 4 decimal places.arrow_forward

- Suppose Var(X) = 36, Var(Y) = 42, and X and Y are independent. What is Var(.25X + .75Y)? Suppose Var(X) = 63, Var(Y) = 87, and X and Y are independent. What is Var(.79X + .21Y)? Suppose that Var(X) = 907.96, Var(X) = 10219.44, and Cov(X,Y) = 2694.59. What is Var(.33X + .67Y)?arrow_forwardA potential customer has described the following scenario to you:We need to keep track of the data that our manufacturing firm needs to run smoothly.We make a number of products, each of which is manufactured by a different de-partment. Products are made up of a number of parts. Parts are bought fromsuppliers.You have been asked to perform a preliminary analysis of the scenario:a) Identify four sets of values from the scenario. b) Identify three relations from the scenario. c) Draw an entity-relationship diagram to visualise the sets and relations you have identi-fied. d) Use the relations you identified in part b) to define the following:i) A relation that records the parts that a department needs. ii) A relation that records the suppliers that a department deals witharrow_forward1. Consider a linear regression model y = XB + € with E(e) = 0. The bias of the ridge estimator of 3 obtained by minimizing Q(B) = (y — Xß)¹ (y — Xß) + r(BTB), for some r > 0, is ——(X²X + r1)-¹8 1 (X¹X +rI)-¹3 r -r(XTX+rI) ¹8 r(X¹X+r1) ¹3arrow_forward

- 4- The manager of Collins Import Autos believes the number of cars sold in a day(Q) depends on two factors: (1) the number of hours the dealership is open (H) and (2) the number of salespersons working that day (S ). After collecting data for two months (53 days), the manager estimates the following log-linear model: Q = aHbSc ----- a. Explain how to transform this log-linear model into a linear form that can be estimated using multiple regression analysis. b. How do you interpret coefficients b and c? If the dealership increases the number of salespersons by 20 percent, what will be the percentage increase in daily sales? c. Test the overall model for statistical significance at the 5 percent significance level.arrow_forward18. A multiple regression model, K = a + bX + cY + dZ, is estimated regression software, which produces the following output: D. If X equals 50, Y equals 200, and Z equals 45, what value do you predict K will take?arrow_forwardWhich of the following statements is true under the Gauss-Markov assumptions? a. Among a certain class of estimators, OLS estimators are best linear unbiased but are asymptotically inefficient. b. Among a certain class of estimators, OLS estimators are biased but asymptotically efficient. c. Among a certain class of estimators, OLS estimators are best linear unbiased and asymptotically efficient. d. The LM test is independent of the Gauss-Markov assumptions. O a. a O b. b О с. с O d. darrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education