FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

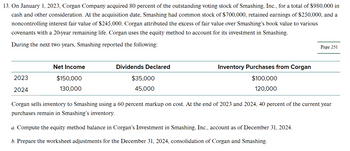

Transcribed Image Text:13. On January 1, 2023, Corgan Company acquired 80 percent of the outstanding voting stock of Smashing, Inc., for a total of $980,000 in

cash and other consideration. At the acquisition date, Smashing had common stock of $700,000, retained earnings of $250,000, and a

noncontrolling interest fair value of $245,000. Corgan attributed the excess of fair value over Smashing's book value to various

covenants with a 20-year remaining life. Corgan uses the equity method to account for its investment in Smashing.

During the next two years, Smashing reported the following:

2023

2024

Net Income

$150,000

130,000

Dividends Declared

$35,000

45,000

Inventory Purchases from Corgan

$100,000

120,000

Page 251

Corgan sells inventory to Smashing using a 60 percent markup on cost. At the end of 2023 and 2024, 40 percent of the current year

purchases remain in Smashing's inventory.

a. Compute the equity method balance in Corgan's Investment in Smashing, Inc., account as of December 31, 2024.

b. Prepare the worksheet adjustments for the December 31, 2024, consolidation of Corgan and Smashing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 8 steps with 18 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2020, Doone Corporation acquired 60 percent of the outstanding voting stock of Rockne Company for $300,000 consideration. At the acquisition date, the fair value of the 40 percent noncontrolling interest was $200,000, and Rockne's assets and liabilities had a collective net fair value of $500,000. Doone uses the equity method in its internal records to account for its investment in Rockne. Rockne reports net income of $160,000 in 2021. Since being acquired, Rockne has regularly supplied inventory to Doone at 25 percent more than cost. Sales to Doone amounted to $250,000 in 2020 and $300,000 in 2021. Approximately 30 percent of the inventory purchased during any one year is not used until the following year. a) What is the non controlling interest's share of Rockne's 2021 income? b) Prepare Doone's 2021 consolidation entries required by the intra-entity inventory transfers.arrow_forwardOn January 1, 2024, Cameron Incorporated bought 30% of the outstanding common stock of Lake Construction Company for $330 million cash, giving Cameron the ability to exercise significant influence over Lake’s operations. At the date of acquisition of the stock, Lake's net assets had a fair value of $700 million. Its book value was $600 million. The difference was attributable to the fair value of Lake's buildings and its land exceeding book value, each accounting for one-half of the difference. Lake’s net income for the year ended December 31, 2024, was $110 million. During 2024, Lake declared and paid cash dividends of $20 million. The buildings have a remaining life of 5 years. Required: Complete the table below and prepare all appropriate journal entries related to the investment during 2024, assuming Cameron accounts for this investment by the equity method. Determine the amounts to be reported by Cameron. 1 Record the investment in Lake Construction shares. 2 Record the…arrow_forwardOn January 1, 2020, Corgan Company acquired 80 percent of the outstanding voting stock of Smashing, Inc., for a total of $1,560,000 in cash and other consideration. At the acquisition date, Smashing had common stock of $900,000, retained earnings of $450,000, and a noncontrolling interest fair value of $390,000. Corgan attributed the excess of fair value over Smashing's book value to various covenants with a 20-year remaining life. Corgan uses the equity method to account for its investment in Smashing. During the next two years, Smashing reported the following: Net Income Dividends Declared Inventory Purchases from Corgan 2020 $350,000 $ 55,000 $ 300,000 2021 330,000 $ 65,000 $ 320,000 Corgan sells inventory to Smashing using a 60 percent markup on cost. At the end of 2020 and 2021, 40 percent of the current year purchases remain in Smashing's inventory. Compute the equity method balance in Corgan's Investment in Smashing, Inc., account…arrow_forward

- On January 1, 2021, Cameron Inc. bought 20% of the outstanding common stock of Lake Construction Company for $360 million cash, giving Cameron the ability to exercise significant influence over Lake's operations. At the date of acquisition of the stock, Lake's net assets had a fair value of $800 million. Its book value was $700 million. The difference was attributable to the fair value of Lake's buildings and its land exceeding book value, each accounting for one-half of the difference. Lake's net income for the year ended December 31, 2021, was $180 million. During 2021, Lake declared and paid cash dividends of $25 million. The buildings have a remaining life of 10 years. Required: 2. Determine the amounts to be reported by Cameron.arrow_forwardOn July 1, 2021, Truman Company acquired a 70 percent interest in Atlanta Company in exchange for consideration of $785,225 in cash and equity securities. The remaining 30 percent of Atlanta's shares traded closely near an average price that totaled $336,525 both before and after Truman's acquisition. In reviewing its acquisition, Truman assigned a $128.500 fair value to a patent recently developed by Atlanta, even though it was not recorded within the financial records of the subsidiary. This patent is anticipated to have a remaining life of five years. The following financial information is available for these two companies for 2021. In addition, the subsidiary's income was earned uniformly throughout the year. The subsidiary declared dividends quarterly. Revenues Operating expenses Income of subsidiary Net income Retained earnings, 1/1/21 Net income (above) Dividends declared Retained earnings, 12/31/21 Current assets Investment in Atlanta Land Buildings Total assets Liabilities…arrow_forwardProtrade Corporation acquired 80 percent of the outstanding voting stock of Seacraft Company on January 1, 2020, for $468,000 in cash and other consideration. At the acquisition date, Protrade assessed Seacraft's identifiable assets and liabilities at a collective net fair value of $585,000, and the fair value of the 20 percent noncontrolling interest was $117,000. No excess fair value over book value amortization accompanied the acquisition. The following selected account balances are from the individual financial records of these two companies as of December 31, 2021: Protrade Seacraft $ 700,000 $ 420,000 320,000 227,000 156,000 800,000 Sales Cost of goods sold Operating expenses Retained earnings, 1/1/21 Inventory Buildings (net) Investment income 352,000 364,000 Not given Each of the following problems is an independent situation: 8. a. Assume that Protrade sells Seacraft inventory at a markup equal to 60 percent of cost. Intra-entity transfers were $96,000 in 2020 and $116,000 in…arrow_forward

- On January 1, 2024, Morey, Incorporated, exchanged $180,575 for 25 percent of Amsterdam Corporation. Morey appropriately applied the equity method to this investment. At January 1, the book values of Amsterdam’s assets and liabilities approximated their fair values. On June 30, 2024, Morey paid $605,500 for an additional 70 percent of Amsterdam, thus increasing its overall ownership to 95 percent. The price paid for the 70 percent acquisition was proportionate to Amsterdam’s total fair value. At June 30, the carrying amounts of Amsterdam’s assets and liabilities approximated their fair values. Any remaining excess fair value was attributed to goodwill. Amsterdam reports the following amounts at December 31, 2024 (credit balances shown in parentheses): Revenues $ (291,000) Expenses 186,000 Retained earnings, January 1 (237,300) Dividends declared, October 1 10,000 Common stock (500,000) Amsterdam’s revenue and expenses were distributed evenly throughout the year, and no…arrow_forwardOn January 1, 2023, QuickPort Company acquired 90 percent of the outstanding voting stock of NetSpeed, Incorporated, for $810,000 in cash and stock options. At the acquisition date. NetSpeed had common stock of $800,000 and Retained Earnings of $40,000. The acquisition-dete fair value of the 10 percent noncontrolling interest was $90.000. QuickPort attributed the $60.000 excess of NetSpeed's fair value over book value to a database with a five-year remaining life During the next two years, NetSpeed reported the following Income 8,000 Dividends Declared On July 1, 2023, QuickPort sold communication equipment to NetSpeed for $42.000. The equipment originally cost $48,000 and had accumulated depreciation of $9,000 and an estimated remaining life of three years at the date of the intra-entity transfer Required: Compute the equity method balance in QuickPort's Investment in NetSpeed, incorporated, account as of December 31, 2024. b. Prepere the worksheet adjustments for the December 31,…arrow_forwardOn January 1, 2022, Aronsen Company acquired 90 percent of Sledel Company's outstanding shares. Sledel had a net book value on that date of $450,000: common stock ($12 par value) of $240,000 and retained earnings of $210,000. Aronsen paid $691,200 for this Investment. The acquisition-date fair value of the 10 percent noncontrolling Interest was $76,800. The excess fair value over book value associated with the acquisition was used to increase land by $222,000 and to recognize copyrights (12-year remaining life) at $96,000. Subsequent to the acquisition, Aronsen applied the Initial value method to its Investment account. In the 2022-2023 period, the subsidiary's retained earnings Increased by $230,000. During 2024, Siedel earned Income of $94,000 while declaring $34,000 in dividends. Also, at the beginning of 2024, Siedel Issued 4,000 new shares of common stock for $52 per share to finance the expansion of its corporate facilities. Aronsen purchased none of these additional shares and…arrow_forward

- On January 1, 2024, Brooks Corporation exchanged $1,194,000 fair-value consideration for all of the outstanding voting stock of Chandler, Incorporated. At the acquisition date, Chandler had a book value equal to $1,150,000. Chandler’s individual assets and liabilities had fair values equal to their respective book values except for the patented technology account, which was undervalued by $216,000 with an estimated remaining life of six years. The Chandler acquisition was Brooks’s only business combination for the year. In case expected synergies did not materialize, Brooks Corporation wished to prepare for a potential future spin-off of Chandler, Incorporated. Therefore, Brooks had Chandler maintain its separate incorporation and independent accounting information system as elements of continuing value. On December 31, 2024, each company submitted the following financial statements for consolidation. Dividends were declared and paid in the same period. Accounts Brooks Corporation…arrow_forwardOn July 1, 2021, Gupta Corporation bought 30% of the outstanding common stock of VB Company for $170 million cash, giving Gupta the ability to exercise significant influence over VB’s operations. At the date of acquisition of the stock, VB’s net assets had a total fair value of $490 million and a book value of $220 million. Of the $270 million difference, $50 million was attributable to the appreciated value of inventory that was sold during the last half of 2021, $160 million was attributable to buildings that had a remaining depreciable life of 10 years, and $60 million related to equipment that had a remaining depreciable life of 5 years. Between July 1, 2021, and December 31, 2021, VB earned net income of $60 million and declared and paid cash dividends of $50 million. Required:1. Prepare all appropriate journal entries related to the investment during 2021, assuming Gupta accounts for this investment by the equity method. a. Record the purchase of VB company shares for $170.0…arrow_forwardPadre, Inc., buys 80 percent of the outstanding common stock of Sierra Corporation on January 1, 2021, for $802,720 cash. At the acquisition date, Sierra's total fair value, including the noncontrolling interest, was assessed at $1,003,400 although Sierra's book value was only $690,000. Also, several individual items on Sierra's financial records had fair values that differed from their book values as follows: Book Value Land $ 65,000 Fair Value $ 290,000 Buildings and equipment (10-year remaining life) 287,000 Copyright (20-year remaining life) Notes payable (due in 8 years) 122,000 (176,000) 263,000 216,000 (157,600) For internal reporting purposes, Padre, Inc., employs the equity method to account for this investment. The following account balances are for the year ending December 31, 2021, for both companies. Padre Revenues Cost of goods sold Depreciation expense Amortization expense Interest expense Equity in income of Sierra Net income Retained earnings, 1/1/21 Net income…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education