FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

s

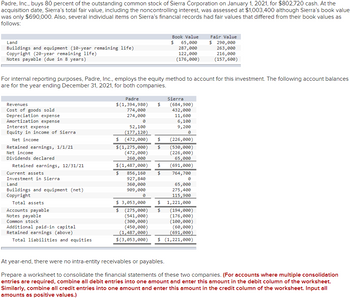

Transcribed Image Text:Padre, Inc., buys 80 percent of the outstanding common stock of Sierra Corporation on January 1, 2021, for $802,720 cash. At the

acquisition date, Sierra's total fair value, including the noncontrolling interest, was assessed at $1,003,400 although Sierra's book value

was only $690,000. Also, several individual items on Sierra's financial records had fair values that differed from their book values as

follows:

Land

$

Buildings and equipment (10-year remaining life)

Copyright (20-year remaining life)

Book Value

65,000

287,000

Fair Value

$ 290,000

263,000

Notes payable (due in 8 years)

122,000

(176,000)

216,000

(157,600)

For internal reporting purposes, Padre, Inc., employs the equity method to account for this investment. The following account balances

are for the year ending December 31, 2021, for both companies.

Padre

Revenues

Cost of goods sold

Depreciation expense

Amortization expense

Interest expense

Equity in income of Sierra

Net income

Retained earnings, 1/1/21

Net income

Dividends declared

Retained earnings, 12/31/21

Current assets

Investment in Sierra

Land

Buildings and equipment (net)

Copyright

Total assets

Accounts payable

Notes payable

Common stock

Additional paid-in capital

Retained earnings (above)

Total liabilities and equities

(684,900)

Sierra

$ (1,394,980)

774,000

$

274,000

0

52,100

(177,120)

$ (472,000) $

$ (1,275,000)

(472,000)

260,000

432,000

11,600

6,100

9,200

0

(226,000)

(530,000)

(226,000)

65,000

$ (1,487,000)

$

(691,000)

$

856,160

$

764,700

927,840

0

360,000

65,000

909,000

275,400

0

115,900

$ 3,053,000

$

1,221,000

$ (275,000) $

(194,000)

(541,000)

(176,000)

(300,000)

(100,000)

(450,000)

(60,000)

(1,487,000)

(691,000)

$(3,053,000) $ (1,221,000)

At year-end, there were no intra-entity receivables or payables.

Prepare a worksheet to consolidate the financial statements of these two companies. (For accounts where multiple consolidation

entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet.

Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Input all

amounts as positive values.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education