ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:### Calculating Tax Incidence

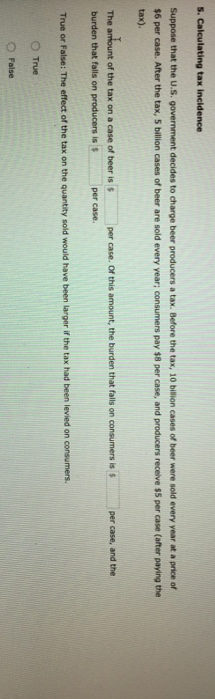

Suppose that the U.S. government decides to impose a tax on beer production. Before the tax, 10 billion cases of beer were sold every year at a price of $7 per case. After the tax, 9 billion cases of beer are sold every year; consumers pay $9 per case, and producers receive $6 per case (after paying the tax).

- The amount of the tax on a case of beer is **$3** per case. Of this amount, the burden that falls on producers is **$1** per case, and the burden that falls on consumers is **$2** per case.

- True or False: The division of the tax burden in this example would have been larger if the tax had been levied on consumers.

- True

- False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- question 29arrow_forwardCan you please check my workarrow_forwardard My courses My Media 30 t of s page pter 17 Figure 8-5 Price Pa P₁ P₂ 0 B D F Tax G 8₂ C O a. F O b. A OC. A+B+C O d. D+E E H 9₁₂ D Jump to... Quantity Refer to Figure 8-5. Which area represents producer surplus after the tax is levied on the consumer? Time left 0:49:47 NEXT PAGE ?arrow_forward

- 7. Effect of a tax on buyers and sellers Part 2 The following graph shows the daily market for wine. Suppose the government institutes a tax of $10.15 per bottle. This places a wedge between the price buyers pay and the price sellers receive.arrow_forwardq6-arrow_forwardQuestion 2 Full explain this questionarrow_forward

- The figure below illustrates the effect of an excise tax (per unit tax) imposed on sellers (S means supply and D means demand). What is the value of the tax and how much tax revenue does it generate? Price S+tax $100 $60 $50 50 60 Quantity O a. $100 and $1000. O b. $50 and $3000. Oc. None of the alternatives is correct. O d. $50 and $2500. O e. $100 and $5000.arrow_forwardImagine there is a tax on cigarettes and that consumers and producers each bear some portion of the tax. Assume that when vape pens were introduced, they were not taxed. How would you expect that introduction of vape pens to affect the distribution of the tax burden associated with the cigarette tax? O It will decrease the consumer tax burden because demand for cigarettes will become more elastic. O It will increase the consumer tax burden because demand for cigarettes will become more elastic. O It will decrease the consumer tax burden because demand for cigarettes will become more inelastic. O It will increase the consumer tax burden because demand for cigarettes will become more inelastic.arrow_forwardQUESTION 8 Figure 14 12 10 8 6 4- 2- 10 20 30 40 50 60 70 Refer to Figure. If the government imposed a tax of $6 per unit in this market then which of the following statements would be correct? O a. The burden of tax will fall equally on the buyers and sellers. O b. The burden of tax will fall more on the buyers. O C. The burden of tax will fall more on the sellers. O d. Neither buyer or seller will have to pay the tax.arrow_forward

- Ciear my cnoice 43. A tax paid by buyers shifts the supply curve, while a tax paid by sellers shifts the demand curve. However, the outcome is the same regardless of who pays the tax. Select one: O a. True O b. False Figure 64 Price 4arrow_forwardHelparrow_forwardIf buyers pay more of a tax than do the sellers اختر أحد الخيارات a. demand is more elastic than supply O .b. supply is more elastic than demand O C. None of the above answers is correct O .d. the equilibrium price paid by buyers rises by less than half the amount of the tax „e. the amount of tax revenue collected by the government is almost zeroarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education