ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

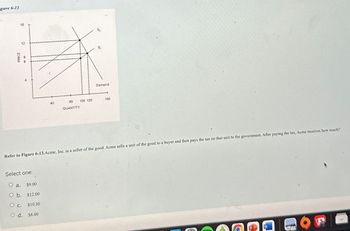

Transcribed Image Text:gure 6-13

PRICE

16

S.

카

Demand

40

80 105 120

QUANTITY

2

12

96

160

Refer to Figure 6-13.Acme, Inc. is a seller of the good. Acme sells a unit of the good to a buyer and then pays the tax on that unit to the govermment. After paying the tax, Acme receives how much?

Select one:

O a.

$9.00

Ob. $12.00

oco

$10.50

Od, $8,00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Price 27.5 CHOKRESE DEDELS 85 80 75 70 65 60 55 50 45 40 35 30 25 20 15 10 5 Supply Demand 5 10 15 20 25 30 35 40 45 50 55 60 65 70 Quantity Refer to the figure. When the price falls from $45 to $35, consumer surplus increases by $100 from new consumers entering the market. O increases by $50 from new consumers entering the market. increases by $50 from consumers who were already buying the good now paying a lower price. decreases by $50 from consumers who were already buying the good now paying a lower price.arrow_forwardPrice of Good ABC $4 5 6 7 Quantity Demanded 100 80 60 50 Quantity Supplied 40 80 110 160 Refer to Table 4-2. Suppose that the government imposes a price ceiling in the market for good ABC at a price of $4. The result of the price ceiling would be a of units of good ABC. O a shortage: 20 0 b surplus: 60 OC surplus: 20 Od shortage: 60arrow_forwardWhat is the consumer surplus when the price is $20? Price 40 35 + 30 25 + 20 15 10 D 10 20 30 40 s0 60 70 00 Duantity Select one: O a. $20 O b. $1000 O. $500 O d. $50arrow_forward

- 36 Social Cost 30 30 24 24 18 PRICE (Dollars per unit) 2 6 Supply Demand H 100 200 300 400 500 600 QUANTITY (Units of plastic) Refer to Figure 10-6. In order to reach the social optimum, the government could O impose a tax of $3 per unit on plastics. impose a tax of $9 per unit on plastics. O impose a tax of $12 per unit on plastics. Ooffer a subsidy of $9 per unit on plastics.arrow_forwardI need answer typing clear urjent no chatgptarrow_forwardQuestion 21arrow_forward

- Just complete Question 7A and 7Barrow_forwardConsumer Willingness to Pay Anya $24 Basil 20 Celeste 15 Dralon 12 Esther 7 Refer to Table 4-2. The table above lists the highest prices five consumers are willing to pay for a theater ticket. If the price of one ticket rises from $10 to $19, O only three tickets will be sold. consumer surplus decreases from $31 to $6. no one will buy a ticket. O consumer surplus increases from $44 to $71.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- The graph shows the demand curve and the supply curve in the market for newpapers. Draw a horizontal line at a price at which there is a surplus of newpapers. Label it Surplus.arrow_forwardSuppose that the government decided to subsidize bacon producers. Will this impact supply or demand? O This will impact both supply and demand causing the supply curve and demand curve to shift to the left. This will only impact supply, causing the supply curve to shift to the left. This will only impact supply, causing the supply curve to shift to the right. This will impact both supply and demand causing the supply curve and demand curve to shift to the right.arrow_forward500 600 100 Quantity (millions of gollons per year) 200 300 400 The figure above shows the market for milk in Cowland. If a subsidy paid to producers of $1 per gallon of milk is introduced, what is the amount, including the subsidy, that suppliers keep per gallon? Select one: O a. $3.00 a gallon O b. between $3.00 and $4.00 per gallon Oc. $4.00 a gallon O d. between $4.00 and $5.00 per gallon Price (dollars per gallon)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education