Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

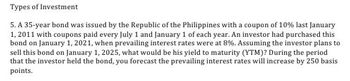

Transcribed Image Text:Types of Investment

5. A 35-year bond was issued by the Republic of the Philippines with a coupon of 10% last January

1, 2011 with coupons paid every July 1 and January 1 of each year. An investor had purchased this

bond on January 1, 2021, when prevailing interest rates were at 8%. Assuming the investor plans to

sell this bond on January 1, 2025, what would be his yield to maturity (YTM)? During the period

that the investor held the bond, you forecast the prevailing interest rates will increase by 250 basis

points.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The U.S. Treasury has issued 10-year zero coupon bonds with a face value of $1,000. Assume that the bond compounds interest semiannually. What will be the current market price of these bonds if the yield to maturity for similar investments in the market is 6.75 percent? $860 O $520 O $604 O $515arrow_forwardHenry is planning to purchase a Treasury bond with a coupon rate of 2.71% and face value of $100. The maturity date of the bond is 15 March 2033. (a) If Henry purchased this bond on 3 March 2020, what is his purchase price (rounded to four decimal places)? Assume a yield rate of 3.36% p.a. compounded half-yearly. Question 1 Answer a. 93.0968 b. 94.4504 c. 94.6609 d. 94.4488arrow_forwardYou are considering buying a 6.5% coupon bond. The bond has a par value of $1,000. The bond was issued in October 2020 with a 20-year term to maturity. The bond makes semiannual coupon payments. The current selling price is $1,432. What is the dollar amount of a coupon payment? (Remember that the bond has semi-annual coupon payments.) $16.25 $32.50 O $65.00 O $130arrow_forward

- 2arrow_forwardA Treasury bond maturing on December 15, 2020 is yielding 3.45% and is priced at $1,124.36. What is this bond's annual coupon rate as of October 31, 2016?arrow_forwardYou buy an 8 percent, 30 - year, $ 1,000 par value floating rate bond in 2025. By the year 2030, rates on bonds of similar risk are up to 10 percent.arrow_forward

- please answer fast i give upvotearrow_forward2. A firm has just issued (January 1, 2018) a bond that has a face value of $1,000, a coupon rate of 7 percent paid semi-annually (June 30, December 31), and matures in 10 years. The bonds were issued with a yield to maturity of 6%. What price were the bonds issued at? Assume that on July 1, 2020, the bond trades to earn an effective yield of 9%. At what price should this bond be trading for on July 1, 2020? PRICE WHEN ISSUED: PRICE ON JULY 1, 2020: 3. A Canadian company has a division in Mexico. The Canadian company needs to borrow money for its Mexican division and has the choice of borrowing in Mexico or Canada. The effective annual interest rate in Canada is 6 percent and the interest rate in Mexico is 10 percent. The current exchange rate is 15 Mexican pesos per Canadian dollar. If you believe that the Canadian dollar will depreciate 10 percent against the Mexican peso over the next 6 months, where should the company borrow? For simplicity, assume that the company wants to borrow…arrow_forwardA bond that settles on June 7, 2022, matures on July 1, 2042, and may be called at any time after July 1, 2032, at a price of 185. The coupon rate on the bond is 6.6 percent and the price is 200.50. What are the yield to maturity and yield to call on this bond?arrow_forward

- On 5/15/2008, the thirty-year T-bond with a coupon of 5.00% and maturing on 5/15/2038 was quoted at a clean price of 102.50. The general collateral repo rate for a term of one month was 4.775%. Your investment bank receives an order from a client to buy this bond forward in one month's time. What is the forward price that you should quote? Why? How should your desk hedge itself assuming that the deal is done on May 15, 2008?arrow_forwardA New Brunswick Power bond issue carrying a 7.6% coupon matures on November 1, 2031. At what price did $1,000 face value bonds trade on June 10, 2019, if the yield to maturity required by the bond market on that date was 5.9% compounded semiannually?arrow_forwardQ1) a) On 1st January 2021 and RBI is considering to issue a new 3-yrs G-Sec bond (semi- annual coupon paying bond) through an auction for a notified amount of Rs. 3000 crs. as a part of the borrowing programme. Let the name of the bond be Bond X. Below are the yields obtained in Auction. Find the coupon rate of the newly issued bond. b) What would be the price of the bond? Bid Yield Bid Amount (Crs) Sl no 1 4.70% 600 2 5.05% 300 3 4.85% 400 4 5.15% 500 5 4.77% 400 6 4.75% 700 7 5.12% 400 8 5.00% 300 9 4.92% 200 10 4.95% 400 (3+2=5) c) Exactly after one year (1 yr), that is on 1st January 2022, the following securities are getting traded in the market at NDS-OM. All the bonds are semi-annual coupon paying bonds. T-bills are the money market instruments. Symbol Secutity Name Maturity time ( yrs) Traded Price (Rs) A 182-Tbill 0.5 97.9317 B 364-Tbill 1 95.8823 C 6.17 GS 20XX 1.5 100.6900 D 6.84 GS 20XX 2 102.2950 E 7.16 GS 20XX 2.5 103.0800 Find the discount factors Z(0,t) from the above…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education