Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

I am not understanding how to use excel to get the answer to this.

Please show excel work. Answer should be: $2,704,814

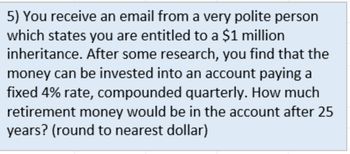

Transcribed Image Text:5) You receive an email from a very polite person

which states you are entitled to a $1 million

inheritance. After some research, you find that the

money can be invested into an account paying a

fixed 4% rate, compounded quarterly. How much

retirement money would be in the account after 25

years? (round to nearest dollar)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Part 1 is complete. I have copied it below before Part 2. This should help to complete Part 2 since there is no missing information. Newspaper ad $120 per month Social media manager $100 per month; $1 per job scheduled Payment collection $0.75 per job Gas $4.00 per job Considering his analysis of similar services and to keep things simple, W.T. plans to price all jobs the same and charge $15 per job. Because of this flat rate, he anticipates he’ll likely need to create different types of “jobs”. For example, purchasing a list of items at the grocery store would be one job, while a bundle of 2-3 small errands such as picking up dry cleaning and prescriptions, might be considered one job. We’ll deal with those details later. For now, assume that all jobs are priced at $15 each and all have the associated variable expenses listed above. Because this will be a new business, W.T. knows business will likely be slow at the beginning. Complete the following…arrow_forwardPlease give a detailed solution to this problem. Do not use any software and just solve manually. Thank you.arrow_forward6. Fabulous Fabricators needs to decide how to allocate space in its production facility this year. It is considering the following contracts: a. What are the profitability indexes of the projects? b. What should Fabulous Fabricators do? **round to two decimal places**arrow_forward

- Hello, I need help solving this accounting problem.arrow_forwardSolve a Related Rates Problem. A technical support contracting firm hires people to work from home using their proprietary support scripting system. The more employess they have, the more contracts they can support and therefore the more revenue they can generate. Suppose that the company's revenue and number of employees is related by R² = 297x³, where is R is the revenue in thousands of USD anda is the number of employees in hundreds. If there is no shortage of work to be done, the company currently has 3300 employees, and the company wants to increase their revenue from $3,267,000.00 this year to $5,643,000.00 next year, how many new employees should be hired in order to make that possible? The company should hire new employees before next year. Preview My Answers Submit Answers harrow_forwardPhoenix Partners provides management consulting services to government and corporate clients. Phoenix has two support departments administrative services (AS) and information systems (IS) and two operating departments-government consulting (GOVT) and corporate consulting (CORP). For the first quarter of 2020, Phoenix's cost records indicate the following: (Click the icon to view the cost records.) Read the requirements. Requirement 1c. Allocate the two support departments' costs to the two operating departments using the step-down method (Allocate IS first). (Do not round intermediary calculations and round your final answers to the nearest whole dollar. Use parentheses or a minus sign when decreasing departments by allocating costs. Enter a "0" for any zero balances.) Support Departments AS Operating Departments CORP Step-down Method IS GOVT Total Budgeted overhead costs 690,000 $2,100,000 $8,675,000 $12,490,000 $23,955,000 before interdepartment cost allocations Allocation of IS…arrow_forward

- I know there is a Bartleby on this, but the commas are all out of place and I'm still confused. Could you give a more in-depth solution and explain on how to calcultae FCF, specifically with excel functions? We are entering the widget business. It costs $500,000, payable in year 1, to develop a prototype. This cost can be depreciated on a straight-line basis during years 1-5. Each widget sells for $40 and incurs a variable cost of $20. During year 1 the market size is 100,000, and the market size is growing at 10% per year. Profits are taxed at 40%, but there are no taxes on negative profits. a) Given our other assumptions, what market share (in %) is needed to ensure the total free cash flow (FCF) of $0 over the five year period? Note: FCF during a year equals after-tax profits plus depreciation minus fixed costs (if any).b) Describe how an increase in percent market growth rate changes total FCF over years 1-5.c) Describe how simultaneous changes in percent market share and changes…arrow_forwardGodoarrow_forwardI will provide the question and answer but I need an explanation on how to get the answers. There are 4 answers (below) and the chart should be attached. Solve the problem. Round dollar amounts to the nearest dollar. Westminster Office Machines allocates its overhead of $1,487,304 by the sales of each product. Find the overhead for each department. List your answers if the order of the table. ($423,696, $458,304, $222,684, $382,620)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education