FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Please I need answer for all parts. If you can't answer all parts just skip/leave. Solve with all working and do not say about your guidelines. I will downvote if incomplete and incorrect. Upvote if complete and correct. Thanks! Please double underline provide answer with all working for each and every part.

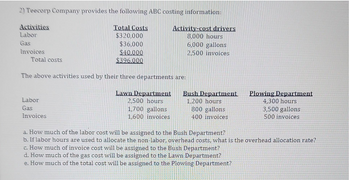

Transcribed Image Text:2) Teecorp Company provides the following ABC costing information:

Activities

Labor

Total Costs

$320,000

Gas

$36,000

$40.000

$396.000

Invoices

Total costs

Activity-cost drivers

8,000 hours

6,000 gallons

2,500 invoices

The above activities used by their three departments are:

Lawn Department

2,500 hours

1,700 gallons

1,600 invoices

Labor

Gas

Invoices

Bush Department

1,200 hours

800 gallons

400 invoices

Plowing Department

4,300 hours

3,500 gallons

500 invoices

a. How much of the labor cost will be assigned to the Bush Department?

b. If labor hours are used to allocate the non-labor, overhead costs, what is the overhead allocation rate?

c. How much of invoice cost will be assigned to the Bush Department?

d. How much of the gas cost will be assigned to the Lawn Department?

e. How much of the total cost will be assigned to the Plowing Department?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduction:

VIEW Step 2: a) Labor cost assigned to Bush Department:

VIEW Step 3: b) Overhead allocation rate:

VIEW Step 4: c) Invoice cost assigned to bush department:

VIEW Step 5: d) Gas cost assigned to Lawn department:

VIEW Step 6: e) Total cost assigned to Plowing department:

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How to solve this?arrow_forwardYou guys provided me an expert answer? Cuz the table for the part 1 of the p missing as well on volum PR what do i enter? and the part 2 has a table but c utilized.arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forward

- hi im looking at the solution above and have a quuestion-im a littlepuzzled on exactly how i should be plugging in the numbersfor example, the chart liists Time (ln2/(ln(1+r)) but how exactly should i type this in my calculatorto get =l3/J3? maybe im overthinking itarrow_forwardI need help on solving gold section if the problem?arrow_forwardThis question has not been submitted previously. Thank youarrow_forward

- BOR Tutor - Solution Page 1 of 1 | Ha X A learn.hawkeslearning.com/Portal/Lesson/lesson_certify#! MSC SSO Login To Do Assignments. E Reading list E Apps BSA Violation Civil... Search FAQS for Indian Trib... CPAJ The Past, Present, a... CPAJ Fraud in a World of... You were asked to answer the following question: Consider a small photography studio with 8 workers and 5 printers. The total cost of labor and capital is $3,300. In order to reduce total operating costs, the owner leases 5 additional printers and fires 5 workers. After these changes, the salary of each worker increases by $30, the cost of using each of the printers (both new and old) remains constant, and the total cost of labor and capital decreases to $2,950. What is the cost of using one printer? The following answer is correct: First, calculate the new total quantities of workers and printers after the changes were made. New quantity of workers= 8-5= 3 workers New quantity of printers = 5 + 5 = 10 printers Assume that C,…arrow_forwardHello i have attached two pictures. They are both used together to answer the question. The first picture is the information to use too answer the question. The second attachment is the for the answer. I hope it is understandable and whoever answer this can please explain how they got the answers. I need the help. I have marked a yellow x on what i have done already. I DO NOT NEED HELP WITH WHAT IS CROSSED IN YELLOW (PARTS 1-3) I NEED PARTS 4-6. THIS IS IS IS THE ANSWER TO PARTS 1-3 Analysis and Calculation: 1) Gold Medal Athletic Co., Sales Budget: For the month ended March: Product Sales Volume Sale Price per unit Sales, $ Batting helmet 1,200 units $40 $ 48,000 Football helmet 6,500 units $160 $1,040,000 Total revenue from sales $ 1,088,000 2) Production Budget: Batting Football Helmet Helmet Expected units to be sold 1,200 6,500 Add: desired Ending inventory 50 220 Total 1,250 6,720 Less: Beginning estimated inventory 40 240 Total…arrow_forwardThe first part of the assignment is to open Excel and in column A starting in row 1 and down to row 40 generate random values using the RAND() function. Copy and special paste those values onto sheet2. You will turn in the Excel file, but you will use the information below when directed. Say an individual is faced with the decision of whether to buy auto insurance or not (like before laws in many states changed). The states of nature are that no accident occurs (with probability .992) or an accident occurs (with probability .008). Here is the payoff table for the decision maker (where -500 is read minus 500, for example) State of Nature Decision No Accident Accident Purchase insurance -500 -500 Do not purchase Ins. 0 -10000 1. Say the individual is a RISK LOVER. Create a table with plausible values of utility for the risk lover where you pick as the indifference probability for the value -500 the first value that is appropriate from your simulation in Excel (starting in cell A1 on…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education