FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

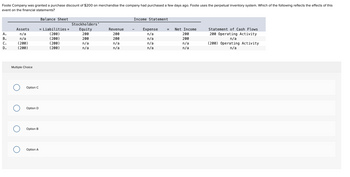

Transcribed Image Text:Foote Company was granted a purchase discount of $200 on merchandise the company had purchased a few days ago. Foote uses the perpetual inventory system. Which of the following reflects the effects of this

event on the financial statements?

A.

B.

C.

D.

Assets

n/a

n/a

(200)

(200)

Multiple Choice

OOO O

Option C

Option D

Option B

Option A

Balance Sheet

= Liabilities +

(200)

(200)

(200)

(200)

Stockholders'

Equity

200

200

n/a

n/a

Revenue

200

200

n/a

n/a

Income Statement

Expense

n/a

n/a

n/a

n/a

Net Income

200

200

n/a

n/a

Statement of Cash Flows

200 Operating Activity

n/a

(200) Operating Activity

n/a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Statement of Cash Flow Preparation Activity Consider the following journal entries: Entry (a) cash $4 %$4 81,000.00 common stock 81,000.00 (b) treasury stock 13,000.00 cash 13,000.00 (c) cash 60,000.00 sales revenue 60,000.00 (d) land 87,700.00 cash 87,700.00 (e) depreciation expense 9,000.00 accumulated depreciation 9,000.00 (f) dividends payable 16,500.00 cash 16,500.00 (g) land 18,000.00 cash 18,000.00 (h) cash 7,200.00 7,200.00 equipment (1) bonds payable cash 45,000.00 45,000.00 (1) building 164,000.00 164,000.00 note payable, long-term (k) loss on disposal of equipment | 1,400.00 equipment, net 1,400.00 Indicate whether each transaction would result in an operating activity, an investing activity, or a financing activity for an indirect method statement of cash flow and the accompanying schedule of non-cash investing and financing activities. Click here to enter text. %24arrow_forward5arrow_forwardJ8arrow_forward

- Lydex Company Comparative Balance Sheet This Year Last Year Assets Current assets: Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current assets Plant and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Note payable, 10% Total liabilities Stockholders' equity: Common stock, $ 78 par value Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 960,000 0 2,700,000 3,900,000 240,000 7,800,000 9,300,000 $ 17,100,000 $ 3,900,000 3,600,000 7,500,000 7,800,000 1,800,000 9,600,000 $ 17,100,000 $ 1,260,000 300,000 1,800,000 2,400,000 180,000 5,940,000 8,940,000 $ 14,880,000 $ 2,760,000 3,000,000 5,760,000 7,800,000 1,320,000 9,120,000 $ 14,880,000 Sales (all on account) Lydex Company Comparative Income Statement and Reconciliation This Year $ 15,750,000 12,600,000 3,150,000 1,590,000 Last Year $ 12,480,000 9,900,000 2,580,000 Cost of goods sold Gross margin Selling and…arrow_forwardsuppose that the following information is related to X company for 2020 net cash flows from operating activities 12000 net cash flows from financing activities 18000 beginning cash balance 5000 Ending cash balance 10000 The net cash flows from investing activities is O a. (25000) O b. 10000 O c. 30000 O d. 8000arrow_forwardPrior Year Current Year Accounts payable 3,153.00 5,915.00 Accounts receivable 6,935.00 9,046.00 Accruals 5,794.00 6,085.00 Additional paid in capital 19,655.00 13,876.00 Cash. ??? ??? Common Stock 2,850 2,850 COGS 22,169.00 18,794.00 Current portion long-term debt 500 500 Depreciation expense 1,016.00 1,037.00 Interest expense 1,276.00 1,138.00 Inventories 3,041.00 6,672.00 Long-term debt 16,904.00 22,546.00 Net fixed assets 75,987.00 73,861.00 Notes payable 4,002.00 6,534.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,536.00 34,724.00 Sales 46,360 45,799.00 Taxes 350 920 Category ww What is the firm's total change in cash from the prior year to the current year?arrow_forward

- d. mutual agency for stockholders 20. Stockholders' equity a. is usually equal to cash on hand b. is shown on the income statement c. includes paid-in capital and liabilities d. includes retained earnings and paid-in capita blec bisearrow_forwardRequired information [The following information applies to the questions displayed below] Golden Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit. (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. Assets Cash Accounts receivable. Inventory Total current assets GOLDEN CORPORATION Comparative Balance Sheets December 31 Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable. Income taxes payable. Total current liabilities Equity Common stock, $2 par value Paid-in capital in excess of par value, common stock Retained earnings Total liabilities and equity GOLDEN CORPORATION Income Statement For Current Year Ended…arrow_forwardCash Flow Data for Interceptors, Incorporated. 2018 2019 2020 2018 Beginning Cash $ 35 $ 40 $ 45 $ 50 Cash from Operations $ 127 $ 125 $ 122 $ 117 Net Capital Spending ($ 140) ($ 130) ($ 140) ($ 145) Cash from Financing $ 18 $ 15 $ 23 Ending Cash $ 40 $ 45 $ 50 $ 55 Based on the cash flow data in the table for Interceptors Incorporated, which of the following statements is (are) correct? 1. This firm appears to be a good investment because of its steady growth in cash. 2. This firm has been able to generate growing cash flows only by borrowing or selling equity to offset declining operating cash flows. 3. Financing activities have been increasingly important for this firm's operations, at least in the short run.arrow_forward

- Classify the following transaction by type of cash flow activity: Issued 100,000 shares of $5 par value common stock for $800,000 cash. Seleccione una: a. Operating activity b. Noncash transaction c. Investing activity d. Financing activityarrow_forwardservice revenue (all cash) $175 operrating expenses saleries (all cash) $85 Net income $90 2020 2019 current assets cash $1,250 $1,600 short- term investment 100 200 $1,350 $1,800 Liabilities Borrowings 600 1,000 Stockholder's Equity Common Stock 200 300 Retained Earnings 550 500 750 800 $1,350 $1,800 Other information: short-term investments are riskless and will…arrow_forwardFinancial statement analysis 2. Given below are the summarized accounts of Belper Ltd for the past five years. These the basis for the questions which follow. Summarized profit and loss accounts of Belper Ltd Sales Cost of sales Trading profit Depreciation Interest Net profit before tax Taxation Net profit after tax Extraordinary items Dividends Retained profits Retained at start of year Retained at end of year Fixed assets Freehold land and buildings Leasehold land and buildings Plant and machinery Total gross fixed assets Depreciation freehold Depreciation leasehold Depreciation plant, etc. Total depreciation Net fixed assets Intangible fixed assets Goodwill Investments Patents and trade marks Current assets Stock Debtors Bank and cash Current liabilities Creditors Taxation Dividends Bank loans and overdraft 19X4 Net current assets £000 Financed by Ordinary share capital Share premium account Retained profits Revaluation reserves 93,930 81,750 12,180 1,023 2,727 8,430 2,517 5,913…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education