FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

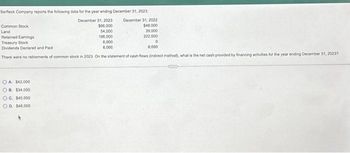

Transcribed Image Text:Serfleck Company reports the following data for the year ending December 31, 2023

December 31, 2023

$90,000

54,000

198,000

Common Stock

Land

Retained Earnings

Treasury Stock

0

Dividends Declared and Paid

6,000

There were no retirements of common stock in 2023. On the statement of cash flows (indirect method), what is the net cash provided by financing activities for the year ending December 31, 20237

OA $42,000

OB. $34,000

OC. $40,000

COD. $48,000

December 31, 2022

$48.000

39,000

222.000

8,000

6,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Net cash flow from operating activities for 2021 for Vaughn Manufacturing was $497000. The following items are reported on the financial statements for 2021: Depreciation and amortization $ 31000 Cash dividends paid on common stock 18400 Increase in accounts receivable 35500 Based only on the information above, Vaughn’s net income for 2021 was:arrow_forwardStatement of cash flows for the following: The comparative balance sheet of Livers Inc. for December 31, 20Y3 and 20Y2, is shown as follows: 1 Dec. 31, 20Y3 Dec. 31, 20Y2 2 Assets 3 Cash $155,000.00 $150,000.00 4 Accounts receivable (net) 450,000.00 400,000.00 5 Inventories 770,000.00 750,000.00 6 Investments 0.00 100,000.00 7 Land 500,000.00 0.00 8 Equipment 1,400,000.00 1,200,000.00 9 Accumulated depreciation-equipment (600,000.00) (500,000.00) 10 Total assets $2,675,000.00 $2,100,000.00 11 Liabilities and Stockholders’ Equity 12 Accounts payable (merchandise creditors) $340,000.00 $300,000.00 13 Accrued expenses payable (operating expenses) 45,000.00 50,000.00 14 Dividends payable 30,000.00 25,000.00 15 Common stock, $4 par 700,000.00 600,000.00 16 Paid-in capital in excess of par—common stock 200,000.00…arrow_forwardDetermining Cash Flows from Financing Activities Nichols Inc. reported the following amounts on its balance sheet at the end of 2019 and 2018 for equity: 12/31/2019 12/31/2018 Common stock $210,000 $135,000 Retained earnings 495,300 412,800 Required: Assume that Nichols did not retire any stock during 2019, it reported $105,610 of net income for 2019, and any dividends declared were paid in cash. Determine the amounts Nichols would report in the financing section of the statement of cash flows. Issuance of common stock $fill in the blank 1 Payment of dividends $fill in the blank 2arrow_forward

- Financing Activities on the Statement of Cash Flows Cosmat Inc. reported net income of $128,000 for 20Y9. The liability and equity accounts from the company’s comparative balance sheet are as follows: Dec. 31, 20Y9 Dec. 31, 20Y8 Accounts payable $57,920 $53,810 Dividends payable 20,000 16,000 Bonds payable 290,000 450,000 Common stock, $10 par value 180,000 120,000 Paid-in capital in excess of par—common stock 328,000 232,000 Retained earnings 488,000 375,000 During the year, the company retired bonds payable at their face amount, declared dividends of $15,000, and issued 6,000 shares of common stock for $26 per share. Prepare the Cash Flows from (used for) Financing Activities section of the statement of cash flows. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Cosmat Inc.Statement of Cash Flows (partial) Cash flows from (used for)…arrow_forwardPrepare the Cash Flow Statement for the year ended 31 December 2022 using info below The information given below was extracted from the accounting records of Excellence Limited Information from the Statement of Financial Position as at 2022 R 2021 R Ordinary share capital 750 000 580 000 Retained earnings 145 000 60 000 Property, plant and equipment (see note) 475 000 410 000 Investments 248 000 220 000 12.5% Debentures 125 000 120 000 Inventory 320 000 260 000 Trade debtors 57 000 67 500 Bank ? Prepaid expenses 15 500 2 500 Trade creditors 60 000 85 000 Bank overdraft 50 000 South African Revenue Services 25 000 40 000 Extract from the Statement of Comprehensive Income for the year ended 31 December 2022 Profit before interest and tax 342 000 Depreciation on equipment 25 000 Dividends received on investment 30 000 Interest on debentures 22 500…arrow_forwardWyoming Company uses the indirect method to prepare its statement of cash flows. Refer to the following portion of the comparative balance sheet Wyoming Company Comparative Balance Sheet December 31, 2024 and 2023 2024 2023 Common Stock Retained Earnings Treasury Stock Total Equity $17,000 114,000 (8,200) $122,800 $12,500 79,000 (5,300) $86,200 Note: 1. There was no retirement of stock during the year. 2. There were sales of treasury stock during the year. 3. Common Stock was issued for cash. Which of the following statements is correct? Increase/(Decrease) $4,500 35,000 (2,900) $36,600 OA. There was a positive cash flow of $4,500 from the issuance of Common Stock. OB. There was zero net cash flow from transactions involving Common Stock. OC. There was a negative cash flow of $4,500 from the issuance of Common Stock. OD. There was positive cash flow of $17,000 from issuance of Common Stock.arrow_forward

- Use the following information to prepare the Operating Activities section of the Statement of Cash Flows WalkRight Inc. For the Year Ended December 31, 2017 $ 1,600,000 Net Income Proceeds from Issuance of Common Stock $ 1,000,000 Increase in inventory Increase in Accounts Payable 400,000 $ 250,000 Purchase of Equipment $ 1,200,000 Payment of Cash Dividend 500,000 750,000 $ Depreciaiton Expense Increase in Accounts Receivable 200,000 Payment of Mortgage 60,000 Reminder: You are being asked to prepare the Operating Activities section only. WalkRight Inc. Statement of Cash Flows For the Year Ended December 31, 2017 Cash flows from operating activitiesarrow_forwardSunland Co. reports the following information: Net cash provided by operating activities Average current liabilities Average long-term liabilities Dividends paid Capital expenditures Purchase of treasury stock Payments of debt Sunland's free cash flow is $192000. $292000. $62000. O $16000. $422000 314000 214000 130000 230000 23000 72000arrow_forwardHarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education