FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

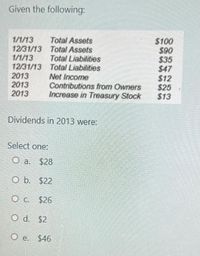

Transcribed Image Text:Given the following:

$100

$90

$35

$47

$12

$25

$13

Total Assets

1/1/13

12/31/13 Total Assets

1/1/13

12/31/13 Total Liabilities

2013

2013

2013

Total Liabilities

Net Income

Contributions from Owners

Increase in Treasury Stock

Dividends in 2013 were:

Select one:

O a. $28

O b. $22

O c. $26

O d. $2

O e. $46

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help mearrow_forwardFollowing are the Balance Sheets of X Ltd. for the year 2014 and 2015. 2014 2015 sin '000 sin '00 L Equity and Liabilities (1) Shareholders' Funds (a) Share Capital : Equity Share Capital 8% Redeemable Preference Share Capital (b) Reserves and Surplus : General Reserve Surplus Account (2) Non-current Liabilities 200 320 150 90 40 70 15 38 Debentures 100 90 (3) Current Liabilities Creditors 55 83 Bills Payable Proposed Dividend (Treating it as non-current liability) Provision for Tax (NCL) 20 16 42 50 40 50 Total Equity and Liabilities 662 807 II. Assets (1) Non-current Assets Fixed Assets: Land & Building Plant & Machinery Intangible Asset : Goodwill 200 80 170 200 80 100 (2) Current Assets Stock Debtors B/R Cash & Bank Balances 59 250 30 18 87 150 20 25 Total Assets 662 807 Additional Information: (1) (1) (I) (IV) An interim dividend of $ 20,000 has been paid in 2015. $ 35,000 income tax was paid during the year 2015. Dividend of $ 28,000 was paid during the year 2015. During the year…arrow_forwardFINANCING ACTIVITIES How much is cash paid for dividends?arrow_forward

- Miscellaneous financial information Amount Retained earnings 786 Total stockholders' equity 14, 971 Operating net working capital 28,483 Net working capital 29,102 Nonoperating current assets other than cash 347 Short-term debt 1, 126 Total current liabilities 13, 613 Total long-term liabilities 107,872 Inventory ? ? Current portion of long-term debt 561 Accounts receivable 2,052 Treasury stock -5,279 What did Madison Makeup report as long-term assets? 93,741 What did Madison Makeup report as cash? 42,368arrow_forward1 Norris Company issued 10,000 shares of Si par common stock for $25 per share during 2010. The company paid dividends of $24,000 and issued long-term notes payable of $220,000 during the year. What amount of cash flows from financing activities will be reported on the statement of cash flows? $6.000 net cash inflow. $226,000 net cash inflow. $470,000 net cash outflow. $446,000 net cash inflow.arrow_forwardPlease do not give solution in image format thankuarrow_forward

- QUESTION I Below are the balances available for Delima Berhad as at 31 December 2015: Statement of Financial Position of Delima Berhad as 31 December 2015 RM 170,000,000 115,000,000 150,000,000 435,000,000 Non-current assets Current assets (except cash at hank) Cash at bank Issued share capital 100,000,000 ordinary shares Retained profits Non-current liability 50,000,000 5% redeemable preference shares Current liabilities Additional information: On 1 January 2016, the directors decided on the following matters 100,000,000 3. To redeem 5% redeemable preference shares at a premium of 10% 240,000,000 55,000,000 20,000,000 435,000,000 1. To issue bonus shares of one (1) ordinary shares for every ten (10) shares held to the existing shareholders. 2. To repurchase 2,000,000 ordinary shares at RM1.50 each for cancellation. (u 4 To issue 30,000,000 ordinary shares at RMI. The application were paid and fully subscribed Required: a) Prepare journal entries to record above transactions b) Prepare…arrow_forwardnet income of $250,000 and paid dividends to common stockholders of $50,000 in 2010. The weighted average number of shares outstanding in 2010 was 50,000 shares. the Corporation's common stock is selling for $30 per share on the New York Stock Exchange. the Corporation's dividends payout ratio for 2010 is a. 25% b. 12.5% c. 20% d. $ 5arrow_forward1. What is the amount of dividend per share that MOONSTONE paid on March 31, 2021? 2. How much is the ordinary share capital, December 31, 2021? 3. How much will is the total cash dividends paid during the year 2021? 4. Number of fractional warrants outstanding as of December 31, 2021 5. How much is the retained earnings appropriated for contingency loss?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education