FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

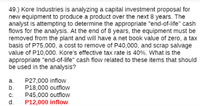

Transcribed Image Text:49.) Kore Industries is analyzing a capital investment proposal for

new equipment to produce a product over the next 8 years. The

analyst is attempting to determine the appropriate "end-of-life" cash

flows for the analysis. At the end of 8 years, the equipment must be

removed from the plant and will have a net book value of zero, a tax

basis of P75,000, a cost to remove of P40,000, and scrap salvage

value of P10,000. Kore's effective tax rate is 40%. What is the

appropriate "end-of-life" cash flow related to these items that should

be used in the analysis?

P27,000 inflow

P18,000 outflow

P45,000 outflow

P12,000 inflow

а.

b.

C.

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An elective project is currently under review. It requires an initial investment of $116,000 for equipment. The profit is expected to be $28,000 each year, over the 6-year project period. The salvage value of the equipment at the end of the project period is projected to be $22,000. Assume a MARR of 10%. Find an IRR for this project.arrow_forwardYour company is considering a project which will require the purchase of $715,000 in new equipment. The company expects to sell the equipment at the end of the project for 25% of its original cost, but some assets will remain in the CCA class. Annual sales from this project are estimated at $256,000. Initial net working capital equal to 32.00% of sales will be required. All of the net working capital will be recovered at the end of the project. The firm requires a 10.00% return on similar investments. The tax rate is 35%, and the project life is 5 years. There are no other operating expenses. If the equipment is in a 33.00% CCA class, what is the present value of the CCA tax shield? Options $153,510 $157,348 $161,186 $165,024 $168,861arrow_forwardNational Integrated Systems (NIS), a global provider of heating and air conditioning is planning a project whose data is provided below. The project’s equipment has a 3 year tax life after which its salvage value will be zero. The machinery will be depreciated on a straight line basis over three years. Revenues and other operating costs are expected to be constant over the project’s life. What is the project’s cash flow in Year 1? Equipment Cost = $130,000Depreciation rate = 33.33%Annual Sales Revenue= $120,000Operating Costs (ex Depreciation) = $50,000 Tax Rate = 35%arrow_forward

- We assume that the company that you selected is considering a new project. The project has 8 years' life. This project requires an initial investment of $580 million to purchase equipment, and $30 million for shipping & installation fees. The fixed assets fall in the 7-year MACRS class. The salvage value of the fixed assets is 10% of the purchase price (including the shipping & installation fee). The number of units of the new product expected to be sold in the first year is 2,660,000 and the expected annual growth rate is 10.5%. The sales price is $280 per unit and the variable cost is $225 per unit in the first year, but they should be adjusted accordingly based on the estimated annualized inflation rate of 3.0%. The required net operating working capital (NOWC) is 11.8% of sales with the corporate tax rate of 21%. The project is assumed to have the same risk as the corporation, so 5.35% is the discount rate for this hypothetical project. Estimate annual cash flows for the 8 years.…arrow_forwardGiant Machinery Ltd is considering to invest in one of the two following Projects to buy a new equipment. Each project will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 9%. The cash flows of the projects are provided below. Project 1Cost $175,000 Project 2 Cost $185,000 Future Cash Flows For Project 1 Year 1 Year 2 Year 3 Year 4 Year 5 is 76,000 83,000 67,000 65,000 55,000 respectively. For Project 2 it is 87,000 78,000 69,000 65,000 57,000 for Year 1 Year 2 Year 3 Year 4 Year 5 resp. Required: a) Identify which project should the company accept based on NPV method. (Note: Please round up the result of each calculation of PV to 2 decimal places only for simplification) b) Identify which project should the company accept based on simple pay back method if the payback criteria is maximum 2 years. c) Which project Giant Machinery should choose if two methods are in conflictarrow_forwardBlossom Company is considering buying a new farm that it plans to operate for 10 years. The farm will require an initial investment of $11.95 million. This investment will consist of $2.60 million for land and $9.35 million for trucks and other equipment. The land, all trucks, and all other equipment are expected to be sold at the end of 10 years for a price of $5.20 million, which is $2.25 million above book value. The farm is expected to produce revenue of $2.05 million each year, and annual cash flow from operations equals $1.95 million. The marginal tax rate is 25 percent, and the appropriate discount rate is 9 percent. Calculate the NPV of this investment. (Do not round factor values. Round final answer to 2 decimal places, e.g. 5,275.25.) NPV $ The project should b accepted rejectedarrow_forward

- Moose Pastures Inc. is considering a seven-year project to improve its production efficiency. Buying a new assembly machine for $708, 000 is estimated to result in $213,000 in annual pre-tax cash flows. The machine has a CCA rate of 30% per year, and it will have a salvage value of $70,000 at the end of the project. The machine also requires an initial investment in inventory of $20, 000 (in year zero), which will be recovered at the end of the project (in year 7). If the tax rate is 40% and the discount rate is 10%, what is the NPV of the machine purchase? (Assume the CCA pool remains open and that there are no capital gains/losses.) Correct answer is $132, 337. (My question) Hi I am confused on how it got 132, 337. I know there's a formula but can you walk me through the steps to get this correct answer?arrow_forwardCrane Company is considering buying a new farm that it plans to operate for 10 years. The farm will require an initial investment of $12.10 million. This investment will consist of $2.65 million for land and $9.45 million for trucks and other equipment. The land, all trucks, and all other equipment are expected to be sold at the end of 10 years for a price of $5.15 million, which is $2.20 million above book value. The farm is expected to produce revenue of $2.10 million each year, and annual cash flow from operations equals $2.00 million. The marginal tax rate is 25 percent, and the appropriate discount rate is 9 percent. Calculate the NPV of this investment. (Do not round factor values. Round final answer to 2 decimal places, e.g. 5,275.25.) NPV LAarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education