Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

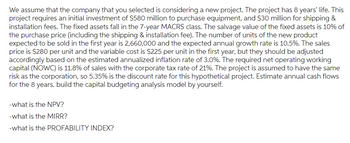

Transcribed Image Text:We assume that the company that you selected is considering a new project. The project has 8 years' life. This

project requires an initial investment of $580 million to purchase equipment, and $30 million for shipping &

installation fees. The fixed assets fall in the 7-year MACRS class. The salvage value of the fixed assets is 10% of

the purchase price (including the shipping & installation fee). The number of units of the new product

expected to be sold in the first year is 2,660,000 and the expected annual growth rate is 10.5%. The sales

price is $280 per unit and the variable cost is $225 per unit in the first year, but they should be adjusted

accordingly based on the estimated annualized inflation rate of 3.0%. The required net operating working

capital (NOWC) is 11.8% of sales with the corporate tax rate of 21%. The project is assumed to have the same

risk as the corporation, so 5.35% is the discount rate for this hypothetical project. Estimate annual cash flows

for the 8 years. build the capital budgeting analysis model by yourself.

-what is the NPV?

-what is the MIRR?

-what is the PROFABILITY INDEX?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Motion Metrics is considering a four-year project to improve its production efficiency. Buying a new production equipment for $414,000 is estimated to result in $154,000 in annual pre-tax cost savings. The equipment falls into Class 8 for CCA purposes (CCA rate of 20% per year), and it will have a salvage value at the end of the project of $55,400. The project also requires an initial investment in spare parts inventory of $24,000, along with an additional $3,500 in inventory for each succeeding year of the project. If the firm's tax rate is 35% and its discount rate is 9%. Calculate the NPV of this project. (Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) O NPVarrow_forwardYou are evaluating a product for your company. You estimate the sales price of product to be $150 per unit and sales volume to be 10,500 units in year 1; 25,500 units in year 2; and 5,500 units in year 3. The project has a 3 year life. Variable costs amount to $75 per unit and fixed costs are $205,000 per year. The project requires an initial investment of $339,000 in assets which will be depreciated straight-line to zero over the 3 year project life. The actual market value of these assets at the end of year 3 is expected to be $45,000. NWC requirements at the beginning of each year will be approximately 15% of the projected sales during the coming year. The tax rate is 21% and the required return on the project is 12%. What will the year 2 free cash flow for this project be?arrow_forwardGemstones Inc. is considering a new production line. The expected economic life of the project is 6 years. The project will generate sales and incur costs annually. Variable cost is 52% of sales. Total annual fixed costs, excluding depreciation, are $353,000. The initial outlay of the project is $1,010,000 and will be depreciated on a straight-line basis to zero at the end of the project. The company's tax rate is 30% and the discount rate is 10.00%. Calculate the NPV break-even level of sales. (Assume that the half-year rule does not apply.) a. $1,425,606 b. $2,241,776 c. $1,575,903 d. $1,275,308 e. $3,103,472arrow_forward

- Reyarrow_forwardEsquire Company needs to acquire a molding machine to be used in its manufacturing process. Two types of machines that would be appropriate are presently on the market. The company has determined the following: Machine A could be purchased for $11,000. It will last 10 years with annual maintenance costs of $400 per year. After 10 years the machine can be sold for $1,155. Machine B could be purchased for $10,000. It also will last 10 years and will require maintenance costs of $1,600 in year three, $2,000 in year six, and $2,400 in year eight. After 10 years, the machine will have no salvage value. Required: Assume an interest rate of 8% properly reflects the time value of money in this situation and that maintenance costs are paid at the end of each year. Ignore income tax considerations. Calculate the present value of Machine A & Machine B. Which machine Esquire should purchasearrow_forwardA "standard" model of a dozer costs $20,000 and has an annual operating expense of $450. The dozer will be replaced in 6 years when the salvage value is expected to be $2,000. A "super" model can be purchased for $25,000, but will have a salvage value of $7,000 when retired in 6 years. Its operating expenses are also $450 a year. The purchaser's other investment opportunities are 5%. Compare these alternatives by using the annual equivalent method.arrow_forward

- Cardinal Company is considering a project that would require a $2,815.000 investment in equipment with a useful life of five years. At the end of five years, the project would terminate and the equipment would be sold for its salvage value of $400,000. The company's discount rate is 16%. The project would provide net operating income each year as follows: $2,863,000 1,014,000 1,849,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses $781,000 483,000 1,264,000 Net operating income 585,000 Click here to view Exhibit 10-1 and Exhibit 10-2, to determine the appropriate discount factor(s) using tables. Required: What is the present value of the project's annual net cash inflows? (Round discount factor(s) to 3 decimal places and final answer to the nearest dollar amount.) Present valuearrow_forwardA firm can purchase a centrifugal separator (5-year MACRS property) for $22,000. The estimated salvage value is $4,000 after a useful life of six years. Operating and maintenance (O&M) costs for the first year are expected to be $2,200. These O&M costs are projected to increase by $1,000 per year each year thereafter. The income tax rate is 24% and the MARR is 11% after taxes. What must the uniform annual benefits be for the purchase of the centrifugal separator to be economical on an after-tax basis? CAN YOU DO THIS PROBLEM BY HAND? AND NOT USING EXCEL I WOULD REALLY APPRECIATE IT!!!!arrow_forwardJDAR Enterprises needs someone to supply it with 156000 cartons of machine screws per year to support its manufacturing needs over the next 4years, and you've decided to bid on the contract. It will cost you $1750000 to install the equipment necessary to start production; you'll depreciate this cost straight-line to zero over the project's life. You estimate that in five years this equipment can be salvaged for $220000. Your fixed production costs will be $281,000 per year, and your variable production costs should be $9 per carton. You also need an initial investment in net working capital of $146,000. If your tax rate is 0.32 percent and you require a return of 0.16 percent on your investment, what bid price per carton should you submit What is the initial investment 1896000 what is the terminal value? (hint, discounted) 163257.76 what is the discounted cash flow 4564795.86 what is the bid price 4.73 Finish review Aarrow_forward

- Bridgeport Industries is considering the purchase of new equipment costing $1,280,000 to replace existing equipment that will be sold for $194,000. The new equipment is expected to have a $220,000 salvage value at the end of its 5-year life. During the period of its use, the equipment will allow the company to produce and sell an additional 32,800 units annually at a sales price of $29 per unit. Those units will have a variable cost of $15 per unit. The company will also incur an additional $86,000 in annual fixed costs. Identify the amount and timing of all cash flows related to the acquisition of the new equipment. (Enter negative amounts using a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Cash Flow Timing Amount Purchase of new equipment $4 Salvage of old equipment Sales revenue Variable costs Additional fixed costs Salvage of new equipment >arrow_forwardA company is considering the purchase of new testing equipment that is expected to produce 8000 profit during the first year of operation. The amount will decrease by 500 per year for each additional year of ownership. The equipment cost 20000 and will have a salvage value of 3000 after 8 years of use. The minimum attractive rate of return is 18%. You are required to adivice the company whether they will go ahead with the purchasearrow_forwardA commercial 3D printer is purchased for $350,000. The salvage value of the printer decreases by 30% each year that it is held. The cost to operate and maintain the machine the first year it is used is $14,000; these costs increase by $5,000 each year. What is the optimal replacement interval and minimum EUAC for the printer, assuming a MARR of 13% is used? Click here to access the TVM Factor Table Calculator. years ORI: EUAC*: $ Carry all interim calculations to 5 decimal places and then round your final answers to a whole number. The tolerance is ±5 for the EUAC*.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education