ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

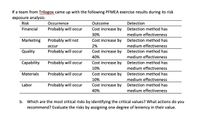

Transcribed Image Text:If a team from Trilogox came up with the following PFMEA exercise results during its risk

exposure analysis:

Risk

Occurrence

Probably will occur

Outcome

Detection

Financial

Cost increase by Detection method has

30%

medium effectiveness

Marketing

Probably will not

Cost increase by Detection method has

medium effectiveness

Cost increase by Detection method has

medium effectiveness

Cost increase by Detection method has

2%

occur

Quality

Probably will occur

40%

Capability

Probably will occur

10%

medium effectiveness

Materials

Probably will occur

Cost increase by Detection method has

medium effectiveness

Cost increase by Detection method has

10%

Labor

Probably will occur

40%

medium effectiveness

b. Which are the most critical risks by identifying the critical values? What actions do you

recommend? Evaluate the risks by assigning one degree of leniency in their value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- pls help asap on botharrow_forward(ii) Jack, initially, has a wealth (W) equal to 2000 and will lose 1200 if his investment in a risky bond is unsuccessful and will gain 1200 if it is successful. The probability that the investment is successful is 0.75 and his utility function is given by U(W) = W^0.5. (a) Is this bond a fair bond? (b) What is Jack;s expected utility? (c) Suppose, there is a secured non-risky. gold bond. How much return should this gold bond offer, so that Jack chooses the gold bond instead of the risky bond.arrow_forwardfind the TP and AP unit TP AP MP 1 20 20 0 2 32 16 12 3 54 18 22 4 26arrow_forward

- Assume you are faced with two decision alternatives and two states of nature whose profit payoff table is shown below. Decision Alternative State of Nature 1 State of Nature 2 Decision 1 25 30 Decision 2 45 15 The probability of state of nature 1 is 0.4.(a) Compute the expected value of each alternative.(b) Which decision is the optimal decision?(c) Compute the expected value with perfect information.(d) Compute the expected value of perfect information.arrow_forwardPLABOR МIC $7.00 -S $5.25 $4.50 MVP QLABOR 1000 1500arrow_forward11arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education