ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Solve (c) and (d) please

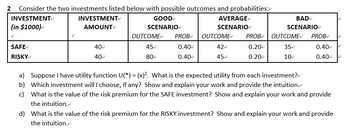

Transcribed Image Text:2 Consider the two investments listed below with possible outcomes and probabilities:

INVESTMENT

(in $1000)

SAFE

RISKY

INVESTMENT

AMOUNTⓇ

40+

40+

GOOD

SCENARIO

OUTCOME

45+

80+

AVERAGE+

SCENARIO

PROB OUTCOME

0.40*

0.40€

42+

45+

BAD+

SCENARIO

PROB OUTCOME PROB

0.20

35+

0.20

10+

0.40€

0.40+

b)

a) Suppose I have utility function U(*) = (x)2. What is the expected utility from each investment?

Which investment will I choose, if any? Show and explain your work and provide the intuition.

c) What is the value of the risk premium for the SAFE investment? Show and explain your work and provide

the intuition.

d) What is the value of the risk premium for the RISKY investment? Show and explain your work and provide

the intuition.<

+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- For the net cash flow and cumulative cash flows shown, the value of x is nearest: (a) $−8,000 (b) $−16,000 (c) $16,000 (d) $41,000 Year 1 2 3 4 5 Net Cash Flow, $ +13,000 −29,000 −25,000 50,000 x CCF, $ +13,000 −16,000 −41,000 +9000 +1000arrow_forwardAt what annual interest rate will $1,200 invested today be worth $2.500 in 12 years'?(a) 6.5%(b) 7.2%(c) 9.02%(d) 5.8%arrow_forwardYour friend withdrew $630,315 from an account into which she had invested $350,000. If the account paid interest at 4% per year, she kept her money in the account for how many years? (a) 1.8 years (b) 6.5 years (c) 12.5 years (d) 15 yearsarrow_forward

- Could you also answer part (d) (e) (f). Greatly Appreciated!arrow_forwardHow much will Sonja have in a savings account 12 years from now if she deposits $3000 now and $5000 four years from now? The account earns interest at a rate of 10% per year. (a) $10,720 (b) $9,415 (c) $20,133 (d) $15,630 (e) Greater than $22,000arrow_forwardAn investment project costs $100,000. ll is expected to have an annual net cash flow of $40,000 for 5 years. What is the project's payback period?(a) 2.5 years(b) 3.5 year(c) 4.5 years(d) 5 yearsarrow_forward

- If $1000 is invested annually at 6% continuous compounding for each of 10 years, how much is in the account after the last deposit? (a) $1822 (b) S10,000 (c) $13,181 (d) $13,295arrow_forwardIf you borrow $1000 from the bank at 5% simple interest per month due back in 2 years, what is the size of your monthly payments? (a) $25 (b) $50 (c) $500 (d) $1200arrow_forwardPlease use the formulae and make the solution Project Month Month Month Month Status at the end of Month 3 Phases 1 2 3 4 Requirements Definition S-F Complete, spent $10,000 Architecture and Design SPF F Complete, spent $12000 Development and unit testing System testing and Operation S -PF 50% done, spent $9000 Not yet startedarrow_forward

- Municipal Engineer wants to evaluate three alternatives for supplementing the water supply. 1st alternative – continue deep well pumping at an annual cost of $10,500 2nd alternative – install a 10” pipeline from a surface reservoir. First cost is $25,000 and annual pumping cost is $7,000 3rd alternative – install a 20” pipeline from the reservoir. First cost of $34,000 and annual pumping cost of $5,000. Life of all alternatives is 20 years. For the second and third alternatives, salvage value is 10% of first cost. With interest at 8%, which alternative should the engineer recommend? Use present worth analysis PW (deepwell) = ? PW (10”pipeline) = ? PW (20”pipeline) = ?arrow_forwardA new corporate bond with a coupon rate of 8% was initially sold by a stockbroker to an investor for $1000. The issuing corporation promised to pay the bondholder $40 interest on the $1000 face value of the bond every 6 months, and to repay the $1000 at the end of 10 years. After one year the bond was sold by the original buyer for $950. (a) What rate of return did the original buyer receive on his investment? (b) What rate of return can the new buyer (paying $950) expect to receive if he keeps the bond for its remaining 9-year life?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education