FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

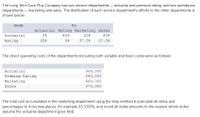

Transcribed Image Text:The Long Term Care Plus Company has two service departments – actuarial and premium rating, and two operations

departments – marketing and sales. The distribution of each service department's efforts to the other departments is

shown below:

FROM

то

Actuarial Rating Marketing Sales

0$

Actuarial

40%

20%

40%

Rating

25%

0융

37.5%

37.5%

The direct operating costs of the departments (including both variable and fixed costs) were as follows:

Actuarial

$60,000

Premium Rating

$40,000

Marketing

$60,000

Sales

$70,000

The total cost accumulated in the marketing department using the step method is (calculate all ratios and

percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar;

assume the actuarial department goes first):

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- H24 A B 1 Paulson Paint, Inc 234567 2 Sales Volume Projection 8 9 10 11 12 13 17 18 19 20 21 22 23 24 25 Sales in Gallons 36 37 38 39 Year Ready 2014 2015 2016 2017 2018 Year 2014 2015 2016 2017 2018 Totals 14 Magnificent Pa tVolume Projection Using Exponential Smoothing 15 16 fx с iT Magnificent 424,000 425,000 413,000 453,000 440,000 2016 2017 2018 424,000 425,000 413,000 453,000 440,000 D Known x's Known y's Year 26 27 Marvelous Paint Volume Projection Using Growth Function 28 29 30 31 32 33 34 35 Actual Sales in Gallons Weight Sales New x Stupendous Year General Information E Marvelous None None 226,560 259,600 295,700 226,560 259,600 295,700 Projection of Marvelous 2019 Sales Volume 2019 Weighted F Sales Volume Projection for 2019 Sales Projection G Sales Budget H 1 Productionarrow_forwardV - MN * 00 因 今4 3. 01 n Chapters 8-10 Saved Help Save & Exit Subm Banc Corp. Trust is considering either a bankwide overhead rate or department overhead rates to allocate $420,000 of indirect costs. The bankwide rate could be based on either direct labor hours (DLH) or the number of loans processed. The departmental rates would be based on direct labor hours for Consumer Loans and a dual rate based on direct labor hours and the number of loans processed for Commercial Loans. The following information was gathered for the upcoming period: Department DLH Loans Processed Direct Costs Consumer 000'0 $280,000 12,000 850 Commercial 0000 000 If Banc Corp. Trust uses a bankwide rate based on the number of loans processed, what would be the total costs for the Commercial Department? Multiple Choice 000'0 Graw < Prev 13 of 25 10:19 PM Type here to search (Gpツ 4/15/2021 近 同回 F10 PrtSc +D -E3 Delete F7 F8 F11 F12 Ins 反 6- & 23 3. Backspac 7. 6 5. [C A G H. B N Alt Ctrl Alt Homearrow_forwardQUESTION 2 S = 48 X = 50 C=$4 P = $3 A straddle requires purchasing one call and one put on the same asset with the same strike price. For this data the payoff for a straddle is a. $2 O b.-$1 Oc. $0 O d.-$7 O e. -$5arrow_forward

- Q1 Please provide justified answer asaparrow_forwardQS 18-15 (Static) Interpreting a CVP chart LO P2 Solve for each of the items below. Dollars $25,000 $20,000 $15,000 $10,000 $5,000 $0 (b) 0 200 400 600 (c) (d). 1. Units produced at break-even point 2. Dollar sales at break-even point 3. Capacity in units 4. Are fixed costs greater than $10,000? 5. If 1,400 units are produced and sold, is there a profit or a loss? (a) (e) 800 1,000 1,200 1,400 1,600 1,800 2,000 2,200 2,400 Units produced and soldarrow_forwardQUESTION 6 You have information about 4 different companies below in the table. The variable and fixed costs are expressed as the percentage of revenue based on the current sales. The companies are otherwise very similar. Which of these companies is probably have the highest degree of operating leverage? A B с D Variable cost (%) 35% 27% 50% 80% 50% 60% 30% 5% Fixed cost O Project A O Project D O Project C O Project Barrow_forward

- -/1 Question 1 rences View Policies borations Current Attempt in Progress PLUS Support Jackson Manufacturing is introducing a new product with a unit selling price of $12.50. The product required an investment of $500,000, and the company requires a 20 % ROI. Projected sales 100,000 units. Compute the target cost per unit. Central e 365 es O $14.50 a O $15.50 O $11.50 O $10 hp noll ins prt sc home delete 4 num backspacearrow_forwardNonearrow_forwardExercise 18 -8 (Static) Computing missing amounts in contribution margin income statements LO A1 Compute the missing amounts in the contribution income statement shown below: (Round "Per Unit" answers to 2 decimal places.) \table[[Number of units sold, Company A, Company B], [,,,, 1,975, ], [,, otal,,unit, Total, Per unit], [Sales, $, 208, 000, $, 65.00,, ], [Variable costs,, 150, 400,,, 39, 500, ], [Contribution margin,,,,, 43, 450, ], [Fixed costs,,,,,19, 750, ], [ Income, $, 46, 400,,,,]]arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education