FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

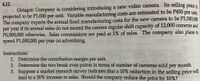

Transcribed Image Text:4.12 ugnso eniraer

ah ho Octagon Company is considering introducing a new video camera. Its selling price is

projected to be P1,000 per unit. Variable manufacturing costs are estimated to be P450 per unit

The company expects the annual fixed manufacturing costs for the new camera to be P3,500.00

per year if its annual sales do not exceed the current regular shift capacity of 12,000 cameras and

P6,000,000 otherwise. Sales commissions are paid at 5% of sales. The company also plans to

spend P1,000,000 per year on advertising.

exod 000,08

aleo

Instructions:

000,81

1. Determine the contribution margin per unit.

2. Determine the two break even points in terms of number of cameras sold month.

3. Suppose a market research survey indicates that a 10% reduction in the selling price wil

lead to a 20% increase in sales. Should the company reduce the price by 10%?

per

Fobcoru coer bet pox

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hit or Miss Sports is introducing a new product this year. If its see-at-night soccer balls are a hit, the firm expects to be able to sell 42,700 units a year at a price of $64 each. If the new product is a bust, only 22,200 units can be sold at a price of $41. The variable cost of each ball is $27 and fixed costs are zero. The cost of the manufacturing equipment is $5.92 million, and the project life is estimated at 9 years. The firm will use straight-line depreciation over the 9-year life of the project. The firm's tax rate is 35% and the discount rate is 13%. Now suppose that Hit or Miss Sports can expand production if the project is successful. By paying its workers overtime, it can increase production by 20,100 units; the variable cost of each ball will be higher, equal to $32 per unit. By how much does this option to expand production increase the NPV of the project? Assume that the firm decides whether to expand production after it learns the first-year sales results. (Round…arrow_forwardA maker of mechanical systems can reduce product recalls by 25% if it purchases new packaging equipment. The cost of the new equipment is expected to be $40,000 four years from now. How much could the company afford to spend now, instead of 4 years from now, if it uses a minimum attractive rate of return of 12% per year?arrow_forwardquick computing currently sells 7 million computer chips each year at a price of $12 per chip. It is about to introduce a new chip, and it forecasts annual sales of 22 million of these improved chips at a price of $15 each. However, demand for the old chip will decrease, and sales of the old chip are expected to fall to 1 million per year. The old chips cost $6 each to manufacture, and the new ones will cost $10 each. What is the proper cash flow to use to evaluate the present value of the introduction of the new chip?arrow_forward

- Given the soaring price of gasoline, Ford is considering introducing a new production line of gas-electric hybrid sedans. The expected annual unit sales of the hybrid cars is 26,000; the price is $21,000 per car. Variable costs of production are $11,000 per car. The fixed overhead including salary of top executives is $80 million per year. However, the introduction of the hybrid sedan will decrease Ford's sales of regular sedans b 9,000 cars per year; the regular sedans have a unit price of $20,000, a unit variable cost of $12,000, and fixed costs of $250,000 per year. Depreciation costs of the production plant are $49,000 per year. The marginal tax rate is 40 percent. What is the incremental annual cash flow from operations? Incremental annual cash flow from operations eTextbook and Media $arrow_forward•StarQuest plans to introduce a new entertainment package and estimates immediate sales of $300 million. However, due to production conflicts, the product launch may be delayed two years, allowing competition to reduce sales by 10 percent. Using a 6 percent opportunity cost, determine the cost of the delay. answer is 59.7010arrow_forward2. Company XYZ sells CDs. The price of its new CD is $15. Fixed costs are $1,500,000 per year. Variable costs are $9. The company expects to sell 300,000 units this year. a. How many DVDS will the company need to sell to break even? b. If the forecasts are correct, how much will company XYZ make or lose this year (before taxes)?arrow_forward

- Assume the company expects to sell 5 million packages ofPop-Tarts Gone Nutty! in the first year after introductionglobally, but expects that 80 per cent of those sales willcome from buyers who would normally purchase existingPop-Tart flavours (that is, they will be cannibalised sales).Assuming the sales of regular Pop-Tarts are normally 300million packs per year and that the company will incur anincrease in fixed costs of €500,000 during the first year tolaunch Gone Nutty!, will the new product be profitable for the company? Refer to the discussion of cannibalisa-tion in Appendix 2: Marketing by the Numbers for an ex-planation regarding how to conduct the analysisarrow_forward(b) The cost of materials is expected to rise by 20%, while total fixed costs are expected to rise by RM13,000 per year:Calculate the number of units that must be sold for the company's net profit to be maintained. Assume that the rest of the data is unchanged. Determine a new break-even point and margin of safety in bottles if the selling price change to RM 6 per packet. Assume that all other variables remain constant. please provide calculations for each of them.arrow_forwardJames operates a business supplying treadmill. During the month of August, the following transactions took place: 2 Additional capital of $40,000 cash inject by the owner into the business. August 4 Cash deposited into the bank amounting $20,000 6 Bought office equipment for $16,400 cash. 8 Bought furniture and fitting from Elsa Corp. on credit $9,400. 12 Sales of treadmill and received cash amounted to $3,000. 24 Withdraw $1,600 of the cash for personal use. 26 Paid Elsa Corp. $3,000 by cheque. Required: (i) Record the above transactions in the general journal. (ii) Post the journal entries to the relevant accounts in the general ledger and balance of all the accounts.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education