Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

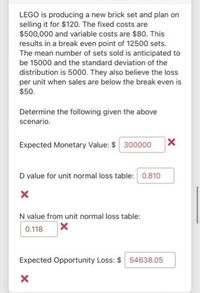

Transcribed Image Text:LEGO is producing a new brick set and plan on

selling it for $120. The fixed costs are

$500,000 and variable costs are $80. This

results in a break even point of 12500 sets.

The mean number of sets sold is anticipated to

be 15000 and the standard deviation of the

distribution is 5000. They also believe the loss

per unit when sales are below the break even is

$50.

Determine the following given the above

scenario.

Expected Monetary Value: $ 300000

D value for unit normal loss table: 0.810

N value from unit normal loss table:

0.118

Expected Opportunity Loss: $ 54638.05

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice. You estimate the sales price of The Farstroke to be $490 per unit and sales volume to be 1,200 units in year 1; 1,125 units in year 2; and 1,000 units In year 3. The project has a 3-year life. Variable costs amount to $270 per unit and fixed costs are $100,000 per year. The project requires an initial Investment of $138,000 in assets, which can be depreciated using bonus depreciation. The actual market value of these assets at the end of year 3 is expected to be $26,000. NWC requirements at the beginning of each year will be approximately 30 percent of the projected sales during the coming year. The tax rate is 21 percent and the required return on the project is 11 percent. What change in NWC occurs at the end of year 1? (Enter a decrease as a negative amount using a minus sign.) Decrease ofarrow_forwardThe technique for calculating a bid price can be extended to many other types of problems. Answer the following questions using the same technique as setting a bid price; that is, set the project NPV to zero and solve for the variable in question. Martin Enterprises needs someone to supply it with 155,000 cartons of machine screws per year to support its manufacturing needs over the next five years, and you've decided to bid on the contract. It will cost $1,950,000 to install the equipment necessary to start production; you'll depreciate this cost straight-line to zero over the project's life. You estimate that, in five years, this equipment can be salvaged for $165,000. Your fixed production costs will be $280,000 per year, and your variable production costs should be $10.90 per carton. You also need an initial investment in net working capital of $145,000. The tax rate is 25 percent and you require a return of 14 percent on your investment. Assume that the price per carton is $17.50.…arrow_forwardwallace inc is considering spending $100,000 for a new grinding machine. this amount could be invested to yield a 12% return. what is the opportunity cost?arrow_forward

- BRAC is considering investing $100000 in a new machine with an expected life of 5 years. The machine will have no scrap value at the end of the 5 years. It is expected that 20000 units will be sold each year at a selling prices of $6.00 per unit. Variable production costs are expected to $2.30 per unit, while incremental fixed costs, mainly the wages of a maintenance engineer, are expected to be $10000 per years. BRAC uses a discount rate of 11% for investment appraisal purposes and expects investment projects to recover their initial investment within two years. Required: (1) Explain why risk and uncertainty should be considered in the investment appraisal process. (2) Calculate and comment on the payback period of the project. (3) Evaluate the sensitivity of the projects net present value to a change in the following project variables: sales volume sales price variable cost and discuss the…arrow_forwardHit or Miss Sports is introducing a new product this year. If its see-at-night soccer balls are a hit, the firm expects to be able to sell 42,700 units a year at a price of $64 each. If the new product is a bust, only 22,200 units can be sold at a price of $41. The variable cost of each ball is $27 and fixed costs are zero. The cost of the manufacturing equipment is $5.92 million, and the project life is estimated at 9 years. The firm will use straight-line depreciation over the 9-year life of the project. The firm's tax rate is 35% and the discount rate is 13%. Now suppose that Hit or Miss Sports can expand production if the project is successful. By paying its workers overtime, it can increase production by 20,100 units; the variable cost of each ball will be higher, equal to $32 per unit. By how much does this option to expand production increase the NPV of the project? Assume that the firm decides whether to expand production after it learns the first-year sales results. (Round…arrow_forwardWebmasters.com has developed a powerful new server that would be used for corporations’ Internet activities. It would cost $10 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year in an amount equal to 10% of the year’s projected sales; for example, NWC0 10% Sales1. The servers would sell for $24,000 per unit, and Webmasters believes that variable costs would amount to $17,500 per unit. After Year 1, the sales price and variable costs will increase at the inflation rate of 3%. The company’s non-variable costs would be $1 million in Year 1 and would increase with inflation. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the project’s returns are expected to be highly correlated with returns on the firm’s other assets. The firm believes it could sell 1,000 units per year. The equipment would be depreciated…arrow_forward

- A new electronic process monitor costs $990,000. This cost could be depreciated at 30% per year (Class 10). The monitor would actually be worth $100,000 in five years. The new monitor would save $460,000 per year before taxes and operating costs. The new monitor requires us to increase net working capital by $47,200 when we buy it. Assume a tax rate of 40% and a 15% return. a. Suppose the monitor was assigned a 25% CCA rate. Calculate the new NPV. (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) ***NOTE*** Hello, I found an answer key saying the answer is $180,108.50. Hopefully this helps for reference when solving for it. Thanks:)arrow_forwardA new project will allow you to sell a new product at $61 each. Variable costs are $24 each and fixed costs would run $75,000 per year. If there is no initial investment required, how many units would you have to sell annually to break-even (aka the "accounting break-even quantity")? (Round up to the next whole number of units.) O a. 1800 O b. 2147 O c. 2287 O d. 1778 Oe. 2028arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education