Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

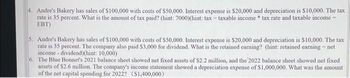

Transcribed Image Text:4. Andre's Bakery has sales of $100,000 with costs of $50,000. Interest expense is $20,000 and depreciation is $10,000. The tax

rate is 35 percent. What is the amount of tax paid? (hint: 7000)(hint: tax = taxable income tax rate and taxable income =

EBT)

5. Andre's Bakery has sales of $100,000 with costs of $50,000. Interest expense is $20,000 and depreciation is $10,000. The tax

rate is 35 percent. The company also paid $3,000 for dividend. What is the retained earning? (hint: retained earning - net

income-dividend)(hint: 10,000)

6. The Blue Bonnet's 2021 balance sheet showed net fixed assets of $2.2 million, and the 2022 balance sheet showed net fixed

assets of $2.6 million. The company's income statement showed a depreciation expense of $1,000,000. What was the amount

of the net capital spending for 2022? ($1,400,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Andre's Bakery has sales of $687,000 with costs of $492,000. Interest expense is $26,000 and depreciation is $42,000. The tax rate is 21 percent. What is the net income? 1b. Washington, Inc. has sales of $45,000, costs of $25,400, depreciation expense of $1,900, and interest expense of $1,600. If the tax rate is 21%, what is the operating cash, or OCF?arrow_forwardAndre's Bakery has sales of $613,000 with costs of $479,000. Interest expense is $26,000 and depreciation is $42,000. The tax rate is 25 percent. What is the net income?arrow_forwardWebster world has sales of $13,800, costs of $5800, depreciation expense of $1100, and interest expense of $700. What is the OCF if the tax rate is 23 percent?arrow_forward

- 1. LaLa Land has sales of $687,000 with total other costs of $492,000. Interest expense is $26,000 and depreciation is $42,000. The tax rate is 35 percent. What is the net income?arrow_forwardThe Good Life Store has sales of $79,600. The cost of goods sold is $48,200 and the other costs are $18,700. Depreciation is $8,300 and is NOT included in other costs. The tax rate is 35 percent. What is the net income?arrow_forwardHelparrow_forward

- Need helparrow_forwardSales = $1000 and costs = $500. Interest expense = $100 and depreciation = $100. The tax rate is 30%. Net income? A. $210B. $300C. $90D. $270arrow_forwardGorilla Movers has sales of S645,560, cost of gods sold of SsA25,890, depreciation of $32,450, and interest expense of S12,500. The tax rate is 30 percent. What is the times interest earmed ratio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning