FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

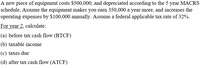

Transcribed Image Text:A new piece of equipment costs $500,000, and depreciated according to the 5 year MACRS

schedule. Assume the equipment makes you earn 350,000 a year more, and increases the

operating expenses by $100,000 annually. Assume a federal applicable tax rate of 32%.

For year 2, calculate:

(a) before tax cash flow (BTCF)

(b) taxable income

(c) taxes due

(d) after tax cash flow (ATCF)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Firm E must choose between two business opportunities. Opportunity 1 will generate an $11,840 deductible loss in year 0, $7,400 taxable income in year 1, and $29,600 taxable income in year 2. Opportunity 2 will generate $8,400 taxable income in year 0 and $7,400 taxable income in years 1 and 2. The income and loss reflect before-tax cash inflow and outflow. Firm E uses a 5 percent discount rate and has a 40 percent marginal tax rate over the three-year period. Use Appendix A and Appendix B. Required: a1. Complete the tables below to calculate NPV. a2. Which opportunity should Firm E choose? b1. Complete the tables below to calculate NPV. Assume Firm E's marginal tax rate over thearrow_forwardTaxes assessments for a property in NYC are $1,000,000, $1,200,000, $1,100,000, $1,300,000, $1,400,000 for years 1-5, respectively. The mil rate is 131 per $1,000 in year 1 an they are anticipated to grow 2% per year. What are the taxes given the phase in over 5 years.arrow_forwardYour brother's business obtained a 30-year amortized mortgage loan for $300,000 at a nominal annual rate of 7.0%, with 360 end-of-month payments. The firm can deduct the interest paid for tax purposes. What will the interest tax deduction be for Year 1? Oa. $20,903.46 O b. $19,169.71 O c. $3,047.43 O d. $21,000.00 O e. $23,950.89arrow_forward

- When using 100% bonus depreciation and claiming the depreciation deduction in the first quarter (thus moved to Year 0), the after-tax rate of return matches the before-tax rate of return (based on federal taxes). O True O Falsearrow_forwardFirm E must choose between two business opportunities. Opportunity 1 will generate an $11,200 deductible loss in year 0, $7,000 taxable income in year 1, and $28,000 taxable income in year 2. Opportunity 2 will generate $8,000 taxable income in year 0 and $7,000 taxable income in years 1 and 2. The income and loss reflect before-tax cash inflow and outflow. Firm E uses a 5 percent discount rate and has a 40 percent marginal tax rate over the three-year period. Use Appendix A and Appendix B. Required: a1. Complete the tables below to calculate NPV. a2. Which opportunity should Firm E choose? b1. Complete the tables below to calculate NPV. Assume Firm E's marginal tax rate over the three-year period is 15 percent. b2. Which opportunity should Firm E choose? c1. Complete the tables below to calculate NPV. Assume Firm E's marginal tax rate is 40 percent in year 0 but only 15 percent in years 1 and 2. c2. Which opportunity should Firm E choose? Complete this question by entering your…arrow_forwardA division of Midland Oil & Gas has a taxable income (TI) of $8.85 million for a tax year. If the state tax rate averages 6% for all states in which the corporation operates, find the equivalent after-tax rate of return (ROR) required of projects that are justified only if they can demonstrate a before-tax return of 22% per year. Use the table given below to calculate taxes, the average tax rate Te and after-tax ROR. If Taxable Income ($) Is: But Not Of the Over over Тax Is Amount over 50,000 15% 50,000 75,000 7,500 + 25% 50,000 75,000 100,000 13,750 + 34% 75,000 100,000 335,000 22,250 + 39% 100,000 335,000 10,000,000 113,900 + 34% 335,000 10,000,000 15,000,000 3,400,000 + 35% 10,000,000 15,000,000 18,333,333 5,150,000 + 38% 15,000,000 18,333,333 35% The equivalent after-tax ROR is determined to be %.arrow_forward

- The annual debt service on a property is $25,000 and the pre-tax cash flow is $50,000. If the mortgage capitalization rate is 8.5% and the overall rate is 10%, what is the indicated value of the property?arrow_forwardUSE INFORMATION FOR QUESTION 35 and 36. Provo, Inc., had revenues of $10 million, cash operating expenses of $5 million, and depreciation and amortization of $1 million during 2020. The firm purchased $500,000 of equipment during the year while increasing its inventory by $300,000 (with no corresponding increase in current liabilities). The marginal tax rate for Provo is 40 percent. TOOL: Revenue - Operating Ex EBITDA - D&A EBIT - Taxes NOPAT + D&A CF Opns - Capital Expenditures + Add WC = FCFarrow_forwardPlease show work in Excel.arrow_forward

- Molton Inc. made a $60,000 cash expenditure this year (year O). Compute the after-tax cost if Molton must capitalize the expenditure and amortize it ratably over three years, beginning in year O. Molton has a 21% marginal tax rate and uses a 8% discount rate. Year 1 Year 2 Year 3 PV Factor at 8%.9259 .8573 .7938 $48,310 $47,400 $40,344 $60,000arrow_forwardYour brother's business obtained a 30-year amortized mortgage loan for $175,000 at a nominal annual rate of 7.4%, with 360 end-of-month payments. The firm can deduct the interest paid for tax purposes. What will the interest tax deduction be for Year 1? a. $1,645.03 b. $14,539.98 c. $12,950.00 d. $11,825.05 e. $12,894.95arrow_forwardA profitable company pays $98,000 wages and has depreciation expense of $98,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education