ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

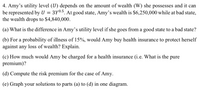

Transcribed Image Text:4. Amy's utility level (U) depends on the amount of wealth (W) she possesses and it can

be represented by U

the wealth drops to $4,840,000.

3Y0.5. At good state, Amy's wealth is $6,250,000 while at bad state,

(a) What is the difference in Amy's utility level if she goes from a good state to a bad state?

(b) For a probability of illness of 15%, would Amy buy health insurance to protect herself

against any loss of wealth? Explain.

(c) How much would Amy be charged for a health insurance (i.e. What is the pure

premium)?

(d) Compute the risk premium for the case of Amy.

(e) Graph your solutions to parts (a) to (d) in one diagram.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 7.7 A farmer believes there is a 50-50 chance that the next growing season will be abnormally rainy. His expected utility function has the form 1 expected utility =In n YNR +In YR, where YNR and YR represent the farmer's income in the states of “normal rain" and “rainy," respectively. a. Suppose the farmer must choose between two crops that promise the following income prospects: Crop YNR YR Wheat $28,000 $10,000 $15,000 Corn $19,000 Which of the crops will he plant? b. Suppose the farmer can plant half his field with each crop. Would he choose to do so? Explain your result. c. What mix of wheat and corn would provide maximum expected utility to this farmer? d. Would wheat crop insurance-which is available to farmers who grow only wheat and which costs $4,000 and pays off $8,000 in the event of a rainy growing season-cause this farmer to change what he plants?arrow_forwardnot use ai pleasearrow_forwardQUESTION 5 A consumer has utility u (I) = √I and income $1,600. The cost of going to the doctor is $1,150, and the cost of going to the gym is $150. If the consumer goes to the gym, the probability of getting sick is 20%; if she does not go to the gym, the probability of getting sick is 80%. When sick, the consumer must go to the doctor. An insurance company is offering a health insurance plan with an insurance premium of $230 and a co-pay of $110 (that is, the consumer must pay the $110 if she goes to the doctor). a) The consumer's expected utility from purchasing this insurance and going to the gym is b) The consumer's expected utility from purchasing this insurance and not going to the gym is c) In this market, the $110 copay ✓ QUESTION 6 A salesperson is trying to sell ca Given her effort e, with probabili The dealership pays her a bonu a) Given the bonus b, the salesp b) Suppose the dealership pays *Select Answer* 34.6061 35.7999 37.0135 43.0338 42.4303 46.2601 fixes the adverse…arrow_forward

- Amy has a utility function U(Y) = Y5 where Y is income. Amy faces an opportunity to invest her savings of $100,000. There is a 85% chance for her to ean $1,600, and a 15% chance for her to earn $6,400. What is her expected utility from this investment opportunity? Select one: OA. 49.19 B. 44 Oc. 48.17 D. 46arrow_forwardView image and calculate for second funciton.arrow_forwardKindly solve 3rd question onlyarrow_forward

- 1. Show if the following utility functions represent risk averse, risk neutral or risk loving preferences. u(c) = 10° + 3 u(c) = C2 + 3C i. ii. ii. u(c) = e4C iv. u(c) = 1 – e-Carrow_forward3. In the second example, we will consider the case where the insurance contract involves a deductible this is an amount which is deducted from the final pay-out of the insurance firm in the case of a loss. In other words, the consumer bears this part of the loss herself. For this problem, assume a risk-averse, expected utility maximizing consumer with initial wealth wo who faces a potential loss of size L which will occur with probability p. Her utility-of-final-wealth function is denoted by u(.). Suppose that the consumer can purchase insurance coverage of C > 0 units of wealth from a perfectly competitive insurance firm at a premium of 7 per unit of coverage, but that the firm charges an additive deductible: if C units of insurance is purchased, the insurance firm pays out (C – d) if the loss occurs, where d 20 is a fixed amount independent of C. (a). For this problem, state the consumer's expected utility function. (b). Set up the consumer's utility maximization problem and find…arrow_forward4) Luke is planning an around-the-world trip on which he plans to spend $10,000. The utility from the trip is a function of how much she spends on it (Y ), given by U(Y) = InY a). If there is a 25 percent probability that Luke will lose $1000 of his cash on the trip, what is the trip's expected utility. b). Suppose that Luke can buy insurance to fully against losing the $1,000 with a actuarially fair insurance. What is his expected utility if he purchase this insurance. Will he purchase the insurance? c). Now suppose utility function is U(Y) = Y/1000 What is his expected utility if he purchase the insurance in b). Will he purchase the insurance?arrow_forward

- Suppose that Natasha's utility function is given by u(I) = √/10/, where I represents annual income in thousands of dollars. Is Natasha risk loving, risk neutral, or risk averse? Explain. A. She is risk averse because her utility function exhibits diminishing marginal utility. OB. She is risk loving because her utility function exhibits increasing marginal utility. OC. She is risk neutral because her utility function exhibits constant marginal utility. Suppose that Natasha is currently earning an income of $40,000 (1 = 40) and can earn that income next year with certainty. She is offered a chance to take a new job that offers a 0.6 probability of earning $44,000 and a 0.4 probability of earning $33,000. Should she take the new job? Natasha should not take the new job because her expected utility of 19.85 is less than her current utility. (Round expected utility to three decimal places.)arrow_forward! plz solved all partsarrow_forwardSadija has a concave utility function of U(W) = In(W). She has inherited a ring from a relative, but she is unsure about its value. She believes that it is worth £6,000 with a probability of 1/3 and £3,000 with a probability of 2/3. a. Ahmed would like to buy the ring from her. Which price would he need to offer for Sadija' utility to remain unchanged after the sale? b. In fact, Ahmed offers £4,000 for the ring. What can you infer about Ahmed?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education