ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

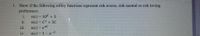

Transcribed Image Text:1. Show if the following utility functions represent risk averse, risk neutral or risk loving

preferences.

u(c) = 10° + 3

u(c) = C2 + 3C

i.

ii.

ii.

u(c) = e4C

iv.

u(c) = 1 – e-C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2arrow_forwardFinn is in charge of decorations for an upcoming festival, and he is planning to decorate withclovers (C) and flags (F). Suppose his preferences over decorations can be represented by theutility function U(C, F) = C^(3/4)F^(1/4) For this problem, assume C and F are infinitely divisible so you don’t need to worry aboutrestricting to whole-number answers.(a) Write Finn’s budget constraint as a function of the prices PC, PF , and his budget I.(b) Write Finn’s constrained optimization problem in Lagrangian form and derive the threefirst order conditions.(c) Use two of the first order conditions to show that Finn’s marginal rate of substitution(MRS) equals the marginal rate of transformation (MRT) at the optimum. (Note: Youdo not need to solve the constrained optimization any more than this.)arrow_forwardPROBLEM (3) (Regret Aversion, Gale's Roulette Wheels) Consider the regret utility u(x, y) = {1 if x>y, 0 if x=y, and -1 if xarrow_forward

- Do it correctly this timearrow_forwardAn individual is off ered a choice of either $50 or a lottery which may result in $0 or $100, each with equal probability 1/2. If the individual has a utility function u(w) = w, which one would they choose? If the individual has a utility function u(w) =sqr(w)?arrow_forwardIf a risk-neutral individual owns a home worth $200,000 and there is a three percent chance the home will be destroyed by fire in the next year, then we know 15. that: a) He is willing to pay much more than $6,000 for full cover. b) He is willing to pay much less than $6,000 for full cover. c) He is willing to pay at most $6,000 for full cover. d) None of the above are correct. e) All of the above are correct.arrow_forward

- 1 Q1. Jerry has wealth of $60 and derives utility from this according to the utility function U(w) = 1 - Where w is his wealth. Jerry now finds a lottery ticket (the drawing takes place the next day) that offers a 50% chance of winning $5. W a) What is the expected value of Jerry if he takes the lottery ticket? (pay attention, it's not jerry's wealth) b) What is the minimum amount for which Jerry would be willing-to-sell the ticket? (Hint: sets a price of p, and at the minimum amount, the expected utility of selling and not selling should be the same) c) Which is bigger, your answer to (a) or (b), and suggest whether Jerry is a risk averse person based on the previous conclusion? d) If he does not sell the ticket, what is Jerry's cost of risk? (The cost of risk is the difference between the expected wealth and the certainty equivalence)arrow_forward1. ) Suppose a driver has a 6% of having one accident a year. In case of an accident the value of the car is reduced from $25,000 to $5,000. If driver buys an insurance policy the insurance company would completely cover damage to the car (essentially restoring its value to its initial level). Assume that the driver's utility function is U = VW. a) If price of the insurance policy (premium) is $1500, would this driver be willing to purchase the policy? Explain Show you computations b) What would be the maximum price a driver with 10% chance of accident be willing to pay for the insurance policy?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education