Microeconomic Theory

12th Edition

ISBN: 9781337517942

Author: NICHOLSON

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

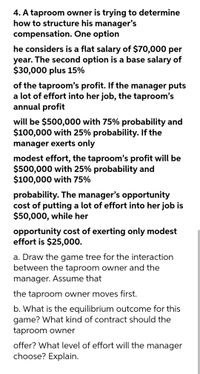

Transcribed Image Text:4. A taproom owner is trying to determine

how to structure his manager's

compensation. One option

he considers is a flat salary of $70,000 per

year. The second option is a base salary of

$30,000 plus 15%

of the taproom's profit. If the manager puts

a lot of effort into her job, the taproom's

annual profit

will be $500,000 with 75% probability and

$100,000 with 25% probability. If the

manager exerts only

modest effort, the taproom's profit will be

$500,000 with 25% probability and

$100,000 with 75%

probability. The manager's opportunity

cost of putting a lot of effort into her job is

$50,000, while her

opportunity cost of exerting only modest

effort is $25,000.

a. Draw the game tree for the interaction

between the taproom owner and the

manager. Assume that

the taproom owner moves first.

b. What is the equilibrium outcome for this

game? What kind of contract should the

taproom owner

offer? What level of effort will the manager

choose? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 14 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 8arrow_forward7. Principal-Agent II A risk-neutral principal can hire a risk-averse agent to undertake a project. There are two possible outcomes for the gross profit of the principal, TL There are also two possible effort levels that the agent can exert, e = 0 or 1; if e = 0, the probability of TH is only 1/3, but if e = 1, the probability of TH increases to 2/3. 20 and TH = 50. The agent's utility from receiving a wage wand exerting effort e is Vw – e, and the agent has a reservation utility of ū = 2. (a) Assume that effort is observable. What wage will the principal offer if she wants to induce low effort? What wage will she offer if she wants to induce high effort? What contract is optimal for the principal?arrow_forwardAssume that the parcels are essentially identical and that the minimum selling price of each is $575,000. The following table states each person's willingness and ability to purchase a parcel. Willingness and Ability to Purchase Person (Dollars) Andrew 520,000 A-Z Beth 510,000 Lorenzo 750,000 Neha 660,000 Sam 600,000 Teresa 550,000 Which of these people will buy one of the three beachfront parcels? Check all that apply. O Andrew Beth O Lorenzo O Neha O Sam O Teresa Assume that the three beachfront parcels are sold to the people that you indicated in the previous section. Suppose that a few days after the last of those beachfront parcels is sold, another essentially identical beachfront parcel becomes available for sale at a minimum price of $535,000. This fourth will nurchase it from the seller for at least the minimum ncice be sold because parcel MacBook Air F12 O O Oarrow_forward

- QUESTION 8 Manager C Effort Level Chance of Cost of effort success High Effort 0.9 100,000 Routine Effort 0.5 60,000 What is the minimum bonus that will entice high effort? O 1. 40,000 2. 260,000 3. 300,000 4. 400,000 5. 520,000 O 6. 60,000 O 7. 100,000 8.0arrow_forwardPLS HELP ASAP ON BOTHarrow_forward2 Consider the two investments listed below with possible outcomes and probabilities: INVESTMENT (in $1000) SAFE RISKY INVESTMENT AMOUNTⓇ 40+ 40+ GOOD SCENARIO OUTCOME 45+ 80+ AVERAGE+ SCENARIO PROB OUTCOME 0.40* 0.40€ 42+ 45+ BAD+ SCENARIO PROB OUTCOME PROB 0.20 35+ 0.20 10+ 0.40€ 0.40+ b) a) Suppose I have utility function U(*) = (x)2. What is the expected utility from each investment? Which investment will I choose, if any? Show and explain your work and provide the intuition. c) What is the value of the risk premium for the SAFE investment? Show and explain your work and provide the intuition. d) What is the value of the risk premium for the RISKY investment? Show and explain your work and provide the intuition.< +arrow_forward

- Im confused on how to complete thisarrow_forwardThe HR department is trying to fill a vacantposition for a job with a small talent pool. Validapplications arrive every week or so, and theapplicants all seem to bring different levels ofexpertise. For each applicant, the HR managergathers information by trying to verify variousclaims on resumes, but some doubt about fitalways lingers when a decision to hire or not isto be made. What are the Type I and II decision error costs? Which decision error is more likely tobe discovered by the CEO? How does this affectthe HR manager’s hiring decisions?arrow_forward6- Suppose Firm B is selling 1 -year insurance contracts for houses. Suppose Firm B's customers are divided into three categories with different probabilities of needing a payment. First category will ask for a payment of 500000 with probability 0.10, the second category will ask for a payment of 250000 with probability 0.15 and the third category will ask for a payment of 100000 with probability 0.2 a. Calculate Firm B's expected payment for the year. Suppose Firm B has 120 customers in the first category, 230 in the second category and 405 in the third category. b. Calculate individual premium if Firm B charges the same amount to all its customers. 1 c. Calculate individual premium if Firm B utilizes the risk groups and charges the same amount of premium within groups d. Which group/groups are more likely to buy the insurance with group pricing compared to the case with uniform pricing?arrow_forward

- 6. A risk-averse individual is offered a choice between a gamble that pays $1000 with probability of 25% and $100 with probability of 75% or a pay- ment of $325. (a) Which gamble would he choose? (b) What is the payment was $320arrow_forward955,000 30 se0,000 15. Jay Seago is suing the manufacturer of his car for $3.5 million because of a defect that he believes caused him to have an accident. The accident kept him out of work for a year. The company has offered him a settlement of 5700,000, of which Jay would receive $600,000 after attorneys' fees. His attorney has advised him that he has a 50% chance of winning his case If he loses, he will incur attomeys' fees and court costs of $75,000. If he wins, he is not guaranteed his full requested settlement. His attorney believes that there is a 50% chance he could receive the full settlement, in which case Jay would realize $2 million after his attomey takes her cut, and a 50% chance that the jury will award him a lesser amount of $1 million, of which Jay would get $500,000. Using decision tree analysis, decide whether Jay should proceed with his lawsuit against the manufacturer.arrow_forwardPLS HELP ASAP ON BOTHarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning