ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

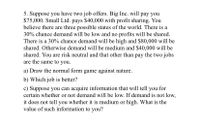

Transcribed Image Text:5. Suppose you have two job offers. Big Inc. will pay you

$75,000. Small Ltd. pays $40,000 with profit sharing. You

believe there are three possible states of the world. There is a

30% chance demand will be low and no profits will be shared.

There is a 30% chance demand will be high and $80,000 will be

shared. Otherwise demand will be medium and $40,000 will be

shared. You are risk neutral and that other than pay the two jobs

are the same to you.

a) Draw the normal form game against nature.

b) Which job is better?

c) Suppose you can acquire information that will tell you for

certain whether or not demand will be low. If demand is not low,

it does not tell you whether it is medium or high. What is the

value of such information to you?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Choose two companies in the same industry in Canada. Read the instructions for question 10.2 before making your choice(s), as you will use the same firms for questions 10.1 and 10.2. In one paragraph, describe your choice of firms and industry, noting in particular what you hope to learn from your financial statement analysis. Provide URLs to the financial statements on the firm's website. *Marks will be awarded choosing less common firms/industry. Common and frequently chosen firms and industries will receive fewer marks in this regard. Summarize each firm's income statement and balance sheet for the last two fiscal years into the categories below. Complete the attached tables (an Excel template is available in the Assignment 3 dropbox area of the course website) with this information. You may cut and paste into and from Microsoft Excel for this assignment.arrow_forward8. Collusive outcome versus Nash equilibrium Consider a remote town in which two restaurants, All-You-Can-Eat Café and GoodGrub Diner, operate in a duopoly. Both restaurants disregard health and safety regulations, but they continue to have customers because they are the only restaurants within 80 miles of town. Both restaurants know that if they clean up, they will attract more customers, but this also means that they will have to pay workers to do the cleaning. If neither restaurant cleans, each will earn $13,000; alternatively, if they both hire workers to clean, each will earn only $10,000. However, if one cleans and the other doesn't, more customers will choose the cleaner restaurant; the cleaner restaurant will make $18,000, and the other restaurant will make only $6,000. Complete the following payoff matrix using the information just given. (Note: All-You-Can-Eat Café and GoodGrub Diner are both profit-maximizing firms.) All-You-Can-Eat Café Cleans Up Doesn't Clean Up $ GoodGrub…arrow_forward16-1 Newspaper Bargaining Two equal-sized newspapers have an overlap in circulation of 10% (10% of the subscribers subscribe to both newspapers). Advertisers are willing to pay $10 to advertise in one newspaper but only $19 to advertise in both, because they’re unwilling to pay twice to reach the same subscribers. What’s the likely bargaining negotiation outcome if the advertisers bargain by telling each newspaper that they’re going to reach an agreement with the other newspaper, so the gains to reaching agreement are only $9? Suppose the two newspapers merge. What is the likely post-merger bargaining outcome? these would be most advantageous from a bargaining position?arrow_forward

- 8. Collusive outcome versus Nash equilibrium Consider a remote town in which two restaurants, All-You-Can-Eat Café and GoodGrub Diner, operate in a duopoly. Both restaurants disregard health and safety regulations, but they continue to have customers because they are the only restaurants within 80 miles of town. Both restaurants know that if they clean up, they will attract more customers, but this also means that they will have to pay workers to do the cleaning. If neither restaurant cleans, each will earn $12,000; alternatively, if they both hire workers to clean, each will earn only $9,000. However, if one cleans and the other doesn't, more customers will choose the cleaner restaurant; the cleaner restaurant will make $16,000, and the other restaurant will make only $4,000. Complete the following payoff matrix using the information just given. (Note: All-You-Can-Eat Café and GoodGrub Diner are both profit-maximizing firms.) GoodGrub Diner Cleans Up Doesn't Clean Up Cleans Up…arrow_forwardYou are the manager in a market composed of 12 firms, each of which has a 8.33 percent market share. In addition, each firm has a strong financial position and is located within a 100-mile radius of its competitors. Instructions: Enter your responses rounded to the nearest penny (two decimal places). a. Calculate the premerger Herfindahl-Hirschman index (HHI) for this market. b. Suppose that any two of these firms merge. What is the postmerger HHI? c. Based only on the information contained in this question and on the U.S. Department of Justice Horizontal Merger Guidelines described in this chapter, do you think the Justice Department would attempt to block a merger between any two of the firms? O It may but will also consider other factors O It likely will not O It likely willarrow_forwardq19 If you advertise and your rival advertises, you each will earn $4 million in profits. If neither of you advertises, you will each earn $10 million in profits. However, if one of you advertises and the other does not, the firm that advertises will earn $1 million and the non-advertising firm will earn $5 million. If you and your rival plan to be in business for 10 years, then the Nash equilibrium is a. for each firm to not advertise in any year. b. for neither firm to advertise in early years but to advertise in later years. c. for each firm to advertise every year. d. for each firm to advertise in early years but not advertise in later years.arrow_forward

- New entry increases your |e| from 2 to 5. If you previously maximized profits at a price of $16, your new profit maximizing is $10 $16 $8 $6.40 **please show your math**arrow_forwardB ← D 16:11 Today 16:05 A firm has $200 million in total revenue and explicit costs of $190 million. If its owners have invested $100 million in the company at an opportunity cost of 10 percent interest per year, the firm's accounting profit is: $400 million. $100 million. C$80 million. E zero $10 million. go Send VPN Favourite + ( 60 اس 4* * Edit Von 4G Delete Morearrow_forwardJulia and Julia is a small, owner-operated bakery. The owner of Julia & Julia is considering two alternative investments, X and Y. There are four possible outcomes for each (1,2,3 and 4 for Investment X and A, B, C, D for Investment Y). Investment X Investment Y Outcome Payoff Payoff Probability 0.2 Outcome Probability 1 A 0.1 2 2 0.2 B 30 0.2 12 0.4 1 0.5 4 14 0.2 14 0.2 (a) To one decimal place (e.g. 3.5), what are the expected values of Investment X and of Investment Y? The expected value of X is The expected value of Y is Say the owner's utility function is given by U (Z) = VZ where U is the utility and Z is X or Y. (b) Is the owner risk averse? O Yes O No (c)Which investment will the owner choose? OInvestment X Investment Yarrow_forward

- 5arrow_forward7. High-tech Industry Synergy and Dynaco are the only two firms in a specific high-tech industry. They face the following payoff matrix as they decide upon the size of their research budget: Synergy's Decision Large Budget Small Budget Large Budget $20 million, $25 million $15 million, $0 Dynaco's Decision Small Budget $0, $60 million $25 million, $30 million If Synergy believes Dynaco will go with a large budget, it will choose a budget. If Synergy believes Dynaco will go with a small budget, it will choose a ▼ budget. Therefore, Synergy a dominant strategy. If Dynaco believes Synergy will go with a large budget, it will choose a budget. If Dynaco believes Synergy will go with a small budget, it will choose a budget. Therefore, Dynaco a dominant strategy. True or False: There is a Nash equilibrium for this scenario. (Hint: Look closely at the definition of Nash equilibrium.) O True O Falsearrow_forwardKarl Lipton is the marketing communications coordinator for a major electronics manufacturer. He is assigned with charting out a communications strategy for a new range of mobile phones developed by his company. How will Karl's communications strategy look over the course of the mobile phones' life cycle?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education