Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

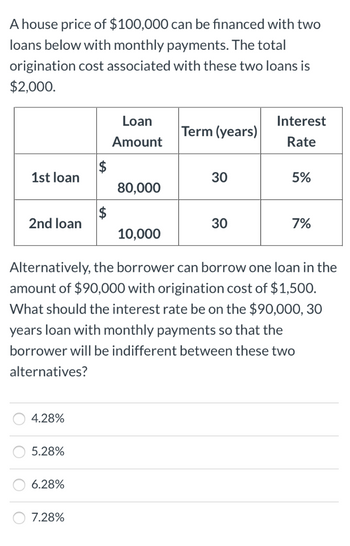

Transcribed Image Text:A house price of $100,000 can be financed with two

loans below with monthly payments. The total

origination cost associated with these two loans is

$2,000.

1st loan

OO

2nd loan

4.28%

5.28%

6.28%

$

7.28%

$

Loan

Amount

80,000

Term (years)

30

10,000

Alternatively, the borrower can borrow one loan in the

amount of $90,000 with origination cost of $1,500.

What should the interest rate be on the $90,000, 30

years loan with monthly payments so that the

borrower will be indifferent between these two

alternatives?

30

Interest

Rate

5%

7%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Toyota S murang auto finance company is prepared to offer you a loan of $38,000 to buy a new Toyota Corolla. The repayments are at the end of every year for a period of 7 years. If the interest rate on the loan is 12%, perform loan amortization calculation that will allow you to determine the amount of the loan outstanding after making the second installment. PV of ordinary annuity-= C/r x [1-1(1+r)n]arrow_forwardFinance A borrower takes out a 30-year mortgage loan (with monthly payments) for $300,000 with an interest rate of 12% The lender requires 4.0 points to be paid at the time the loan is originated. What is the effective interest rate on the loan if the loan is repaid after 5 years?arrow_forwardA borrower takes out a 30-year mortgage loan for $150,000 with an interest rate of 6% plus 4 points. What is the effective annual interest rate on the loan if the loan is carried for all 30 years? 5.63% 5.35% 6.36% Ⓒ 5.00%arrow_forward

- A $25,000 loan is to be repaid with a payment of $4,500 in 1 month, another payment in 8 months and a final payment that is three times larger than the 2nd payment in 1 year. Use today as the focal date. a. Find the 2nd and final payments if interest is 6 4 % p.a. 2nd Payment: Final/3rd Payment: Round to the nearest cent b. Find the amount of interest paid on this loan. Interest Paid: Round to the nearest cent SAVE PROGRESS SU -3°Carrow_forwardI need correct ans if possible handwrittenarrow_forwardFill in the missing values A through D in the table for a loan of $10,000, if the interest rate is compounded at 10% per year.arrow_forward

- How much interest will be collected in advance from a loan of $ 25,000 for 2 2 years if the discount rate is 10 2 %?arrow_forwardA 30 year, monthly payment ARM has the following characteristics: loan amount = $135,000, index value = 5.00%, margin = 2.50, discount points = 2, teaser rate = 6%. The payment for year one is: d $925.06 A. $943.94 B. $724.71 C. $809.39 D. $793.21arrow_forwardA car loan is taken for $22,000 to be paid back in 5 years, with monthly payments of $457. What nominal annual interest rate is being charged in this loan? 10.99% 9.00% 1.25% 0.75%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education